Why Fast Savings for Kids Is Not Just a “Nice-to-Have” Anymore

Imagine this: Your child turns 18, ready to chase big dreams—college, a car, even starting a business. But instead of scrambling for scholarships or taking out hefty loans, you confidently say:

“We have got it covered.”

You do not need a six-figure salary. You do not need to sacrifice your own financial health.

All you need is a plan that is smart, fast, and sustainable.

This blog post is your action-packed blueprint to building a powerful financial foundation for your child—without delaying it another day.

Let’s dig in.

1. Turn Pocket Change Into a Powerhouse: The “Round-Up Strategy”

Analogy: Think of every purchase as a savings opportunity hiding in plain sight. It is like finding coins in your couch—only smarter and on autopilot.

What It Means: Every time you swipe your card, you can automatically “round up” the spare change to the next dollar—and direct that difference to a savings account for your child.

Real-World Example:

Spend $4.25 on coffee? The extra $0.75 goes into your kid’s savings. You will not miss the cents—but over time, it adds up to serious dollars.

Actionable Steps:

• Link your debit card to a round-up savings app (like Acorns, Qapital, or Chime).

• Set your round-up to deposit daily or weekly into a custodial savings account.

• Add a 2x multiplier—so every $0.75 becomes $1.50!

Fast Fact: People who use round-up apps save an average of $300–$500 per year without even noticing.

2. Set Up a High-Yield Custodial Account: Let Interest Be the Babysitter

Story Time: My cousin Lisa opened a traditional savings account for her 5-year-old, earning a microscopic 0.01% interest. After a year, her total interest was… $0.04.

Yes. Four cents.

Now she uses a high-yield custodial account earning 4.25%—and it is growing fast.

Financial Takeaway:

You are not just saving—you are multiplying. A custodial account (UGMA/UTMA) under your child’s name earns tax-advantaged interest, and you remain in control until they are legally of age.

Action Steps:

• Open a custodial account at a high-yield online bank (try Capital One Kids Savings, Ally, or Fidelity Youth).

• Set up automatic monthly transfers—even $25–$50.

• Turn birthdays and holiday gifts into deposits instead of toys.

Bonus Tip: Add a 529 Plan for tax-free education savings if college is the goal.

3. Start a Family Side Hustle—In Your Kid’s Name

Analogy: Picture a lemonade stand—but digital. Your kid becomes the “mascot” while you manage the backend.

Yes, you can legally earn money for your child through kid-led ventures.

Relatable Story: A dad started a kids’ craft Etsy store called “Tiny Treasures by Tia” using his daughter’s artwork. They have now made over $3,000—and every penny goes into her savings.

Action Steps:

• Launch a simple Etsy shop or YouTube channel for your kid’s creations.

• Register earnings under a custodial Roth IRA if they qualify as earned income.

• Keep income under the standard deduction limit ($14,600 in 2024) to avoid taxes.

Why It’s Brilliant: You teach entrepreneurship, get tax-advantaged growth, and supercharge long-term savings with compound interest.

4. Automate a Weekly “Mini-Save” Day

Real-Life Tip: Set up a “Mini-Save Monday” tradition with your child. Each week, they put aside a small amount—$5, $10, even $2—into a jar or digital savings account.

Financial Lesson: You are teaching consistency, delayed gratification, and compound growth—all without big sacrifices.

Make It Fun:

• Use a transparent piggy bank or kid-friendly savings app like Greenlight or BusyKid.

• Match their savings dollar-for-dollar as an incentive.

• Celebrate milestones with a reward (non-financial—like picking the family movie or dessert night).

Fast Stat: According to Cambridge University, money habits are formed by age 7. Start now, win forever.

5. Cut the Clutter, Fund the Future: The Toy-to-Cash Swap

Shocking Fact: The average American home has over 300,000 items, and many are unused toys.

Turn that clutter into capital.

Here’s What One Mom Did: Before her daughter’s birthday, she asked her to choose 10 toys to donate or sell. They earned $110 from Facebook Marketplace—and deposited every dollar into her daughter’s “big dreams” fund.

Your Turn:

• Sort through clothes, books, or gadgets your kids have outgrown.

• Sell them via eBay, Facebook, OfferUp, or ThredUp.

• Let your child “co-invest” by choosing which goal the money supports (bike, trip, or future college).

Bonus Tip: Involve them in pricing and selling to teach entrepreneurship.

