Think of money as a language—and most people only learn vocabulary. The Five Pillars of Financial IQ teach you the grammar: how ideas connect, how decisions translate into long-term results, and which small habits compound into outsized freedom.

This guide doesn’t sell tricks or stock picks; it gives you a clear map and the exact first steps to move from confused to confident. Read on if you want a practical, no-fluff playbook that shows which pillar to fix first, the micro-actions that produce real momentum, and how to build a money life that scales without drama.

Five Pillars of Financial IQ — How they fit into your money life

Before we dive into the pillars, picture a small control room that runs your financial life: one panel monitors emotions, one tracks cash inflows and outflows, one watches assets and protection, another runs multiplication engines (compound interest, leverage), and the last decodes rules and systems. When all five panels are calibrated, you react predictably and profitably. When one panel misreads, everything else compensates poorly.

This section explains how the five pillars connect: mindset sets the rules you follow; cash flow fuels opportunities; asset acquisition converts that fuel into engines; leverage multiplies output; financial fluency ensures legal, tax, and macro forces do not quietly bleed your gains. You will not succeed by focusing on one pillar alone—this framework demands balance.

Below you will find the deep dive into each pillar. Each pillar is written to give you immediate, actionable moves plus a clear link to where to go next (for example, Market IQ or Emotional IQ deep dives you can build toward). Use the self-audit later to score yourself and spot the pillar that’s starving for attention.

Pillar 1: Mindset & Awareness: The Psychology Pillar

Imagine two people receiving the same unexpected $1000 bonus. One immediately mentally allocates it—some to safety, some to delight, some to investment—then sleeps well. The other describes it as “not mine,” spends impulsively, and wakes anxious about next month. The difference: financial wiring.

Core Explanation

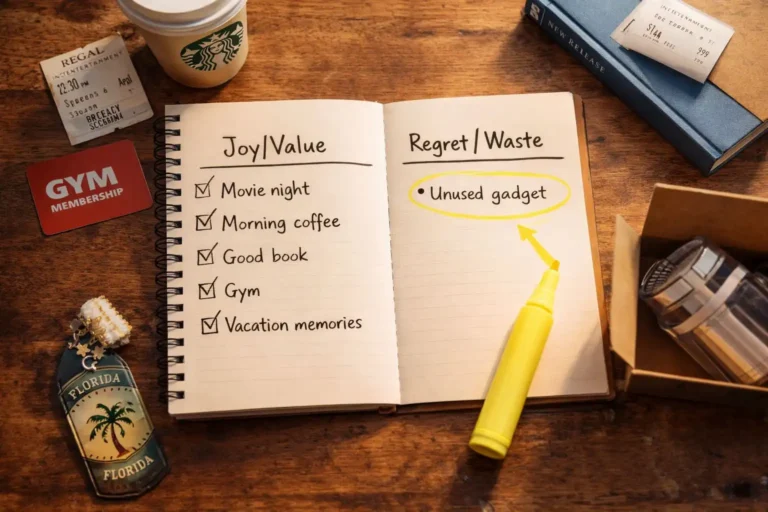

Mindset & Awareness is the set of beliefs, narratives, and attention patterns you bring to money. It’s where money stories live: “I’m bad with money,” “Rich people are greedy,” or “Debt is always evil.” These narratives shape every decision—what you save, when you cut costs, when you chase returns. If you ignore this pillar, technical skills (budgeting, investing) will fight the unconscious scripts and lose. Mindset isn’t fluffy: it’s the operating system that runs your financial apps.

The “IQ” Angle

In Financial IQ terms, mindset is the calibration layer. It converts data into decisions. High Financial IQ without mindset work is brittle: the person knows strategies but keeps sabotaging them. Growing your mindset raises the ceiling of what your technical skills can accomplish.

Actionable Steps (3–5 immediate moves)

- Map your money stories: Spend 15 minutes writing five sentences that begin “Money means…” Notice the feeling behind each.

- Weekly money date: 30 minutes every Sunday to review one win, one worry, and one micro-adjustment (e.g., reassign $50 from eating out to emergency fund).

- Reframe one limiting belief: Replace “I can’t save” with “I can prioritize savings”—write a short social-proof sentence you’ll repeat daily.

- Create a 50-word Money Empowerment Manifesto and pin it where you pay bills.

- Micro-accountability: tell one trusted person one small goal (e.g., increase SIP by $25 or $50) and set a two-week check-in.

