Many Americans wonder, “Can a middle-class boy become rich?” or “Can an average middle class person become a millionaire?” The short answer: absolutely. Data and real stories show that millions of U.S. families have built seven-figure net worth from modest beginnings. In fact, Statista reports over 22.7 million Americans now have a net worth above $1 million (about 8.8% of U.S. adults). Importantly, wealth surveys consistently find most of these millionaires grew up with ordinary incomes. For example, Zippia’s analysis shows 80% of U.S. millionaires were raised in middle-income or lower families (only 2% were wealthy as kids). That means the vast majority of millionaires came from backgrounds just like yours.

Statistically, the American dream is alive: middle-class roots are no barrier to wealth. Federal data even reveal a typical mid-income U.S. household has a median net worth around $356,300. Saving and investing just a bit more each year can compound that to $1 million. With the right habits and strategy, any hardworking person can plausibly cross the millionaire threshold. Researchers and finance writers back this up. For instance, one financial blog notes that Americans have been adding about 1,700 new millionaires every single day on average from 2016–2020. Each day, hundreds of middle-class workers push past $1M net worth through diligent investing and frugal living.

Even a modest saver can reach $1,000,000 over time. Disciplined investing – represented by the calculator showing “1000000” above – can realistically turn a middle-class salary into a million-dollar investment portfolio.

Who Gets Rich? Education, Industry and Background

Who are these newly wealthy Americans? Surprisingly, they come from many walks of life, not just Wall Street or tech. Studies show millionaires work in finance and tech, but many also come from everyday careers. According to Zippia, the industries producing the most millionaires and billionaires in the U.S. are finance & investments, technology, manufacturing, fashion & retail, and healthcare. Yet the same report notes “many millionaires” hold ordinary jobs – engineers, teachers, managers, accountants or lawyers. In fact, a third of U.S. millionaires never earned a six-figure salary, and most never peaked above $100k income in any year.

Education also helps but is not everything. Roughly 88% of U.S. millionaires have a college degree, and over half hold a graduate degree. But even these stats mask reality: a large share attend public/state schools (only 8% went to elite private universities). As Zippia notes, most millionaires did not inherit their fortune – 79% had zero inheritance. This underscores that wealth is earned, not given. Instead, persistent middle-class habits build it.

Crucially, wealth itself does not necessarily feel like “being rich” to many. A 2024 survey found 91% of American millionaires do not consider themselves “upper-class rich”. In that study, 60% called themselves upper-middle class and 31% identified as middle class. This reflects the reality that a million-dollar net worth is still just upper-middle in many regions. In practical terms, reaching $1M often means buying a modest home, investing for decades, and living relatively frugally. Indeed, legendary investor Warren Buffett (worth ~$100+ billion) still lives in the Omaha house he bought for $31,500 in 1958. The point: living modestly and budgeting are common millionaire habits, not the flashy lifestyles we imagine.

Habits of the Self-Made Millionaire

So what do middle-class people who became millionaires have in common? Research reveals clear patterns:

Hard work and persistence. A long-term study of U.S. millionaires found most believe wealth comes from effort, not luck. As one researcher put it, middle-class millionaires tend to be “hard-working, networked, persistent and [put] themselves in the flow of money”. In other words, they don’t give up at the first obstacle and they actively seek opportunities (job promotions, side gigs, investments).

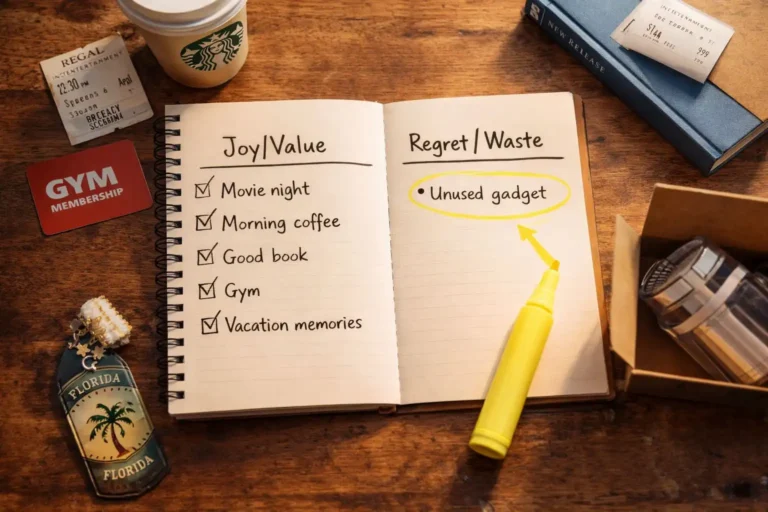

Frugal habits. The largest-ever “National Study of Millionaires” (10,000 respondents) found virtually none lived luxuriously before they were millionaires. Instead, they spent less than they earned, avoided wasteful debt, and invested the difference. For example, the survey noted nearly half of millionaires save at least 16% of their income each month. A concrete tip: many early millionaires drove used cars, bought modest homes, and skipped expensive vacations. The Ramsey Solutions millionaire study highlights Warren Buffett as a role model – despite enormous wealth, he still drives a mid-priced car and lives in a normal neighborhood. Put simply, wealthy people live well below their means, freeing up cash to invest.

