Buying a home is often the largest financial commitment most people will ever make, yet many borrowers rush through the mortgage process. Like any major purchase, comparison‑shopping can mean the difference between overpaying and securing a great deal. A 2025 LendingTree study found that borrowers who shopped for their mortgage could save an average of $80,024 over the life of a 30‑year fixed‑rate loan. That works out to around $222 per month or $2,667 per year-money that could fund an emergency fund, pay down high‑interest debt, or accelerate retirement savings. Despite the potential for significant savings, data from the Federal Reserve Bank of Philadelphia reveal that half of borrowers consider only one lender and a mere 3 percent compare quotes from more than three lenders.

This guide is designed to change that. Over the next few thousand words you’ll learn Why you should always shop your mortgage quote, How to compare lenders effectively, and the steps you can take today to strengthen your financial profile.

Most Homebuyers Never Shop Their Mortgage Quote – And Pay for It for 30 Years

Why You Should Always Shop Your Mortgage Quote

The high cost of complacency

Many people assume that mortgage rates are fairly uniform and that one lender’s offer will be similar to another’s. In reality, mortgage pricing varies widely based on lender margins, market conditions, and borrower characteristics. When rates rise quickly, this dispersion becomes more pronounced. Freddie Mac researchers examined loan application data from 2010–2022 and found that rate dispersion doubled in 2022, reaching about 50 basis points (0.5 %) on some days. In such an environment, borrowers with identical credit scores and down payments might receive quotes ranging from 5.5 % to 6.5 %.

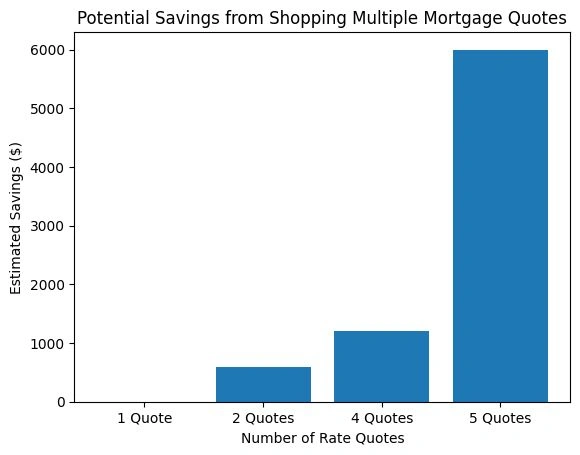

These differences translate into major savings. According to the same Freddie Mac analysis, applying with two lenders could reduce the annual mortgage payment by around $600, while getting quotes from four lenders could save more than $1,200 per year. If you went the extra mile and gathered quotes from five lenders, you could save over $6,000 over five years. Similarly, the Federal Reserve study on borrower overpayment found that low‑income borrowers taking FHA loans stood to reduce their interest rate by 28 basis points simply by obtaining one additional quote. That kind of reduction can lower monthly payments and the total interest paid over the loan’s lifetime.

Real‑world example

Imagine this scenario: Ashley and Marcus are first‑time homebuyers in Ohio shopping for a $300,000 home. Their bank pre‑approved them at a 7 % fixed rate, resulting in a monthly principal and interest payment of about $1,996. Ashley’s co‑worker casually mentions that they should always shop their mortgage quote instead of accepting the first offer. Skeptical but curious, the couple contacts three additional lenders. Lender B offers 6.875 %, Lender C offers 6.5 %, and Lender D offers 6.25 %. Choosing the 6.25 % loan reduces their monthly payment to $1,847-a $149 monthly savings (over $53,000 saved over 30 years). That’s money that could go toward home improvements, travel, or boosting a retirement fund.

Why people skip rate shopping

If shopping around can save tens of thousands of dollars, why do so many people accept the first quote? Several factors play into this behavior:

1. Lack of awareness: Many borrowers simply don’t know that lenders’ offers can differ by a full percentage point. Some assume that the mortgage market is standardized and competitive, so shopping seems unnecessary.

2. Time pressure: In hot housing markets, buyers may feel pressure to secure financing quickly. They might fear losing the home if they don’t submit an offer fast or believe rate quotes expire instantly.

3. Trust in referrals: Real estate agents often recommend lenders with whom they have relationships. Although these referrals can be convenient, they might not yield the lowest rate. Investopedia quotes mortgage expert Jennifer Beeston advising borrowers to vet the individual loan officer rather than relying solely on referrals.

4. Misleading marketing: Big banks and popular online lenders spend millions on advertising, creating an impression of unbeatable rates. In reality, many local credit unions and smaller lenders offer highly competitive quotes.