Real-Life Analogy

Mindset is like the operating system on your phone: no matter how many apps (investments, budgets) you install, a buggy OS will cause crashes and misfires. Fix the OS first.

Pillar 2: Cash Flow Command: The Circulation Pillar

If mindset is the OS, cash flow is the battery and fuel pump combined. You can have brilliant financial ideas, but if you habitually run negative cash flow, those ideas stay ideas. One small rule trumps many clever hacks: never let cash velocity outpace your plan.

Core Explanation

Cash Flow Command is the active management of money coming in and money going out—earning, allocating, optimizing, and short-circuiting waste. It’s not just “make more” or “spend less”; it’s the architecture of how money moves: envelopes, accounts, automated funnels, and timing. Ignore it and you trade long-term profits for short-term convenience.

The “IQ” Angle

A high Financial IQ treats cash flow as the ecosystem that enables every other pillar. Efficient cash flow funds asset acquisition, reduces stress (mindset), and creates surplus for leverage. Commanding your cash flow raises optionality: with clarity, you can invest without panic or hold liquidity to seize opportunities.

Actionable Steps (3–5 immediate moves)

- Build a 30-day cash map: track every rupee for 30 days (or use bank statements) and highlight 3 recurring, negotiable expenses to downsize.

- Automate your priorities: split incoming salary into at least three automated buckets—Essentials, Growth (investments), and Freedom (savings/emergency). Start with 50/30/20 and adapt.

- Increase income by an experiment: pick one side project idea and commit 4 hours a week for one month with measurable goals.

- Biweekly liquidity check: ensure at least one month of fixed expenses is accessible; if not, shift a discrete portion from low-priority spend.

- Create a “pause rule”: for any non-essential purchase above $25, wait 48 hours and write why you want it.

Real-Life Analogy

Cash flow is like a city’s water system: if supply and channels are clogged, the tallest skyscraper will not have water. Fix the pipes before you build.

Pillar 3: Asset Acquisition & Defense: The Accumulation Pillar

Think of assets as machines that produce future cash or resilience. But unprotected machines rust, and misselected machines burn capital. The best investors pair constructive acquisition with ironclad defense.

Core Explanation

This pillar covers what to own (assets) and how to protect those assets (insurance, legal structures, diversification). Acquisition includes real assets (real estate, business equity) and financial assets (stocks, bonds, index funds). Defense covers emergency funds, insurance, legal documents, and the right level of diversification and risk controls. Ignoring defense makes acquisition dangerous; ignoring acquisition makes defense an expensive hobby.

The “IQ” Angle

A full Financial IQ recognizes that owning assets is how you transfer present income into future security and optionality. Defense prevents single events from eroding years of compound growth. Together, acquisition + defense create a durable balance sheet.

Actionable Steps (3–5 immediate moves)

- Inventory exercise: list every asset and its purpose (income, growth, protection). Mark each as “core” or “speculative.”

- Emergency reserve rule: set a target (3–6 months of fixed costs) and automate transfers until it’s reached.

- Insurance gap analysis: list policies (health, term life, asset) and estimate uncovered risk—get quotes for shortfalls.

- Acquisition plan: pick one low-cost index fund or business micro-investment and fund it monthly—document expected timeline and metrics.

- Legal hygiene: ensure basic wills/power of attorney and that beneficiary designations are current.

Real-Life Analogy

Assets and defenses are like a tree and its root system: the branches (investments) produce fruit, but the roots (protection and structure) keep the tree standing in storms.

Pillar 4: Leverage & Multiplication: The Amplification Pillar

Multiplication is the quiet engine behind real wealth: compound interest, smart debt, business scaling. But leverage is a two-edged sword—used wisely it multiplies returns; used carelessly it multiplies losses.

Core Explanation

Leverage & Multiplication is about using tools (debt, derivatives, business systems, time arbitrage) to amplify returns and outcomes. It includes compounding strategies, scaling income models, structured credit, and efficient tax-aware vehicles. This pillar is not “take on debt.” It’s about controlled, margin-of-safety thinking: where does leverage improve odds, and where does it worsen them?

The “IQ” Angle

In Financial IQ, leverage is the controlled accelerator. Mastering it means understanding probabilities, downside exposure, and worst-case scenarios. It allows someone with modest capital but high skill to grow much faster than someone without tools. It distinguishes steady savers from scalable wealth builders.

