Drowning in minimum payments and high interest? You’re not alone – Americans carry over $1.23 trillion in credit card debt. You have more power than you think. Imagine debt as a crafty opponent in a game, not a monster: with smart moves, even a huge balance can be defeated. There’s no magic trick to make debts vanish, but there are little-known Credit Card Debt Loophole strategies that can ease your burden. In this guide, we’ll uncover surprising hacks (legal and psychological) that help Americans break free from crushing credit card bills.

We will dive beyond basic advice with five juicy loopholes: Psychological tricks (like asking banks for hardship or retention deals), System tactics (settlements vs. bankruptcy), Legacy laws (how inherited debt really works), Float strategies (using balance transfers and 0% promotions as cash-flow hacks), and Statute shields (navigating time-barred “zombie” debt). We include actionable steps, playful analogies, bold takeaways, and even a quick self-quiz to find the strategy that fits your situation.

Prevention: Keep Your Debt Monster at Bay

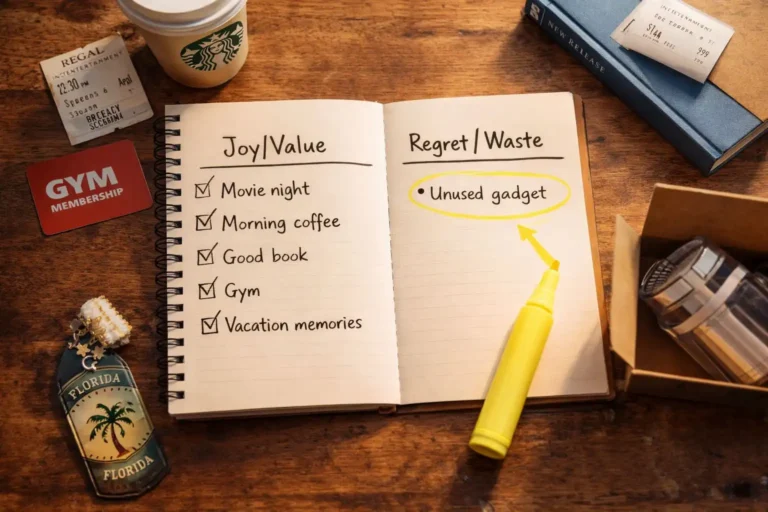

Before we conquer existing debt, let’s talk prevention. You would not let your favorite character level up into a boss without training, right? Keep your credit utilization ratio low (aim under 30%), pay on time, and build an emergency fund. Freeze or cut unused cards so you don’t give yourself new temptations. Track every dollar and budget like a boss – it’s way easier to avoid a debt trap than to fight your way out.

• Use the 50/30/20 rule: 50% of income for needs, 30% for wants, 20% for savings/debt.

• Pay more than the minimum whenever possible to attack the principal.

• Key Takeaway: Even small extra payments shave off interest and shorten your payoff time.

• Ever heard the myth that 0% utilization is best? In reality, any ratio above 30% can hurt you.

The Psychological Loophole: Hardship & Retention Offers

When debt hits, stress can make us panic or give up. Instead, pick up the phone: many issuers offer unadvertised hardship programs to customers in need. Call your credit card company and explain your situation. Use a clear debt negotiation script like: “I just lost work hours and can only afford $X per month; can we lower my rate or set up a hardship plan?” Treat the rep like a coach – mention that you may have to close or cancel accounts if things don’t improve. Banks want to keep your business, so they may cut you a break with lower APRs, waived fees, or other concessions.

• Call your issuer before missing payments, explain the situation calmly, and be polite but firm.

• Mention the word “hardship” and ask for fee waivers or interest-rate reductions.

• Bold Tip: Even a slightly lower APR or minimum payment gives you breathing room to catch up.

• Key Takeaway: You have negotiating power. Collectors and issuers prefer a deal over a default, so stay calm and make an offer.

Credit Card Debt Loophole: Settlement vs. Bankruptcy

If you’re overwhelmed by multiple cards with no relief in sight, it’s time to compare two big options: debt settlement or bankruptcy. Debt settlement means you offer one lump sum to clear a balance for less than you owe (e.g. $600 to settle a $1,000 balance). The creditor then marks it “settled in full.” This can wipe out debts quickly, but it hurts your credit report.

Bankruptcy (Chapter 7 or 13) discharges most unsecured debts entirely, but it also stays on your credit report for years. If your total debt far exceeds what you can ever pay, a clean slate via Chapter 7 might be the smarter reboot. If you have cash savings or assets, negotiating settlement could save money. Which fits you?

• Try a simple script: “I can pay $X today (around 60% of what’s owed). If I do that as a settlement in full, will you accept it?”

• If a creditor counters, negotiate up until you find a number you can pay.

• Bold Fact: Settling debt usually stays on your report for 7 years as “settled for less,” while bankruptcy appears as “discharged” for up to 10 years.

• Key Takeaway: Both options damage credit, but wiping out debt may be worth the trade-off if you’re otherwise stuck.

The Legacy Loophole: What Happens to Inherited Debt

Good news: in most cases, you won’t inherit a family member’s credit card debt. Debts of someone who dies are paid from their estate, not from your pocket – unless you co-signed or were a joint account holder. (In community property states like CA, TX, AZ, etc., a surviving spouse may be on the hook for debts incurred during marriage.) Typically, any remaining debt after assets are used is wiped out. If you co-signed or had a joint card, though, you remain responsible.

• Confirm all debts and assets by asking the executor or attorney handling the estate.

