Struggling with multiple dues and unsure which method to choose — debt snowball vs avalanche? What if we told you that you do not have to pick just one? In this blog, we’ll explore how combining both strategies could be your ultimate game plan to crush debt faster and smarter.

Table of Contents

Can You Combine Both Debt Snowball and Avalanche Methods for Maximum Impact?

“Yes” Absolutely! Combining the snowball and avalanche methods allows you to gain quick motivation by paying off small debts early while also saving money by focusing on high-interest debts. This hybrid strategy can speed up your debt-free journey while keeping you emotionally and financially engaged.

But how do you actually make this hybrid approach work? When should you lean into one over the other? And is it right for everyone?

Let’s break it down:

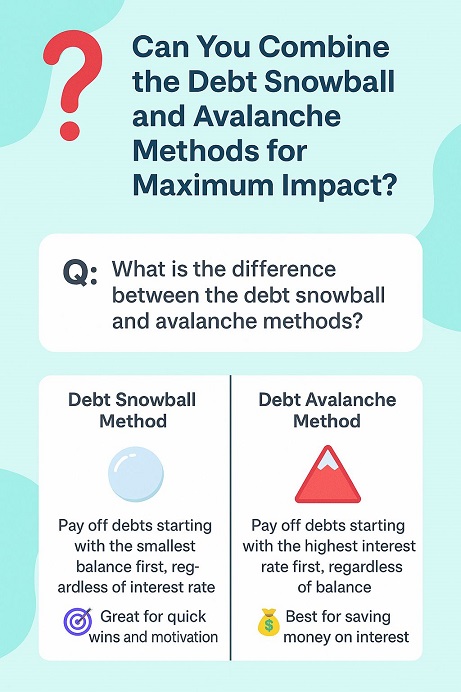

What’s the Difference Between the Debt Snowball and Avalanche Methods?

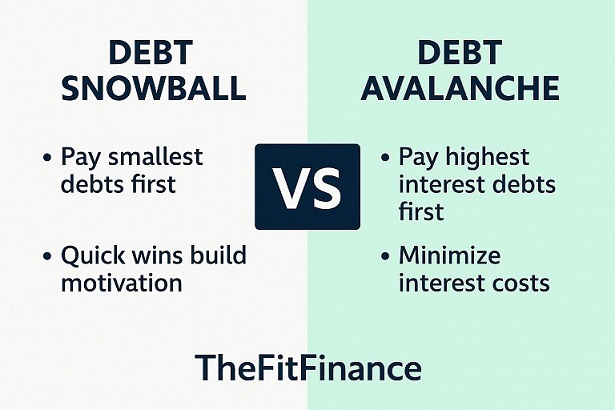

Before diving into hybrid strategies, let’s understand how debt snowball and avalanche method works:

🟢 Debt Snowball:

You pay off debts from smallest to largest balance, regardless of interest rate.

✅ Great for motivation

✅ Quick wins build momentum

🔵 Debt Avalanche:

You pay off debts with the highest interest rate first, regardless of balance.

✅ Saves the most money in the long run

✅ Requires discipline and patience

Both work, but each has strengths and weaknesses. So, what if you could use the emotional power of snowball and the financial logic of avalanche?

Why do some people struggle to stick to either method?

Because real life isn’t just about numbers. It’s also about emotions, willpower, and momentum.

• Snowball gives fast wins but may cost more in interest.

• Avalanche saves more money but can feel slow and discouraging—especially when your first target is a $10,000 card at 24.99% APR.

Many people quit halfway.

So, can I combine both methods into one strategy?

Absolutely! This is where the Hybrid Debt Payoff Strategy comes in—a blend that borrows the best from debt snowball vs avalanche methods.

The Hybrid Strategy means:

🟢 Start with a few small balance debts to get some momentum (like snowball).

🔵 Then shift focus to high-interest debts to avoid costly interest (like avalanche).

Think of it as mental wins first, money wins second — and that’s a formula that sticks.

How does a hybrid strategy actually work? (Create a Personalized Hybrid Debt Payoff Plan)

Here’s a step-by-step plan to blend debt snowball vs avalanche strategies smartly:

✅ Step 1: List all your debts

Include the:

• Name of the creditor

• Total balance

• Interest rate

• Minimum monthly payment

✅ Step 2: Pay minimums on all, then attack the smallest debt first (Snowball mode)

Use any extra money to destroy the smallest balance. This gives you the psychological win of knocking out a debt fast.

✅ Step 3: After 1–2 debts, switch to Avalanche mode

Once you have eliminated one or two small debts, reorder your list by highest interest rate. Focus your extra payments here from now on.

✅ Step 4: Rank remaining debts by interest rate

Now switch gears and tackle high-interest debts to maximize savings.

✅ Step 5: Stick to your plan with discipline

Reassess monthly and adjust if needed — flexibility is key!

This switch:

• Builds momentum 💪

• Then optimizes money 💸

When exactly should I switch from snowball to avalanche in Your Hybrid Plan?

There is no one-size-fits-all answer, but here are 3 common trigger points:

1. 🎯 After 1–2 small wins

Great for motivation.