Actionable Steps (3–5 immediate moves)

- Compound experiment: start or increase a SIP into a broad-market index fund with a 3-year minimum horizon—track monthly progress.

- Leverage audit: list current debts and classify as “productive” (mortgage, business loan) vs “consumptive” (high-interest cards). Create a payoff/prioritization plan.

- Business leverage sprint: if you have a side gig, identify one repeatable process to automate or outsource this month to double capacity.

- Risk sizing: for each leveraged position, write a one-paragraph worst-case scenario and what you’d do. Only proceed if you can live with that scenario.

- Use time arbitrage: delegate or automate tasks that cost you high hourly rates so your human capital compounds.

Real-Life Analogy

Leverage is like adding gears to a bicycle: in the right gear you sprint; in the wrong gear you stall and hurt yourself. Choose gears by terrain (risk) and fitness (buffers).

Pillar 5: Financial Fluency: The Systems & Macro Pillar

Too many people treat taxes, fees, and macro shifts as background noise. The truth: small percentage differences and rule changes compound into enormous advantage or hidden leakage. Financial fluency converts rules into runway.

Core Explanation

Financial Fluency means understanding the systems around money—tax rules, basic macroeconomics (inflation, interest-rate cycles), regulatory frameworks, and common financial product mechanics (mutual funds, SIPs, bonds). It’s how you translate a market event into a tactical change in your portfolio or behavior. Without fluency, you overpay taxes, misinterpret volatility, and miss policy-driven windows.

The “IQ” Angle

At the highest level of Financial IQ, fluency is the decoding key. It takes the outputs of other pillars (surplus, assets, leverage) and optimizes them against the landscape. You won’t need to be a professional economist—just fluent enough to ask the right questions and act smartly.

Actionable Steps (3–5 immediate moves)

- Tax checklist: list the tax-advantaged instruments available to you and confirm you’re using the most appropriate ones; schedule a 30-minute consult with a tax advisor if uncertain.

- Macro simple rules: create two rules for market downturns (e.g., buy-the-dip allocation cap, rebalancing frequency).

- Fee audit: review investment and banking fees; renegotiate or move away from services costing >1% without clear value.

- Policy watch: sign up for one reliable newsletter or calendar for major tax and policy dates to avoid surprises.

- Scenario planning: once per quarter, outline one optimistic and one pessimistic macro scenario and what portfolio actions each would trigger.

Real-Life Analogy

Financial Fluency is like knowing how the electrical grid works before installing high-power devices at home. Without that knowledge, you’ll overload circuits; with it, you install safeguards and maximize functionality.

Bonus Tips — Tactical Wins to Amplify Your Five Pillars of Financial IQ

These are the high-impact, low-friction moves that most people miss. Use them to accelerate all five pillars at once.

1. Turn one habit into a system.

Pick a single 10-minute weekly ritual (a “money date”) and automate it into your calendar. Fixing awareness (Pillar 1) compounds faster when it’s scheduled.

2. Use the “Pay-yourself-first” funnel + micro-buckets.

Automate transfers the day you’re paid: 40% Essentials, 30% Growth (SIPs, index), 20% Optionality (side-hustle seed), 10% Fun. This lightweight allocation improves Cash Flow Command immediately.

3. Buy assets, not speculation.

Focus early purchases on simple, diversified assets (broad index funds, a low-cost emergency fund, a small productive skill investment). Pair each asset buy with a one-line defense plan (insurance or legal step).

4. Leverage cautiously — test with ‘dry runs’.

Before using borrowed money or business credit, run a simulation of worst-case cash flows for 6 months. If you can survive that, the leverage is survivable.

5. Make fluency bite-sized.

Subscribe to one practical tax/finance newsletter and read one explainer a week. Over 6 months you’ll outpace peers who rely on headlines.

FAQs — Answers People Search For About the Five Pillars of Financial IQ

Q: What are the Five Pillars of Financial IQ?

A: The five pillars are Mindset & Awareness, Cash Flow Command, Asset Acquisition & Defense, Leverage & Multiplication, and Financial Fluency. Together they form a repeatable framework that turns random financial choices into an intentional growth engine.

Q: Which pillar should a beginner focus on first?

A: Start with Mindset & Awareness and Cash Flow Command. Fixing mental patterns and stabilizing cash flow creates immediate breathing room and funds for investing. Small wins here unlock the rest faster.