Budgeting and planning. Regular millionaires keep very close track of money. The same study shows “budgeting is the key to winning with money” for millionaires. They follow simple rules: don’t spend more than 50% on needs, keep “wants” moderate, and divert at least 20% to saving. One-third of surveyed millionaires never made six figures, yet reached $1M through savvy money management. By contrast, high salaries mean nothing if you outspend them.

Investing consistently. Nearly all self-made millionaires invest. About 80% of them never received an inheritance, so they generated wealth through markets, real estate or businesses. Over 37% hold a professional career or advanced degree, but even doctors or lawyers invest heavily in retirement accounts. For instance, one analysis shows 537,000 Americans had over $1M in a 401(k) in 2024 – more than doubling from 2019. Becoming a “401(k) millionaire” isn’t a fantasy; it’s done by consistent contributions. Kiplinger notes that a 25-year-old who saves just $416/month into a 401(k) (earning ~7.5% per year) would accumulate about $1.27 million by age 65. Even starting later works: someone who waits until 35 can reach $1.1M by saving $833/month at 7.5%. The lesson: time in the market matters, so start early and save regularly.

Learning and networking. Millionaires value knowledge. Most are avid readers and learners, constantly educating themselves on business and finance. They also cultivate networks. A common saying goes, “you become who you hang out with,” and wealthy people make sure their circle includes mentors and goal-oriented peers. Even if you’re starting from a middle-class background, surrounding yourself with driven, financially savvy friends can create accountability and open doors.

High income doesn’t guarantee high IQ. A new Swedish study found that among very high earners, cognitive scores actually plateau, and the top 1% scored slightly worse than those just below them. This debunks myths about genius IQ being necessary for wealth.

IQ Myths: Do Millionaires and Billionaires Need to Be Geniuses?

Many people think you have to be a genius to get rich. Viral posts on social media even claim the “average IQ of a millionaire is 117” and of a billionaire is 133. These numbers have no solid basis. Recent academic research shows that beyond a certain point, wealth and IQ are not strongly correlated. A 2023 Swedish study matched income data with cognitive test scores and found that once income exceeds about €60k/year (~$65k), higher earnings stop tracking with higher IQ. In fact, the top 1% of earners in that study scored slightly lower on cognitive tests than the next income group. In plain terms, you do not need a sky-high IQ to become wealthy. Practical intelligence, social skills, and perseverance count for far more.

So if you are searching for the “average IQ of millionaires” or “average IQ of billionaires,” take those claims with skepticism. Real data suggest that “wealth is not an IQ contest.” A creative idea or disciplined habit can beat pure book smarts. Many millionaires (and even billionaires) credit mentors, luck and hustle over inherent genius. The evidence is clear: even college dropouts and self-described average students (for example, Richard Branson, Mark Zuckerberg, and others) have become extremely wealthy. In short, an average IQ or background will not stop you – so do not let that myth discourage a middle-class kid from dreaming big.

How Are Most Self-Made Millionaires Under 25 Made?

Legends about teen millionaires abound. It’s natural to ask: How are most self-made millionaires under 25 made? The truth is, it usually comes down to entrepreneurship and innovation. Many young millionaires start companies online, develop smartphone apps, or ride new internet trends. For example, Inc. magazine notes “there is no shortage of advice out there to help even the very young make strong business decisions. There is also no minimum age to become a millionaire”. Some teen founders create products or services that go viral (see famous stories of a 12-year-old stock trader or app developers in high school). Others piggyback on platforms like YouTube, gaming, or social media to earn significant revenue. The key is spotting a need and delivering value, regardless of age.

Similarly, tales of a “middle class young boy becoming millionaire” are more common than one might think. Across the U.S., countless kids have turned hobbies into businesses: selling handcrafted goods online, coding a viral app, or launching a tutoring service. While these are outliers, they share traits with all rich folks – passion, persistence, and time. Even the youngest winners often admit they worked relentlessly (sometimes while keeping up with school!).

Global examples underscore this potential. For instance, in India the “youngest self-made millionaire” on record is a guy named Ankit Bhati, who co-founded a ride-sharing startup (Ola Cabs) from a middle-class family. If a teenager in a developing country could reach a million, it tells us Americans with greater resources can too. The takeaway is inspirational: imaginative, driven youth do achieve big financial milestones, and their stories should motivate, not intimidate, any middle-class American.

