Imagine trying to solve a complex puzzle while someone keeps tapping you on the shoulder. That’s what living in poverty can feel like for the brain. Concerns about money are widespread: a 2025 survey found 77% of Americans say they aren’t completely financially secure, underscoring how money anxiety crosses all income levels. For context, about 36 million Americans lived in poverty in 2024—so this question affects many lives. Yet many people wonder, “What is the average IQ of poor people?” That’s a loaded question tapping into a stubborn myth: that poverty equals low intelligence. But research tells a different story. Financial stress and mindset play a far bigger role than innate smarts in shaping outcomes.

In reality, average IQ of poor people reflects circumstances, not destiny. Chronic stress, scarcity, and limited resources can temporarily suppress cognitive performance. But those effects can be reversed. It’s not a fixed number; it’s about strategies, support, and mind over money. In this post, we’ll unpack the science of poverty’s stress, debunk the “low financial iq and poverty” myth, and list the common signs of a poverty mentality. We’ll share actionable steps to rewire a scarcity mindset into abundance. By the end, you’ll see why intelligence is fluid and why your financial destiny is not sealed.

Imagine two high school seniors: one comes from a wealthy family with tutors and college savings, and one from a low-income family who works part-time to help support home. Even if both students are equally smart, the wealthy student will likely score higher on college-entrance tests — not because of IQ, but because of environment and reduced stress. This simple scenario shows how easily circumstances, not innate brainpower, shape outcomes.

This parallels the famous “marshmallow test” of delayed gratification. In that study, kids who waited to receive a second treat tended to do better later in life. But if a child never knows where the next meal is coming from, grabbing the first marshmallow is smart — not dumb. Scarcity simply rewires the brain’s priorities. With this in mind, let’s dive into the evidence.

The Science of Stress: How Poverty Changes the Brain

Poverty is not just about not having enough money; it is about the constant mental tax it imposes. Think of your brain like a smartphone with limited RAM. In chronically poor conditions, the limbic system (our stress/fear center) keeps firing worry signals, crowding out the prefrontal cortex (the planning center). It’s as if alarms are blaring while you’re trying to focus—anyone would struggle. This cognitive load under scarcity drains brainpower, roughly equivalent to losing an entire night’s sleep. This effect is sometimes called decision fatigue — after making so many urgent choices under stress, your mental “battery” runs down quickly. Psychologists call this going into “survival mode” — focusing only on immediate threats with little capacity for future planning. For many, chronic economic instability (job cuts, medical crises, inflation) keeps the mind on high alert. This ongoing uncertainty piles stress on day after day, slowing down every thought.

For example, Princeton researchers put this to the test. They found that simply thinking about serious money problems made people perform about 13 IQ points worse on puzzles. Meanwhile, another landmark study tested sugarcane farmers in India on logic problems before and after harvest. Every farmer did significantly better after harvest (when they had cash) than before. Interestingly, when tasks were given without any money worries, low-income participants scored just as well as wealthier peers. In other words, normal cognitive performance can tank under scarcity and bounce back with resources. That really shows it’s stress and context — not innate intelligence — at play.

Neuroscience backs this up. Chronic poverty correlates with changes in brain structure. MRI studies show that children from low-income families often have smaller hippocampi and altered prefrontal activity. The hippocampus (memory center) is especially sensitive to stress — it’s literally loaded with stress receptors, meaning constant cortisol surges (from worry) can dull memory and learning. On the bright side, these brain regions are plastic. When stress is reduced through support or programs, the brain can rewire and improve.

In short, poverty triggers a scarcity mindset in the brain. Every urgent worry takes up space, leaving little for planning or creativity. This is like driving with your headlights half off — you just can’t see as far. But knowing how poverty changes the brain also means we know it can change back with the right help and habits. The science shows: it’s not a permanent IQ drop, just a heavy cognitive load that can be lightened.

Nationally, this cognitive impact shows up in schools: children from poor families generally score lower on standardized tests and go to college at much lower rates. This stark achievement gap reflects the stress and limited resources these children face early on, not their innate intelligence.