Q: How long does it take to see results from applying the Five Pillars of Financial IQ?

A: Expect momentum within 30–90 days for behavioral and cash-flow improvements (automation, emergency funds). Asset growth and tax optimization take 6–18 months to produce noticeable financial change. Consistency is the multiplier.

Q: Can I use leverage safely?

A: Yes — when it’s used for productive purposes (scaling business revenue, investment with defined downside) and accompanied by a written worst-case plan. Treat leverage as a tool, not a shortcut.

Q: Will mastering these pillars guarantee wealth?

A: No single framework guarantees outcomes. But the Five Pillars of Financial IQ drastically improve your odds by reducing avoidable mistakes, increasing optionality, and focusing scarce resources where they compound.

Q: How do I protect assets as I accumulate them?

A: Use three defenses: an emergency reserve, appropriate insurance (health, term life), and legal basics (wills/beneficiaries). Revisit protection whenever your asset mix or family situation changes.

Q: How does Financial Fluency help in market downturns?

A: Fluency teaches simple trigger rules (when to rebalance, how much to hold in cash, tax-loss harvesting basics). These rules convert volatility from panic into tactical opportunity.

Q: Best quick wins to improve Financial IQ today?

A: Do a 30-day cash map, set up one automatic SIP, write a 50-word Money Manifesto, and schedule a 30-minute consult with a tax or insurance pro. These four actions touch every pillar.

Financial IQ Pillars Self-Audit Worksheet (Interactive)

Download your free, printable in-depth audit checklist below.

| Pillar | Rate yourself 1–10 (honest) | One action this week (write one) |

|---|---|---|

| Mindset & Awareness | [ ] | __________________________ |

| Cash Flow Command | [ ] | __________________________ |

| Asset Acquisition & Defense | [ ] | __________________________ |

| Leverage & Multiplication | [ ] | __________________________ |

| Financial Fluency | [ ] | __________________________ |

How to use this: Give each pillar a 1–10 score. Circle the pillar with the lowest score and pick the corresponding “one action” to complete this week. Repeat audit every 30 days. Want the printable PDF version? > Just comment below or mail me. (We will mail for free)

Five Pillars of Financial IQ: Your 30-Day Starter Plan

This 30-day plan turns insight into momentum. Choose one pillar to be primary and one pillar to be supportive. Example: Primary = Cash Flow, Supportive = Mindset.

Week 1 — Diagnose & Stabilize

- Do the self-audit. Score everything honestly.

- Implement one immediate stabilizer (e.g., automate savings 10% of income).

Week 2 — Build a Small Win

- Execute one actionable step from your primary pillar (e.g., 30-day cash map).

- Create a small barrier (48-hour pause rule for big purchases).

Week 3 — Protect & Invest

- Set up or top up your emergency fund.

- Open or add to a simplest investment vehicle (index SIP).

Week 4 — Scale & Review

- Introduce one leverage-safe move (increase SIP or test a small side gig).

- Review the month, update your audit, and plan next 30 days.

This starter plan forces sequencing: stabilize cash flow, protect assets, and then scale—never the other way around.

Conclusion

The Five Pillars of Financial IQ are not a checklist you glance at and forget. They are a coherent system: your mindset interprets reality, cash flow fuels action, assets build optionality, leverage amplifies your output, and financial fluency keeps you on the right legal and strategic rails. When you link them intentionally, you stop reacting to headlines and start commanding outcomes.

This framework is the missing architecture most people never learn. It’s what separates those who tinker with budgets from those who build generational optionality. Pick the weakest pillar from your audit, complete one micro-action this week, and repeat. Small, consistent application compounds into unshakeable confidence and materially different financial outcomes.

Remember: mastery is iterative. Use the self-audit, follow the 30-day starter plan, and join the conversation below—tell us which pillar you chose and what you learned. The Five Pillars of Financial IQ are not theoretical; they are your playbook.

Multi-Part Call to Action (CTA)

- Audit: Start with your Self-Audit right now in the section above—circle your weakest pillar and commit one action.

- Comment: Which pillar feels most challenging? Share below—let’s troubleshoot together; I’ll reply with one concrete fix.

- Share / Subscribe: If this blueprint clarified your path, share it with one friend who needs it. Subscribe for deep dives on each pillar (e.g., Emotional IQ for Investors, Market IQ for Beginners, Leverage Tactics).