Age at first million. Most Americans don’t hit $1M until late in life – the average millionaire is 57 years old. The graphic above (via The Market Hustle) compares this with tech founders like Zuckerberg (22) or Bezos (30). These outliers prove it’s possible to become rich young, but for most it’s a decades-long process.

Steps to Build Wealth from Middle-Class Roots

So if you are asking “Can an average middle class person become a millionaire?”, the answer hinges on what steps you take. The path is rarely magic; it involves practical actions repeated over years. Here are key strategies, all supported by data and expert advice:

- Live Below Your Means. Make frugality a habit. Most millionaires in surveys avoided conspicuous consumption early on. Drive reliable used cars, rent or modestly pay for housing, and skip big-ticket “lifestyle” spending until you’re secure. As Ramsey Solutions advises, live like a “broke person” on purpose (e.g. take the bus, use secondhand items) so you can save the difference. This creates extra cash to invest instead of fueling creditors’ incomes.

- Budget and Save Aggressively. Plan every dollar. The cornerstone of the wealthy mindset is budgeting. Set a realistic budget and stick to it. Aim to save or invest at least 15–20% of your gross income immediately, like an automatic “bill” (ideally through retirement plans or brokerage accounts). A massive study found nearly half of millionaires consistently save 16% of income. If your company offers a 401(k) match, contribute enough to get the full match – it’s free money. Over time, even small consistent savings grow enormous via compounding.

- Invest for the Long Haul. You’ve earned it – now put it to work. Backed by decades of data, the stock market is one of the most reliable wealth engines. Historically, the S&P 500 has returned roughly 10% annually on average. This means every $100 you invest can become roughly $1,000 in 25-30 years (rule of 72: doubling every ~7 years). Index funds or ETFs are low-cost ways to capture market gains. Kiplinger’s example shows a 25-year-old socking away ~$416 a month (with 7.5% returns) would have ~$1.27 million by 65. Even a modest salary can grow to millions with patience and compound growth. If you have a mortgage, consider extra principal payments once you’re on track; each percentage point return above your loan rate is pure gain.

- Build Skills and Income. Higher income means more to save. Continue to improve your earning power by investing in yourself:

• Education and skills. In-demand fields like engineering, finance, healthcare, and tech often have high pay. Certification courses or degrees (attainable through state schools or online) can boost income.

• Side hustles. Many millionaires had multiple income streams before hitting $1M. Ideas: start an online store, do freelance consulting, invest in rental property, or monetize a hobby. Any extra income that goes straight into savings/investments accelerates wealth-building.

• Networking. Keep expanding your contacts in your industry or field of interest. Good relationships lead to better job offers, business deals, or investment tips.

- Avoid or Manage Debt. Use credit cautiously. Surveyed millionaires typically have little to no consumer debt. High-interest debts (credit cards, payday loans) can sap your wealth before it forms. If you have existing debt (student loans, auto loans), budget aggressively to pay it off. Avoid financing depreciating assets. If you need to borrow, do so for appreciating assets (like a home or education), and make sure it’s manageable.

- Stay the Course Through Market Cycles. Economic downturns happen (e.g. 2008, 2020). Don’t panic-sell when markets drop. The new millionaires in 2020 show that market crashes often set up big gains later. A disciplined investor buys the dips and sits tight. Dollar-cost averaging (investing fixed amounts regularly) automatically handles ups and downs. Over 20-30 years, bear markets are usually temporary blips in the path to wealth.

- Keep Learning and Adapting. The financial world changes. Millionaires stay curious: they read business news, learn about new investment tools, and adjust strategy as needed. For example, when 401(k) plans and index funds became widely available in the ’80s and ’90s, savvy middle-class savers leveraged them heavily. Today’s tools (like robo-advisors, taxable brokerage accounts, and HSAs) can accelerate results if you understand them. So, always educate yourself about smarter ways to save, spend, and earn.

Connecting It All

Let’s recap with some data highlights that prove the middle class can become rich:

- Most Millionaires Were Middle Class: Over 80% grew up with “normal” incomes. Only a tiny fraction inherited wealth. This means the pathway is open to anyone with discipline.

- Delayed Gratification Pays Off: The average millionaire is not a 20-something celebrity – it’s about 57 years old. That aligns with a lifetime of steady saving and compounding. As the infographic above shows【41†】, tech founders are exceptions, not the norm.

- Consistent Investing Works: If you save a few hundred dollars monthly from your 20s into diversified index funds, you will likely hit seven figures by retirement. No secret stock picks needed – just time and regularity.

- Frugality and Planning: Traditional millionaire advice still applies: live below your means, budget, avoid debt, and make a plan. These aren’t glamorous, but they’re proven.

