Originally Published: March 2025 | Last Updated: September 2025

Warren Buffett’s Timeless Financial Wisdom

Money lessons from Warren Buffett are more than just financial tips—they are timeless principles that have shaped the lives of millions worldwide. Buffett, often called the “Oracle of Omaha,” didn’t just build an empire worth billions; he built a philosophy that starts with strong financial habits at home. What makes Buffett unique is his simplicity: he believes financial education should begin early, long before kids step into the real world. In fact, studies from Cambridge show that children develop core money habits by the age of 7—a concept Buffett understood decades ago. That’s why he emphasized conversations around saving, investing, and living below your means at the dinner table, not just in boardrooms.

Today, these principles are even more relevant. In an era of instant gratification, consumer debt, and flashy social media lifestyles, teaching kids the money lessons Warren Buffett taught his children is the ultimate gift. These lessons don’t just prepare kids to manage money; they prepare them to manage life. Let’s explore six powerful strategies from Buffett that can transform how your children think about money—starting today.

It’s no surprise, considering that Buffett’s estimated IQ is between 130 and 140. But here’s what’s fascinating: while many believe high intelligence is the key to wealth, studies show the average IQ of a millionaire is closer to 115, and the average IQ of a billionaire often falls below 130 (Also you can compare with The Average Financial IQ of Kids) Clearly, building wealth is not just about being the smartest person in the room—it is about making smart, consistent money choices early in life. And that’s exactly what Buffett teaches.

1. Start Early—Because Habits Form Young

Ever heard the phrase, “The best time to plant a tree was 20 years ago. The second-best time is today”? That’s Buffett’s approach to money.

Buffett learned about money management as a child, and he swears by teaching kids about finances early. Studies back him up — Cambridge University researchers found that children develop core money habits by age 7.

How to Teach This Lesson to Your Kids:

✅ Give them an allowance and encourage saving a portion.

✅ Use real-life examples: Explain that just like they need to brush their teeth daily, they should make saving money a habit.

✅ Introduce a savings challenge—ask them to save for something they want instead of asking you to buy it instantly.

👉 Buffett’s Wisdom: “Sometimes parents wait until their kids are in their teens before they start talking about managing money—when they could be starting when their kids are in preschool.”

2. Saving Is the First Step to Wealth

Most kids want instant gratification—spend today, worry tomorrow. But Buffett teaches that even small amounts of savings can grow into something meaningful over time and this the most powerful Money Guides which were taught by Warren Buffett to His Kids.

Example:

Imagine giving your child $5 each week. If they save just $1 every week, that’s $52 in a year. Add some interest, and suddenly, they see their money growing—without doing extra work!

How to Teach This Lesson:

✅ Set up a savings jar or piggy bank labeled “Future Fortune.”

✅ Match their savings contributions like a 401(k) to encourage them.

✅ Introduce them to kid-friendly finance apps where they can track savings growth.

👉 Buffett’s Wisdom: “Saving even a little bit of money on a regular basis pays off.”

3. Know the Difference Between Needs and Wants

Ever been to a store with a child who NEEDS the newest toy? Buffett teaches a simple but powerful strategy: Before buying, pause and ask, “Do I need this, or do I just want it?”

Teaching kids to prioritize spending helps them develop self-discipline—a key trait of financially successful adults.

How to Teach This Lesson:

✅ Before any purchase, ask them to list three reasons why they need it.

✅ Play the “24-hour rule”—if they still want it after a day, it might be worth considering.

✅ Show them a real-world example: Explain how you budget for household essentials before luxuries.

👉 Buffett’s Wisdom: “If you buy things you don’t need, you will soon sell things you do need.”

4. Invest in Yourself—Your Skills Are Your Greatest Asset

Buffett attributes his success not just to investing in stocks but to investing in himself. He took a public speaking course in his early years because he knew communication was key to success.

Want to future-proof your child’s finances? Teach them that learning and skill-building will always yield the highest returns.

How to Teach This Lesson:

✅ Encourage them to read daily—Buffett reads 500 pages a day!

✅ Enroll them in courses that develop valuable skills (coding, writing, sales, public speaking).

✅ Make learning exciting—show them how their favorite YouTubers or entrepreneurs built their skills before making money.

👉 Buffett’s Wisdom: “The more you learn, the more you’ll earn.”

5. Encourage an Entrepreneurial Mindset

Did you know Warren Buffett started his first business at 6 years old—selling packs of gum for a profit? That entrepreneurial spark led him to become the world’s most famous investor.

Teaching kids to think entrepreneurially helps them develop problem-solving skills, creativity, and financial independence.

How to Teach This Lesson:

✅ Help them start a small business—lemonade stands, Etsy shops, or even selling handmade crafts.

✅ Introduce books about young entrepreneurs (Kidpreneurs is a great one!).

✅ Encourage them to find ways to earn money outside of allowances—maybe babysitting, dog-walking, or tutoring.

👉 Buffett’s Wisdom: “Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble.”

