Connection Between Water and Money Flow

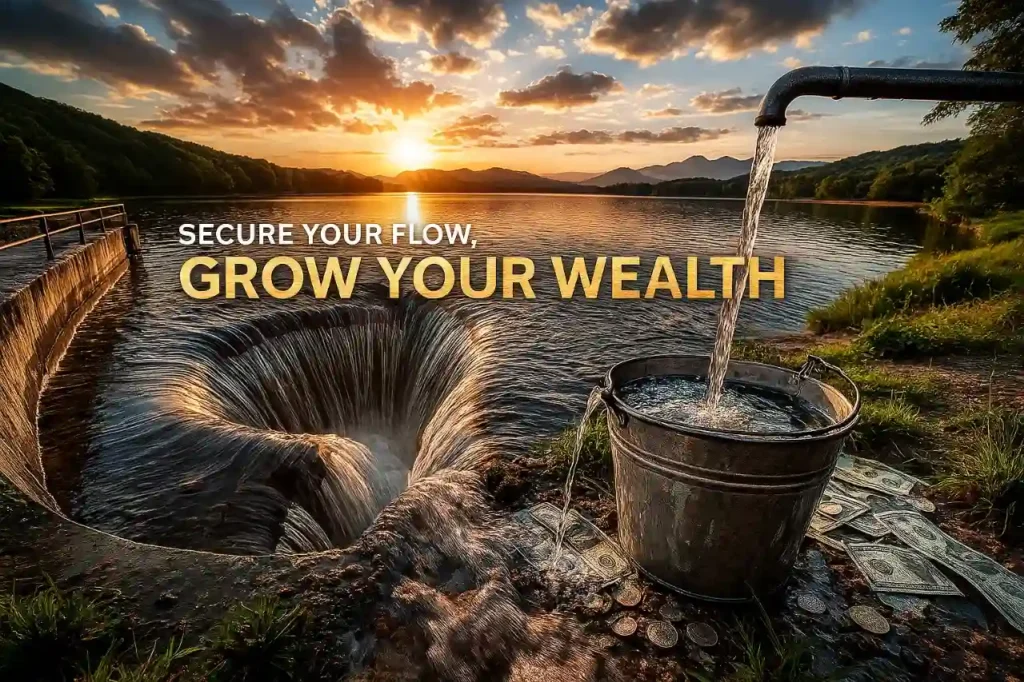

Imagine your money as a river winding through a vibrant forest. This river of personal finance carries your money flow – money entering with each paycheck or side hustle, and exiting through expenses. Like water, money is a precious resource meant to nourish life. With smart financial planning, you can direct that flow toward your goals instead of watching it flood away or dry up. In this post, we will explore powerful water metaphors to clarify budgeting, cash flow, emergency funds, and income streams, inspiring you to take charge of your finances.

Cash Flow: Let It Flow, Do not Let It Stagnate

Cash flow is literally the stream of money moving in and out of your life. As one financial resource explains, cash flow “goes out of and into your bank account”. Think of your daily expenses and earnings like a river’s current. If you have positive money flow (more water coming in than leaking out), your finances stay healthy. If not, you might find your financial river running dry. Managing cash flow keeps you in the comfort of steady currents. In fact, experts note that tracking money flow helps “identify your sources of income and how you spend your money,” enabling you to maintain positive flow and hit your goals.

Many of the terms we use in personal finance come from water. For example, being “underwater” on a loan means you owe more than its worth, just like being submerged by debt. Hearing about “liquidity” or a “financial wellspring” reminds us that money should move like water – freely and purposefully. Here are a few common water-money metaphors to keep in mind:

Cash Flow: The continuous flow of money into and out of your life. Like a river current, healthy cash flow keeps everything moving smoothly.

Income Streams: Each paycheck or side gig is like a tributary feeding your financial lake. Multiple streams (e.g. salary, freelance work, investments) combine into a powerful river of wealth.

Leaks (Overspending): Any uncontrolled spending is a leak or hole in your financial bucket. Just as water drains from a leaky container, wasted expenses drain your cash flow. Plugging leaks is a budgeting priority.

Rainy Day Fund (Emergency Fund): A reservoir of savings set aside for storms and droughts. Think of it as collecting rainwater in a tank – money reserved for life’s unexpected expenses.

Financial Planning: Designing banks, dams, and canals to guide your money flow. Intentional planning is like building levees; it channels and controls the flow for financial stability.

By visualizing these metaphors, you can better understand your financial situation. Are you letting the water flow freely, or is it pooling and evaporating? Take a moment to assess: Is your money flow smooth or obstructed? What would happen if you add more tributaries (extra income) or seal a leak? Identifying these patterns is the first step toward clear, purposeful financial planning.