- Young Outliers Prove It’s Possible: Stories of teen millionaires confirm that age and origin don’t strictly limit you. They show how – by solving real problems in the marketplace, not by lottery. The techniques that helped them (tech skills, sales savvy, etc.) are available to motivated individuals everywhere.

In short, YES, a middle-class boy (or girl) can become rich, and so can an average middle-class person become a millionaire. It won’t happen overnight, and it requires patience and hard work, but data-driven strategies and countless success stories show it does happen. Americans have a strong infrastructure of investing (401(k), IRAs), entrepreneurship (small business loans, online markets), and education that make upward mobility feasible.

As you plan your own journey, remember: focus on action, not intimidation. Ignore myths about needing a genius IQ or a silver spoon. Instead, adopt the habits of wealth-builders: spend less, save more, invest wisely, and continually improve your skills. Even small steps – like automating contributions and avoiding impulse buys – will add up.

You have as good a shot as anyone: most millionaires started from regular backgrounds. It may not be easy, but for a motivated, informed American, becoming rich from middle-class roots is entirely attainable.

📘 Real-Life FAQs: Can a Middle-Class Boy Truly Become Rich?

Q1. Does a lowest IQ billionaire in the world really exist?

While the idea of the “lowest IQ billionaire in the world” fascinates many, there’s no confirmed ranking. Billionaires typically don’t release IQ scores, but several have openly admitted to struggling in school or being labeled “average.” This suggests that building wealth isn’t only about intelligence—it’s also about timing, grit, and action.

Q2. Are there any ultra-wealthy people with very low IQs?

Yes. Several ultra-wealthy individuals, though not known for scoring high on IQ tests, became billionaires through street smarts, strategic decisions, and relentless hustle. They prove that becoming ultra-wealthy doesn’t demand a genius IQ—just exceptional execution and vision.

Q3. Who is the lowest IQ self-made billionaire?

There’s no public record of IQ scores among billionaires, so we can’t confirm the identity of the lowest IQ self-made billionaire. However, many billionaires were poor students, dropped out, or lacked formal education, proving that perseverance, not intelligence, often drives success.

Q4. Are there self-made billionaires with less than average IQs?

Absolutely. The question “Are there self-made billionaires with less than average IQs?” is common among dreamers. These individuals often succeeded by solving real-world problems, showing that wealth creation is possible without an above-average IQ.

Q5. Are there billionaires with low IQ who still succeeded?

Yes. There are billionaires with low IQ who still succeeded, largely due to emotional intelligence, risk-taking, and visionary thinking. Their stories inspire millions who believe that hard work and grit outweigh academic smarts.

Q6. Who is the richest person with lowest IQ ever recorded?

There’s no verified data naming the richest person with lowest IQ ever recorded. However, public fascination with this question underscores the belief that wealth is about mindset, not just mental metrics.

Q7. Which billionaires have the lowest IQs?

There’s no official list of which billionaires have the lowest IQs. Still, many billionaires admit they weren’t the “smartest” in traditional terms, showing success is more about action than IQ.

Q8. Is it possible for a person with a low IQ to become rich?

Yes. If you’re asking, “Is it possible for a person with a low IQ to become rich?”—the answer is a resounding yes. Wealth creation favors persistence, financial literacy, and long-term strategy over pure intellect.

Q9. Do I need to earn six figures to become a millionaire?

No. Most millionaires never earned a six-figure salary. The secret is in smart budgeting, consistent investing, and avoiding debt—not a high paycheck.

Q10. How long does it take for a middle-class person to become a millionaire?

With steady investing and discipline, it typically takes 20–30 years. For example, investing ₹40,000/month in a well-performing index fund can help you reach millionaire status by your late 50s or earlier.

Q11. Can I become a millionaire at 35+?

Yes. Even if you’re starting at 35, investing ₹80,000/month in a diversified portfolio can still help you become a millionaire by 60. It’s never too late.

Q12. Can a middle-class boy become rich without a business?

Absolutely. Real estate investing, stock market growth, and career progression can all lead to wealth. You don’t need to launch a startup—you need a smart, consistent financial plan.

Q13. What stops middle-class people from getting rich?

Lifestyle inflation. When income rises, so do expenses. Millionaires avoid this by investing the surplus instead of upgrading their lifestyle.

Q14. What mindset builds wealth from a middle-class background?

Think long-term. Learn consistently. Prioritize assets over luxury. Stay consistent and grounded.

Q15. Are there real examples of middle-class people becoming millionaires?

Yes. People like Chris Reining (retired at 37) and Ronald Read (a janitor who died with $8M) show that regular folks can build wealth through smart saving and investing.

You don’t need to be born rich—you just need the courage to grow rich.

Ready to go from surviving to thriving? Learn the bold money moves that could Retire you early—with zero regrets and maybe even a Ferrari.