• If you co-signed or were a joint cardholder, you must pay your share – otherwise, you’re off the hook.

• Quick Tip: Notify card issuers and credit bureaus of the death (send a certified death certificate) to prevent collectors from bothering surviving relatives.

• Key Takeaway: Heirs generally don’t pay a deceased person’s unsecured debts (the estate does). Only co-signers or spouses in community property states might face liability.

The Float Loophole: Balance Transfers & 0% Promotions

Think of balance transfers and zero-interest promotions as short-term rafts for your finances. For example, moving $5,000 from a 20% APR card to a new card with 0% APR gives you many months of interest-free breathing room. But beware: treat it like a loan you must repay. Set strong calendar reminders—if you miss the deadline, back interest can be brutal. Most transfers have a fee (around 3–5%), so do the math: if the interest you avoid exceeds the fee, it’s worth it. Used properly, this tactic lets every dollar go to principal without interest for a while. But slip up and you could face a huge penalty rate. With discipline, this strategy can zap credit card debt much faster.

• Monitor your credit utilization ratio: using a new card up to 90% of its limit can ding your score. Try to keep each card’s balance modest.

• Use 0% convenience checks (if issued by your card) only for true emergencies. They carry the same need-to-payback discipline.

• Warning: A single late payment often voids the promo and triggers a penalty APR (sometimes 25% or more).

• Key Takeaway: Balance transfers are powerful but need discipline. They’re essentially an interest-free loan—use them to eliminate debt faster, with a solid repayment plan.

The Statute Loophole: Time-Barred Debt & Zombie Collections

Every state caps how long debt can be collected by lawsuit. This “statute of limitations on debt” is usually 3–6 years for credit cards. After that period, the debt becomes “time-barred.” Collectors may still call or send threats, but they cannot legally sue you. (If they do sue, simply show up in court and assert the clock has expired.) Important: making even a small payment or acknowledging an old debt can restart the clock. If a collector calls, request a debt validation letter – by law they must prove the debt is yours. This is especially useful if an old or “zombie” debt resurfaces. Always keep the conversation in writing and know your rights.

• If sued on an old debt, attend court and assert the statute-of-limitations as your defense. Courts usually won’t know unless you raise it.

• Use debt collector loopholes: collectors must follow FDCPA rules (no harassment, no threats). Know your rights and report any violations.

• Some collectors do a Pay for Delete: pay part of a charged-off debt, and they agree in writing to remove it from your credit report. It’s not guaranteed, but sometimes collectors will delete the negative entry if you insist in writing.

• Key Takeaway: Once debt is time-barred, creditors can’t enforce it through court. Keep everything in writing, never revive an old debt, and zombie debt loses its power.

Debt Strategy Self-Assessment Quiz

Answer the questions below to identify which loophole strategy fits your profile:

1. Your credit card calls are piling up and you can barely afford the minimum. What do you do?

• A) Call the issuer, explain hardship, and ask for a lower rate or payment plan.

• B) Look for a 0% balance transfer offer or use a zero-interest promotion.

• C) Offer a lump sum to settle the balance for less (negotiate a settlement).

• D) Stay quiet and hope the debt eventually becomes time-barred.

2. You’ve just inherited a modest sum, but your late aunt had a $10k credit card debt. Are you responsible?

• A) Yes, I must use the inheritance to pay it.

• B) Only if I co-signed or lived in a community property state.

• C) No, her estate pays it; I inherit only what’s left.

• D) I’m not sure; I might ignore it and see if collectors sue.

3. A collector contacts you about a 7-year-old charged-off card you forgot. What’s your move?

• A) Request a debt validation letter so they prove the debt.

• B) Offer to pay half of it now in exchange for removal from my report.

• C) Wait for them to sue me and then use the statute of limitations as a defense.

• D) Start making payments again to bring the account current.

4. You have three cards at 20% interest, but you got approved for a 0% intro APR card. How do you use it?

• A) Transfer the largest balance there and pay it down aggressively.

• B) Transfer all balances if possible and pay down the new card.

• C) Use it for new spending so I can apply payments on old cards.

• D) Ignore it and just keep paying the old cards normally.

5. Debt feels like a video game boss: overwhelming. Which description matches you?

• A) I have more power than I realize – I’ll negotiate with creditors and use every legal tactic.

• B) I’ll gather tools (like 0% deals) as temporary superpowers to weaken the boss.

• C) Sometimes you have to reset the game (declare bankruptcy) to win overall.

• D) I’ll try a stealth approach: wait out old debts and rebuild credit quietly.

Answer Key (loophole alignment): Mostly A’s suggest hardship/negotiation; mostly B’s lean on the float/balance-transfer hack; mostly C’s point to settlement or bankruptcy; mostly D’s favor statute/zombie strategies. Mix and match as needed – now go pick your best move!

Conclusion & Call to Action

Credit card debt might feel like a champion boxer, but even champs have weak spots. With these loopholes in your corner – savvy negotiation, legal knowledge, smart offers – you can win this fight. You have more power than you think! Grab these tips, follow the strategy that suits you, and start taking action now. The sooner you move, the sooner that debt is history.

Which loophole strategy will you try? Drop a comment below or share your own clever tactic. If this guide helped, share it with friends buried in debt and subscribe for more empowering money advice. You got this.

“Curious how your mindset shapes your wallet? Check out our previous post on mastering a winning money mindset > How to Enhance IQ for Money Growth | 7 Habits for Wealth Mindset – it’s the first step to financial victory!”