2. 📉 Once your total debt drops by 25–30%

This is a perfect time to refocus on interest savings.

3. 📆 After 3–6 months of steady payments

Enough time to build the habit and see progress.

You can also switch your strategy in this way;

🟢 Use the snowball method when:

• You feel overwhelmed and need fast results

• You want momentum to stay consistent

🔵 Use the avalanche method when:

• You have built up some confidence and want to crush interest

• You are ready to go full-speed into financially efficient debt reduction

🎯 The secret? Do not be afraid to switch gears based on your mental state and progress.

Can you show me a real-life example of this hybrid method?

Sure! Meet Sarah:

• $1,200 credit card at 17%

• $3,000 car loan at 6%

• $9,000 personal loan at 12%

• $5,500 credit card at 24%

🟢 Month 1–4 (Snowball Mode):

• Sarah pays off the $1,200 card quickly—celebrates 🎉!

• Then chips away at the $3,000 car loan.

🔵 Month 5 Onward (Avalanche Mode):

• She switches focus to the $5,500 card at 24%, saving loads on interest.

• Personal loan comes last.

Sarah feels proud early on AND saves thousands in interest. Win-win.

Is this better than just choosing snowball or avalanche alone?

In many cases—Yes.

| Method | Motivation Boost | Interest Savings | Long-Term Efficiency |

| Snowball | ✅✅✅ | ❌ | ⚠ May cost more |

| Avalanche | ❌ | ✅✅✅ | ✅ |

| Hybrid | ✅✅ | ✅✅ | ✅✅✅ |

The hybrid method gives you emotional fuel AND mathematical advantage.

Tools and Tips to Stay on Track with a Hybrid Strategy

Need help managing your hybrid debt plan? Try these:

✅ Apps:

• Undebt.it (great for hybrid strategies)

• YNAB (You Need A Budget)

• Debt Payoff Planner

✅ Spreadsheets:

Use Google Sheets or Excel with auto-calculating fields for balances, interest, and progress charts.

✅ Reminders & Journaling:

Set debt-free goals, celebrate milestones, and write down “why” you’re doing it.

Pros and Cons of Mixing debt snowball vs avalanche

Pros & Cons:

✅ Combines motivation and money-saving ❌ Requires planning and tracking

✅ Flexible and adaptable ❌ Might feel inconsistent at times

✅ Personalizes your journey ❌ Not as automated as single-method plans

If you are intentional and willing to check in monthly, this strategy can truly outperform either method alone.

What are some motivational hacks to stay committed?

Here is how to stay fired up:

• 💡 Track progress visually – use a whiteboard, debt thermometer, or app

• 🎁 Reward milestones – after every debt payoff, treat yourself (within reason)

• 🙋♀ Accountability buddy – tell someone your plan

• 📆 Weekly check-ins – schedule 10 minutes every Sunday to review

Small systems = long-term wins.

Is it okay to modify my method over time?

Absolutely!. Your income, mindset, and priorities evolve—and so can your plan.

Reassess every 3–6 months:

• Can you increase extra payments?

• Has your credit improved (refinance opportunity)?

• Should you adjust your debt order?

Your strategy should serve your financial reality and emotional bandwidth.

✅ 5 Frequently Asked Questions (FAQs)

Questions & Answers:

- What is the debt snowball method?

The debt snowball method focuses on paying off your smallest balances first. It builds momentum and motivation as you eliminate debts quickly, regardless of the interest rate. - What is the debt avalanche method?

The debt avalanche method prioritizes paying off debts with the highest interest rates first. This approach helps you save more money in the long run, though it may take longer to see progress. - Which is better: debt snowball or avalanche method?

It depends on your personality and goals. The snowball method is ideal for motivation, while the avalanche method is financially efficient. A hybrid strategy can combine the best of both worlds. - Can I combine snowball and avalanche strategies?

Yes! A hybrid strategy lets you enjoy early wins from the snowball method while tackling high-interest debts like the avalanche method. It offers both emotional satisfaction and financial efficiency. - How can I choose the best debt payoff method for me?

Start by evaluating your financial behavior, debt types, and emotional triggers. If motivation keeps you going, try the snowball. If saving interest matters most, go avalanche—or use a hybrid mix.

What’s the final verdict on the debt snowball vs avalanche debate?

Let’s end the debate by reframing the question.

Instead of:

“Which is better—debt snowball versus avalanche method?”

Ask:

“What strategy will I actually stick to?”

And the answer for (debt snowball vs avalanche) most people is:

👉 Start with a snowball, finish with an avalanche.

A hybrid payoff strategy balances the psychology of success with the math of money.

🚀 Final Thoughts: Do not Just Pay Off Debt—Build a Future

Paying off debt isn’t just about being debt-free. It’s about what comes next:

• Investing 💹

• Saving for dreams 🌍

• Gaining confidence 💪

• Achieving financial independence 🏖

Each payment gets you closer to that future.

Start today. Pick your first target. And build your freedom—step by step.

🔗 Bonus Read:

Ready to plan what comes after debt freedom?

Do not forget to read it