Diversify Your Income Streams: Connect More Hoses

Like an impressive waterfall, more income streams pour together to create power. If you rely on only one faucet (your day job), your cash flow can feel narrow or precarious. Instead, think of adding more hoses to your financial pool. Each side hustle, part-time gig, or passive income source is another stream feeding your wealth. This concept is famously illustrated by the “hose into the pool” analogy: one commentator notes that the average millionaire has seven sources of income (seven hoses) filling their wealth pool. When you connect multiple hoses, even if they are thinner, the combined flow is impressive – often more reliable than waiting for one giant “firehose” paycheck.

For U.S. millennials juggling gig work, and busy families finding side gigs, adding income streams is crucial. For example, if you are freelance designing logos on the side or renting out an extra room, you have added a tributary to your financial river. This not only speeds up how fast your net worth pool fills, but it also protects against unexpected droughts. (If one faucet fails, the others still flow.) Side hustlers in particular should create a plan to balance multiple streams.

Quick Tips for Income Streams: Consider launching small, low-effort streams alongside your job. Maybe a weekend Etsy shop, freelancing, or dividend-yielding investments. Even a little extra water makes a difference. Just remember – each stream needs maintenance (some effort), but the goal is a constant trickle. Do not wait for one flood; collect multiple rivulets.

Budgeting: Plug Your Leaks and Manage Outflow

Without a budget, you might as well be dumping water into a sieve. One personal finance guru compares uncontrolled spending to “trying to put more water in a bucket that has holes in the bottom”. No matter how much you earn, unplanned splurges or forgotten subscriptions will drain it away. The key is to patch those holes first. Before chasing bigger raises or more gigs, reign in wasteful spending. That 7th latte a week or unused streaming service might seem small, but cumulatively they are significant leaks.

Budgeting for Beginners

Start by tracking where your money goes. Write down monthly essentials (rent, bills, groceries) and non-essentials (dining out, shopping). Ask yourself: Where are the leaks? Next, plug them. Can you negotiate a lower insurance rate, cancel unused memberships, or cook more at home? Even small fixes make your bucket hold more. With each leak patched, your flow toward savings quickens. (For a full starter plan, see our guide Budgeting for Beginners: A Simple Guide.)

Identify spending leaks: Review recent bank statements. Circle items that are not urgent needs. Was your last gadget an impulse buy? Streamers you do not use? Plan to cut or reduce them.

Create a bare-bones budget: Allocate income first to necessities (housing, food, bills), then to essentials like insurance. Only then fund wants. This creates disciplined flow.

Automate where possible: Set up automatic transfers for savings or bill payment. Automating is like building a mini-reservoir that fills itself; you avoid spending what you never see.

Review and adjust: Revisit your budget monthly. If water (money) is still leaking, seal those holes. If a faucet (income) increases, redirect the extra stream to savings or debt paydown.

Remember, budgeting isn’t about deprivation – it’s about control. By controlling outflow, you make the most of every drop. Patch the leaks and your personal “river” will flow with purpose.

Emergency Fund: Your Financial Reservoir

Even well-managed rivers can face storms or droughts. In finances, emergencies can be medical bills, car repairs, or unexpected job loss. For these storms, you need a reservoir of savings – often called a rainy day fund. This is your “financial dam,” a safe pool of cash ready to release when trouble hits. The U.S. Consumer Financial Protection Bureau emphasizes that setting aside even a small emergency fund lets you recover quicker and stay on track with your goal. In other words, having some money stored is like having a tank of water when rivers dry up – it keeps things running until conditions improve.

It may surprise you how important this dam can be. Recent surveys found that only 46% of Americans have enough saved to cover three months of expenses. Shockingly, about 24% have no emergency savings at all. This means nearly a quarter of people are one flood away from financial ruin. Protect yourself by building that reserve slowly but steadily. (For step-by-step help, see our post How to Build an Emergency Fund.)

Set a goal: Aim to save 3–6 months’ worth of living costs. That could mean $5,000–$20,000 depending on your lifestyle. Write it on a calendar or goal tracker. Like building a reservoir, you will fill it drop by drop.

Start small: If that seems daunting, begin with just $100 or one week’s expenses in a separate account. Even a trickle adds up. One expert notes that automating regular contributions (even modest amounts) is “one of the fastest ways” to see savings grow. Celebrate every milestone (reach 10%, then 25%, etc.) to stay motivated.

Use the right container: Keep this money in a safe, liquid place – a high-yield savings account or money market. This is your clear dam reservoir, so it should not be stuck in risky investments or retirement accounts. (You want easy access when the flood comes.)

Protect it: Treat your emergency fund as off-limits for non-emergencies. If a small repair comes up, try to use your regular cash flow; save the reservoir for big storms.

Building this buffer creates real financial stability. When trouble hits, you won’t need to siphon money from retirement or chase payday loans; you’ll have water in your tank. This peace of mind lets you focus on recovery, not debt.

Financial Planning: Chart Your Course for Stability

All these pieces – income, budget, savings – flow together into your financial plan. Think of planning as designing the entire water system for your life’s property. You would not construct a home without foundations or flood defenses; similarly, do not navigate your money life without a plan. Good financial planning means intentionally guiding your resources. Just as farmers plan irrigation routes or engineers build dams to direct water, you plan investments and spending to secure your future.