Mindset vs. Intelligence: Low Financial IQ and Poverty

Raw intelligence (IQ) and money smarts are very different. Even highly intelligent people can have low financial IQ if they have not learned money skills (Spending Habits, Budgeting, Strategic Credit Card Uses, Paying Bills on Time, Debt Payoff Strategies, Saving for Retirement). Financial IQ is really just knowledge and habits — things anyone can improve. Surveys show that only about half of Americans can answer basic financial questions, and fewer than 30% can correctly calculate simple interest or inflation. In fact, even among richer folks, many miss basic money concepts. For example, in 2024 only about half of Americans answered basic financial literacy questions correctly, and under 30% could do simple interest math. That means low financial IQ is common across all income levels — it’s a knowledge gap, not a reflection of being “smart” or “dumb.”

Consider this: a genius could still go broke if they never learned to budget, while a modestly smart person could build wealth by mastering money management. It’s well known that many lottery winners and athletes end up broke — not because they lost IQ points, but because they lacked financial guidance when suddenly rich. (This is not judgment — it happens because money decisions can be emotional and tricky for anyone.) Poverty often teaches you not to gamble, but that fear of risk can also keep you stuck. Avoiding even safe bets (like asking for a raise or trying a side job) can perpetuate scarcity.

Money habits are learned, not inherited. If no one taught you about credit and saving in childhood, you might never learn those lessons — no matter how high your IQ. In contrast, someone who helps run a family shop picks up practical finance skills from a young age. Often you see high-IQ graduates struggling with debt while hard-working entrepreneurs thrive on learned habits. Mindset and training can outweigh raw intelligence when it comes to wealth.

It is also worth noting that researchers find some IQ test gaps between rich and poor — but these gaps stem from environment, not destiny. One British twin study found that children in low-income families scored about 6 IQ points below their wealthier peers at age 2, and that gap grew over time. Importantly, those authors link this to differences in nutrition, stress, and schooling, not genetics. So by age 16 the gap had tripled in their data, but those differences are not fixed. Improving early-childhood conditions (better nutrition, education, stability) could significantly narrow that gap.

Finally, there’s good evidence that improving financial knowledge lifts people up. One international study found that households with better financial literacy were more likely to start small businesses, use insurance, and avoid predatory loans — all factors that significantly reduced poverty. This has huge real-world impact: teaching someone about insurance or loans can mean the difference between getting by and getting stuck. Financial education programs around the world have been linked to increased household income and reduced poverty rates. And remember: someone can carry financial trauma from past hardships (job loss, eviction, or emergency debt), which makes money decisions feel extra scary — again, this is about fear, not ability. In sum, boosting your “money IQ” and healing from financial trauma are proven ways to break the cycle. So don’t blame your brain — focus on growing your skills and mindset instead.

The Traps We Set for Ourselves: Signs of a Poverty Mentality

Common signs of a poverty mentality are actually mental habits anyone can fall into. Recognizing them is the first step to change. Some key signs include:

- Scarcity Mindset: Constantly feeling that there’s never enough money or opportunity. This mindset warps decisions and keeps you trapped in survival mode. For example, avoiding even small investments (like a useful course) because you’re afraid it’s a “luxury” is a classic sign of a poverty mentality.

- Short-Term Focus (Immediate Gratification): Putting present needs above future goals. For example, spending a windfall on a splurge or covering today’s bills instead of saving or investing. This short-term thinking sacrifices long-term security for instant relief — a tough poverty trap.

- Fear of Risk: Being overly cautious about money opportunities. If you avoid asking for a raise or refuse to try a side gig because you assume failure, that’s a sign of poverty mindset. Calculated risks and learning from mistakes are necessary for growth, but this fear holds many back.

- Price Over Value: Always choosing the cheapest option, even if it means more problems later. For instance, skipping a needed appliance repair to save $20, and then paying $200 for an emergency fix later — that’s a poverty mentality decision. It comes from focusing on immediate cost rather than long-term value.

- Victim Mentality: Believing “the system is rigged” or “I’ll never win, so why bother?” When we tell ourselves we’re destined to lose, we’re less likely to try anything. This self-defeat is a strong sign of poverty mindset because it stops action before you begin. Catching this thought pattern is key to moving forward.