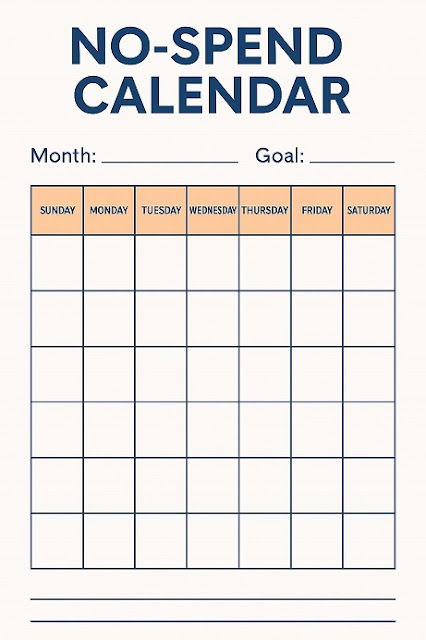

6. The 30-Day No-Spend Family Challenge: Reset. Reboot. Reallocate.

Relatable Setup: You think you’re saving… until you check your Amazon orders and realize you’ve bought 7 unnecessary items in two weeks.

Enter the “No-Spend” Challenge.

For 30 days, spend only on essentials—and direct the savings to your child’s future.

Real-Life Example: A family in Ohio saved $680 in one month just by cutting eating out, streaming subscriptions, and impulse buys.

How to Launch It:

• Create a “No-Spend” calendar (downloadable image).

• Set a fun family goal—like saving $500 for a child’s education or travel.

• Track weekly progress visually with a thermometer or sticker chart.

What It Teaches: Discipline, prioritization, delayed gratification—and serious saving power.

Bonus 1: Redirect Windfalls & Cashback into Your Kid’s Fund

Analogy: Think of windfalls like surprise power-ups in a video game—you can use them to leap ahead, but only if you don’t waste them on pizza.

The Reality: Most of us blow tax refunds, cashback, bonuses, or rebates on short-term treats. But imagine if every unexpected dollar helped your child skip student loans or start their first business debt-free?

Actionable Moves:

• Redirect all cashback from credit cards or apps (like Rakuten or Honey) into a savings or custodial investment account.

• Allocate 10% of your tax refund or work bonus directly into your kid’s future fund.

• Use rebates from big purchases (like electronics or furniture) as one-time boosts for their savings.

Pro Tip: Label the savings goal with your child’s name and a purpose, e.g., “Ava’s First Apartment Fund.” Emotional labeling boosts saving motivation.

Bonus 2: Invest in Index Funds with a Custodial Brokerage Account

True Story: A friend invested $1,000 in an S&P 500 index fund in her son’s name when he was 3. By the time he was 11, it had grown to over $2,300. No active trading. No stress.

The Lesson: If you are saving for 5+ years, let your child’s money work harder than a savings account ever could.

Simple Action Plan:

• Open a custodial brokerage account at platforms like Fidelity, Charles Schwab, or Vanguard.

• Choose low-cost index funds (e.g., VTI, VOO, or SPY).

• Automate monthly contributions, even if it is just $50–$100.

Why It Works: With an average annual return of 7–10%, this method builds long-term wealth without gambling.

Bonus 3: Turn Grandparents & Relatives into Savings Partners

Let’s upgrade that to stock shares or seed funding.

Here is the twist: Instead of another plastic toy or birthday sweater, encourage relatives to contribute to a child’s 529 Plan, custodial account, or even an experiential fund (like a travel savings pot).

Actionable Scripts:

• Send a polite note before birthdays:

“In place of gifts this year, we’re helping Emma build her future! Any contribution to her education/savings fund is deeply appreciated.”

• Create a gift registry linked to a UGMA/UTMA account or 529 gifting portal.

Emotional Bonus: You are giving loved ones a chance to be part of your child’s success story—not just another name on the gift tag.

The “Kid Wealth Kickoff” Worksheet

Download (image below) your free worksheet: “Kid Wealth Kickoff: Save $1,000 in 90 Days”

Includes:

• A daily mini-saving tracker.

• A list of 20+ money-making or cost-cutting activities.

• A savings milestone reward chart.

• Space for your child to draw or visualize their savings goal.

Conclusion: Start Small, Grow Big—And Make It Fast

If you are still wondering how to save money fast for kids, here is the truth:

You do not need a financial degree.

You just need the right system—and a little creativity.

From round-up apps and high-yield accounts to decluttering and kid-powered side hustles, you now have actionable, proven, and FUN ways to build wealth for your child—faster than ever before.

Remember: small, consistent actions today = massive freedom tomorrow.

You are shaping their future.

Your Turn—Let’s Take Action Now!

Ready to kickstart your kid’s financial future?

Here is what to do next:

• Comment below: Which strategy will you start first?

• Share this post on social media with fellow parents and families.

• Download your free worksheet and start your 90-day savings challenge today.

And speaking of legacies, if you are serious about generational wealth, do not miss our deep dive into “Secrets to Retiring Early and Wealthy”—a must-read that ties directly into today’s mission.