One study notes that positive cash flow and careful tracking “achieve your financial goals” more reliably. In practice, that means budgeting for retirement, saving for kids’ college, or building wealth. Picture yourself as the planner of a watershed: decide how much water goes to savings versus spending, create banks of investment, and set aside pools for short-term needs. This planning makes your finances drought-proof.

For example, set long-term goals (buy a home, retire comfortably) and break them into monthly targets. Like carving new channels, shift some funds each month into retirement or investment accounts. Re-evaluate yearly – are your goals flooding you with success or are adjustments needed?

Step-by-Step Plan:

Outline your goals: Map out where you want your money to eventually go (downstream objectives).

Make a budget canal: Allocate current cash flow to those goals (how much “water” will flow each period).

Invest for growth: Use savings to earn a return – like building a reservoir that eventually overflows into more wealth.

Review the map: Keep an eye on market changes and personal life shifts. Adjust your plan as rivers shift course over time.

By planning, you ensure your financial river never dries up or overflows unexpectedly. Instead, you canalize it toward prosperity.

📌 FAQ: Connection Between Water and Money Flow

❓ What is the cash flow formula, its calculation, and uses with an example?

Answer:

The cash flow formula is:

Cash Flow = Cash Inflows – Cash Outflows

Cash Inflows: money coming in (salary, sales, investments).

Cash Outflows: money going out (rent, bills, expenses).

Example:

If a small business earns $10,000 in revenue and spends $7,000 on expenses, the cash flow is:

👉 $10,000 – $7,000 = $3,000 positive cash flow.

Uses:

Track financial health.

Decide on investments or expansions.

Prevent overspending.

❓ What are the thumb rules of money?

Answer:

Some timeless money thumb rules include:

50-30-20 Rule: Spend 50% on needs, 30% on wants, and save 20%.

Emergency Fund: Save at least 3–6 months of expenses.

Invest Early: Start small, but be consistent with retirement savings.

Avoid Bad Debt: Don’t borrow for depreciating assets.

Live Below Your Means: Income should always exceed expenses (like water filling more than it leaks).

❓ What are the techniques for effective cash flow management?

Answer:

To manage cash flow effectively:

Budget Monthly: Know what’s coming in and going out.

Track Leaks: Identify small, unnecessary expenses (subscriptions, impulse buys).

Negotiate Payments: Stretch payables, but collect receivables faster.

Build Reserves: Keep a cash buffer for emergencies.

Invest Wisely: Put excess cash into growth instruments instead of letting it sit idle.

❓ How can small businesses manage cash flow?

Answer:

Small businesses should:

Forecast Regularly: Predict revenue vs. expenses weekly/monthly.

Separate Business & Personal Finances: Avoid mixing accounts.

Use Technology: Accounting software or apps to automate tracking.

Monitor Inventory: Too much stock ties up cash; too little loses sales.

Access Credit Smartly: Use lines of credit only as backup, not habitually.

❓ What are money flow tips for beginners?

Answer:

If you’re new to managing money, start simple:

Track Every Dollar: Use apps or a notebook.

Automate Savings: Treat savings like a bill you must pay.

Cut Small Leaks: Coffee, dining out, or unused subscriptions.

Set Goals: Short-term (vacation), medium (car), long-term (retirement).

Keep Learning: Read personal finance blogs, books, or listen to podcasts.

❓ Why is money flow compared to water flow?

Answer:

Money is like water:

If you have steady inflow, your “bucket” fills (savings grow).

If there are leaks, even a full bucket empties (overspending drains you).

With balance, money flows smoothly toward your goals.

❓ How do you stop money leaks?

Answer:

Audit your bank statements monthly.

Cancel unused subscriptions.

Avoid lifestyle inflation.

Use cashback/reward programs mindfully.

Reinvest savings into debt repayment or investments.

💧 Inspired to act? Begin today:

Trace your cash flow, patch a spending hole, or open a new savings account. For more guidance, check out our related articles and guides: Building Wealth Through Real Estate Flipping, and Top Cryptocurrency Investments.

Take Charge: Your Financial Journey Awaits

Whether you are a young millennial just learning the ropes or a side hustling parent balancing household books, remember this: You are the river engineer of your financial life. You can expand it, narrow it, dam it, or let it run wild – but the choices are yours. If you have felt unsteady on the money journey, let these water metaphors guide you. Plug budget leaks to keep more water in the pool. Start new income streams to swell your river. Build that emergency reservoir so storms pass by. Each effort sends you closer to financial stability and peace of mind.

🌟 Your financial success is within reach. By planning, diversifying, and budgeting with the force of nature on your side, you’ll steer toward calmer waters and brighter horizons. Keep this article’s tips in mind, and subscribe to our newsletter for more water-tested personal finance wisdom. Ride the waves of your cash flow with confidence, and watch your financial future flow robust and clear.

Understand How to Invest in an Uncertain World ~ 5 Proven Ways to Build Wealth When Others Panic