- Comparison & Envy: Constantly comparing yourself to others and feeling resentful of their success. This reinforces the belief that wealth is limited. It wastes energy and keeps you stuck in “not enough” thinking, instead of focusing on your own path.

- Avoiding Learning: Rarely reading or improving your money skills (thinking “finance is too complicated for me”) is another poverty trap. Growth requires learning. The first investment should be in education (even free articles or podcasts). Not knowing is not permanent — you can always learn.

Each of these patterns can sneak into anyone’s thinking. If you recognized any of these in yourself, that’s a clue — awareness is the first step to change.

Mindset Check-In Quiz

Do you avoid budgeting or tracking expenses because you think it won’t help? This might signal a scarcity mindset stopping you from planning.

When you get extra cash (bonus, tax refund, etc.), do you spend it right away instead of saving or investing? Reflect if immediate gratification is blocking your long-term goals.

Do you often tell yourself “I’ll never get out of this” or “I’m just unlucky”? This kind of self-talk can be a sign of a poverty mentality holding you back.

Does the thought of negotiating a price or selling something make you anxious? This could indicate fear of risk, a common mindset trap.

Do you constantly compare your situation to others and feel discouraged? Frequent envy can be a trap of the poverty mentality, focusing on limited resources instead of your own path.

If you answered “yes” to any of these, don’t worry — the key is awareness. Let’s move on to how to flip the script.

Breaking the Cycle: How Poverty Changes Your Mindset

Understanding how poverty changes your mindset is empowering because it means you can change it back. Remember, the brain is plastic: with new habits and environments, the effects of scarcity can be reversed. Here are steps to start rewiring from scarcity to abundance:

- Shift to an Abundance Mindset: Practice gratitude daily, even for small things. An abundance mindset focuses on possibilities. Over time, this trains your brain to notice opportunities instead of lack. (Try listing three things you are grateful for each day.)

- Set Small, Achievable Goals: Create quick wins like saving $1 each day or reading one finance article per week. Hitting small goals builds confidence. For example, start a savings jar and drop in spare change — each win tells your brain “I can do this,” breaking the cycle of defeat.

- Reduce Cognitive Load: Simplify decisions so you don’t waste willpower on budgeting calculations. Automate bills and savings, use calendars/reminders, and prep routines (like meal planning). For instance, putting all bills on autopay or prepping five lunches on Sunday frees up brainpower for bigger challenges.

- Boost Financial IQ: Make learning a habit. Use free resources — books, podcasts, online courses — to improve budgeting and investing skills. Even answering one personal finance question a week is progress. Knowledge is a powerful poverty antidote; every fact you learn increases your “financial IQ.”

- Build Support Networks: Surround yourself with positive influences. Join a community group, workshop, or online forum focused on financial growth. Sharing goals with a friend or mentor provides encouragement and accountability. These social “nudges” can help break bad habits (even research suggests well-timed nudges help people escape poverty).

- Prioritize Self-Care: Your physical well-being affects financial decision-making. Good sleep, regular exercise, and healthy eating improve cognitive function. When you feel sharper and less stressed, you make better money decisions. Simple stress-reducers — like a walk after work or talking with a friend — can clear your mind and reset your perspective.

- Challenge Limiting Beliefs: Notice negative thoughts (“I’ll never get ahead”) and replace them with positive actions. For instance, each time you think “I can’t,” add “…but I will try one small step.” Over time, changing this internal dialogue rewires your mindset from “I’m helpless” to “I can learn and improve.”

- Mind Your Circle: The people you spend time with influence your mindset. If your close friends or family often complain about money or focus on lack, that reinforces scarcity thinking. Try to connect with people who have an abundance mindset and good money habits. Supportive peers or mentors can inspire you to change.

- Address Financial Trauma: If past money problems trigger anxiety or shame, consider seeking help. Talking to a counselor or joining a support group can help unpack old money beliefs. Healing these wounds removes mental blocks that IQ alone can’t fix.

- Positive Affirmations: Remind yourself daily of healthy money beliefs (e.g. “I am learning and growing” or “I have the power to change”). Simple affirmations can counteract negative thoughts and rewire your mindset over time.