6. Leave “Enough, But Not Too Much”

Buffett has long stressed inheritance with intention. He advises parents to “leave children enough so that they can do anything, but not enough that they can do nothing“. Rather than handing over a blank check, teaching children money responsibility includes giving them autonomy—but not entitlement. This approach encourages ambition, independence, and smart financial behavior—core lessons you can adopt in your family’s wealth strategy.

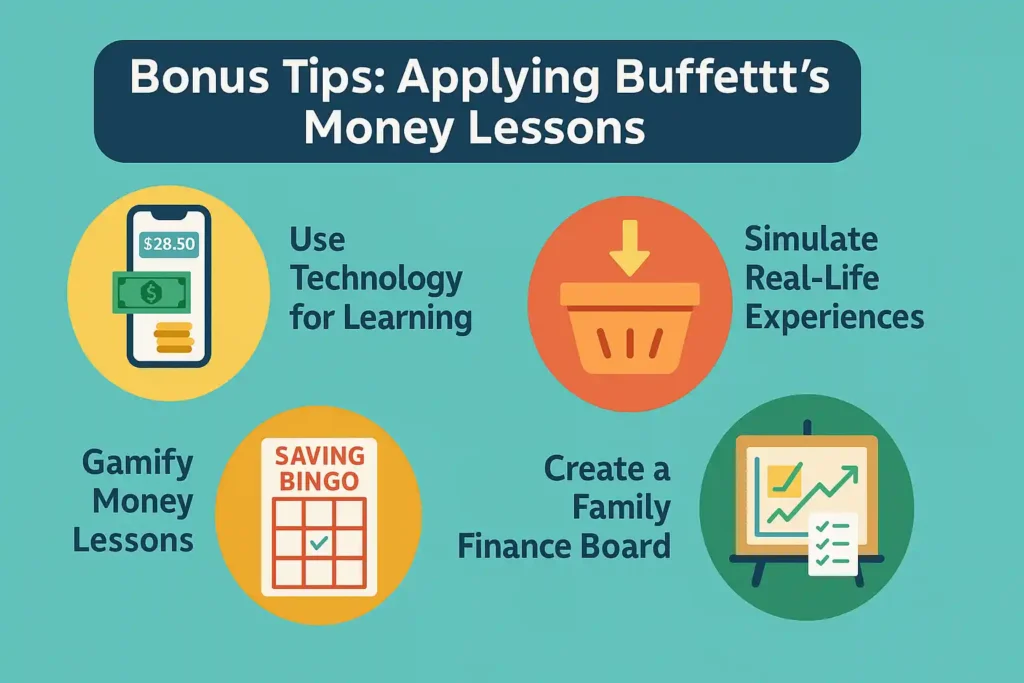

🔥 Bonus Tips: How to Apply Buffett’s Teachings in Today’s World

Warren Buffett didn’t raise financially unaware children—and neither should you. His money lessons are timeless, but the way we teach them can evolve. Let’s break down some bonus tips that bring the financial wisdom into the modern, digital age.

1. 📱 Use Technology as a Financial Learning Tool

Apps for allowance tracking and savings goals are today’s equivalent of piggy banks and ledgers.

Top picks for parents:

• Greenlight: Teaches budgeting, investing, and saving with parental controls.

• RoosterMoney: Helps kids allocate allowance into Spend, Save, Give jars.

• Bankaroo: A virtual bank for kids to manage their money digitally.

🧠 These tools make it easy to teach kids money management in an engaging way.

2. 🧠 Gamify Money Lessons

Kids learn better through play. Create fun challenges based on financial literacy for kids principles.

Try these:

• Saving Bingo: Fill a square every time they make a smart money move.

• Entrepreneur Challenge: $5 seed fund. What can they grow it into by the weekend?

👉 This reinforces Warren Buffett parenting tips in a way kids remember for life.

3. 🏦 Simulate Real-Life Experiences

The best way to raise financially smart kids? Let them experience money decisions firsthand.

Here’s how:

• Take them grocery shopping with a mini-budget.

• Let them plan a weekend outing with a set amount.

• Encourage them to research before buying something online.

📊 These activities drive home personal finance lessons for families in real time.

4. 💡 Teach the Concept of Compound Interest Visually

Warren Buffett once said, “My wealth has come from a combination of living in America, some lucky genes, and compound interest.”

🎯 Tip: Use an online calculator to show how saving $10/month at 5% grows over 10, 20, 30 years.

✅ This simple exercise explains Warren Buffett financial advice for children in a way even 8-year-olds can grasp.

5. 🗂 Create a “Family Finance Board”

Every week, hold a quick 15-minute “money chat” with your kids:

• Celebrate their savings wins

• Discuss spending mistakes

• Set a family money goal (e.g., saving for a vacation or gadget)

This builds an open household money culture, reflecting personal finance lessons for families Buffett would be proud of.

6. 📚 Read Buffett-Approved Kids Books

Some of the best Warren Buffett parenting tips involve encouraging lifelong learning.