- Be Patient and Persistent: Changing your mindset and habits takes time. Small, consistent actions build momentum. Even if progress seems slow at first, keep going — every step forward adds up.

- Celebrate Small Wins: Keep track of every little financial success and reward yourself in healthy ways. This positive feedback teaches your brain that progress is real, making it easier to stick to new habits.

- Learn from Mistakes: Instead of beating yourself up over money blunders, treat them as lessons. Everyone makes mistakes — what matters is what you do next. Viewing errors as learning shifts your mindset to growth.

Taking these steps consistently can help you escape the poverty mentality. Taking these steps is a journey, not a sprint. Use tools and resources around you: budgeting apps, community classes, or even a simple notebook for tracking goals and progress. Over time, consistent small efforts compound. For example, note each time you stick to your budget or save a bit more — celebrating these moments, however small, keeps your momentum alive. And remember: intelligence is not fixed. Learning new skills literally grows your brain. Think of financial education like learning a language: every lesson builds neural connections. With consistent practice — even just a few minutes a day — your “money IQ” will rise on its own.

Conclusion

There is no magic number when someone asks about the “average IQ of poor people.” Brain science and real-world data show that poverty’s impact on intelligence is about environment and mindset, not fixed ability. Everyone’s mind has limits — but those limits can expand with better conditions and habits. And remember: surviving hardship often builds strengths IQ tests don’t measure (creativity, grit, resourcefulness). These human qualities can drive real-life success.

You are not doomed by your IQ or your past. Every step you take to learn money skills, challenge scarcity thinking, and reduce stress rewires your future. Start today by choosing one poverty-mentality trap to overcome from above. Even a tiny change can start a ripple of improvement.

In short, don’t buy into the myth that “poor = dumb.” It is the mental taxes of poverty that handicap performance — not anyone’s true intelligence. If someone asks about the average IQ of poor people, you can tell them it is the wrong question — focus instead on how to change your financial mindset.

You might be thinking, “That’s fine in theory, but can I really change?” The answer is a resounding yes. Start small. Even taking one tip above (like writing down something you’re grateful for or automating a payment) and doing it this week is progress. Over months, those small steps will snowball. Imagine where you could be in a year — more confident, more secure. Your future self will thank you for every positive change you make today. And remember, every expert was once a beginner: your first attempt may not be perfect, but that’s OK. Learn, adjust, and move forward. Celebrate progress, not perfection.

- What’s one “poverty mentality” trap you recognize in yourself? Share it in the comments below — let’s discuss how to tackle it together!

- Found this eye-opening? Share the post to help friends or family see that their mindset, not fate, can change their financial story.

- Stay in the loop: Subscribe to our newsletter for more science-backed tips on wealth and well-being.

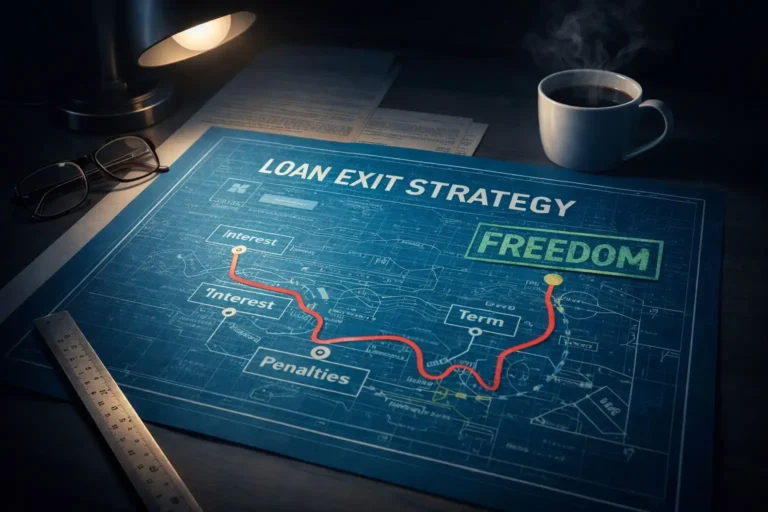

Once you understand the mental game, it’s time to master the practical moves. In my last post, we discussed How to Get Out of a Mortgage — a perfect first step to applying this new mindset.