Here are some Buffett-style reads for young minds:

• The Four Money Bears by Mac Gardner

• Money Ninja by Mary Nhin

• Investing for Kids by Dylin Redling

📖 Reading together strengthens family bonds while reinforcing financial literacy for kids.

7. 💼 Encourage Teenagers to Invest—Simulated or Real

If your kids are 13+, consider opening a custodial investment account. You can also simulate stock investing using apps like:

• Invstr

• Stockpile

• Fidelity Youth

Use Buffett’s philosophy: “Invest in what you understand.”

📈 These actions transform Buffett’s teachings into a lifelong financial advantage.

❓ FAQs: Most Common Questions for Parenting Rules

Q1. At what age should I start teaching my kids about money?

You can start as early as age 3-5 with basic concepts like saving, sharing, and spending.

By age 7, children have formed lasting money habits. That’s why the financial habits should started early.

Q2. My child doesn’t care about money. What should I do?

Make money relevant to their interests.

Example: If they love gaming, teach them how to budget for new games.

Use goal-setting: “Save $2 per week, and you’ll afford that $40 game in 20 weeks.”

This technique supports teaching kids money management with real incentives.

Q3. What are some real-life activities I can do with my kids?

Try these Buffett-inspired activities:

✅ Set up a lemonade stand

✅ Give them $10 to invest in snacks, and sell to friends/family

✅ Let them “budget” their next birthday party

All these align with Warren Buffett financial advice for children: hands-on experience is the best teacher.

Q4. Should I give my child an allowance?

Yes—with a purpose.

Break it into categories:

• Spend

• Save

• Give

• Invest

This system mirrors Buffett’s own advice and helps children master financial literacy.

Q5. How can I teach investing in a kid-friendly way?

Use companies they know—Disney, Apple, Nike.

Explain: “If you own 1 share of Disney, you’re a part-owner of Mickey Mouse’s house!”

Let them track the company’s stock online weekly. This aligns with how to raise financially smart kids the Buffett way.

Q6. What if I’m not good with money myself?

Then you have a powerful opportunity: learn together.

Start with small goals and include your child in the process.

Buffett believes in continuous learning—your journey can inspire theirs.

Q7. How do I measure if my child is learning?

Look for signs like:

✅ Delayed gratification (e.g., saving for a toy instead of impulse buying)

✅ Budgeting their allowance

✅ Asking thoughtful questions about prices or brands

Progress shows you’re successfully applying personal finance lessons for families.

⚠ Common Mistakes Parents Make (and How to Avoid Them)

1. Waiting too long to start

Don’t assume kids “aren’t ready.” Buffett began early—and so should you.

2. Using only lectures

Money lessons must be lived, not just told. Kids learn best by doing.

3. Shielding kids from financial struggles

Age-appropriate honesty builds resilience and understanding.

4. Rewarding every task with money

Not everything deserves a payout. Differentiate between chores (family responsibility) and gigs (earning opportunities).

5. Forgetting to model good behavior

Kids mirror what they see. If you overspend or avoid saving, they’ll adopt the same habits.

✍ Reflection Exercise:

Use this short reflection to spark conversation and action with your child:

✅ Parent’s Prompt:

• “What’s one thing you spent money on last week?”

• “Did it bring you happiness for a long time or just a moment?”

• “If you could go back, would you still buy it?”

✅ Kid’s Prompt:

• “What’s one thing you want to save for?”

• “How much do you need?”

• “What can you do this week to get closer to that goal?”

💡 Write the answers on a whiteboard, fridge note, or savings chart. This habit builds financial self-awareness—just like the Warren Buffett’s advise for kids.

✅ Wrapping-Up

The money lessons from Warren Buffett are not reserved for billionaires—they are practical, actionable strategies every parent can pass on to their kids. Buffett did not teach his children how to chase quick wealth; he taught them the art of patience, discipline, and value-driven decision-making. These lessons go beyond money management—they build character, independence, and resilience. Whether it is understanding the difference between needs and wants, the magic of compound interest, or the importance of investing in personal growth, Buffett’s wisdom creates a lifelong foundation for financial success.

As parents, we hold the key to shaping our children’s future financial behavior. Every allowance, every conversation, and every decision is an opportunity to instill these principles. The sooner we start, the greater the impact. So, don’t just read these lessons—apply them. Model them in your own life. Because, as Warren Buffett himself says, “The more you learn, the more you earn.” Let these timeless strategies empower your family to build wealth—not just in money, but in wisdom.

Loved reading it, also look it: How to Turn $500 a Month into a Wealth-Building Machine (Even If You’re Just Starting Out)

Just want to say your article is as amazing. The clearness in your post is just nice and i could assume you’re an expert on this subject.

Fine with your permission let me to grab your feed to keep updated with forthcoming post.

Thanks a million and please keep up the rewarding work.

Very rapidly this site will be famous amid all blogging and site-building users, due to it’s good articles

Very descriptive blog, I liked that bit. Will there be

a part 2?