The takeaway is clear: treat your mortgage like any other major purchase. You wouldn’t buy a car or a smartphone without comparing prices. The same discipline-if not more-is necessary when dealing with six‑figure loans.

How to Shop for Mortgage Quotes the Right Way

Step 1: Prepare your financial profile

Before you approach lenders, ensure your financial profile is in good shape. Start by checking your credit score-most lenders offer better rates to borrowers with scores above 740. If your score is lower, spend a few months paying down debt, disputing errors on your credit report, or reducing credit card utilization. According to the Philadelphia Fed paper, borrowers with lower incomes and credit scores stand to benefit the most from shopping around, with potential rate reductions of 28 basis points or more.

Next, calculate your debt‑to‑income ratio (DTI) by dividing your total monthly debt payments by your gross monthly income. A DTI below 43 % is ideal; the lower it is, the better your chances of securing the best mortgage rates. Finally, gather documentation such as pay stubs, W‑2s, tax returns, and bank statements. Having these documents ready speeds up the pre‑approval process and helps lenders provide accurate quotes.

Step 2: Shop multiple lenders on the same day

Mortgage rates can fluctuate daily, sometimes changing multiple times within a day. To make an accurate comparison, gather quotes from multiple lenders on the same day. When requesting quotes, specify the same loan type (e.g., 30‑year fixed), down payment, and loan amount. Ask each lender for a Loan Estimate-a standardized three‑page document required by federal law that itemizes interest rates, monthly payments, fees, and closing costs. The Consumer Financial Protection Bureau encourages consumers to request multiple Loan Estimates to compare offers.

The Loan Estimate’s Box A (origination charges) lists the lender’s own fees, while other boxes include third‑party costs like title insurance. Comparing Box A across multiple estimates allows you to see which lender is charging higher underwriting or processing fees. Also, make sure each quote is rate‑locked for a consistent comparison. Quotes that aren’t locked can change before you close on the loan, potentially wiping out your anticipated savings.

Step 3: Evaluate the entire package

When comparing quotes, focus on the annual percentage rate (APR) rather than the nominal interest rate. The APR represents the true cost of borrowing by including upfront fees and points. A loan with a slightly higher interest rate but lower fees might have a lower APR, saving you money over time. Other considerations include:

• Loan term: A 30‑year loan has lower monthly payments but a higher total cost due to extended interest accrual. A 15‑year loan costs more per month but could save tens of thousands of dollars in interest.

• Down payment and mortgage insurance: Putting down at least 20 % eliminates private mortgage insurance (PMI). Smaller down payments increase PMI costs but might free up cash for other investments. Evaluate whether waiting to save a larger down payment outweighs the cost of paying PMI.

• Rate type: Fixed‑rate loans provide certainty-your payment remains the same for the life of the loan. Adjustable‑rate mortgages (ARMs) typically offer lower introductory rates that reset after a set period. ARMs can be beneficial if you plan to sell or refinance before the adjustment but risky if rates rise.

• Closing costs and lender credits: Some lenders charge lower rates but higher fees, while others may offer a slightly higher rate with a lender credit that covers closing costs. Compare scenarios to see which combination fits your financial goals.

Step 4: Negotiate and ask the right questions

Armed with multiple quotes, don’t be afraid to negotiate. Lenders know you have options and may lower their rates or fees to earn your business. Ask questions such as:

• What is the loan origination fee, and can it be reduced or waived?

• Are there discount points available, and if so, how long would it take to recoup the cost?

• Is there a prepayment penalty if you pay off the loan early?

• How long is the rate lock period, and what happens if closing is delayed?

• What is the total cash to close, including prepaid taxes and insurance?

By comparing and negotiating, you can secure better terms and potentially save thousands. As Freddie Mac notes, borrowers who obtained two quotes saved as much as $600 annually, while four quotes saved more than $1,200 annually. These savings can add up to substantial amounts over the life of your loan.

Tools and Strategies for Effective Home Loan Shopping

Use online comparison tools wisely

Several websites aggregate mortgage rates from multiple lenders, allowing you to see a range of offers quickly. These tools can be a good starting point for understanding current rate ranges in your area. However, always verify quotes directly with lenders. Online rate tables often display “teaser” rates based on ideal borrower profiles, which may not reflect your unique situation. When using these tools:

1. Input accurate information: Include your credit score, down payment, loan amount, and property location to receive more precise estimates.

2. Look beyond the rate: Pay attention to APR, lender fees, discount points, and estimated closing costs. A low rate with high fees may not be the best deal.

3. Protect your privacy: Some sites sell your information to multiple lenders, resulting in a flood of calls and emails. Choose reputable sites that allow you to opt out of marketing and limit the number of lenders that receive your data.

Consider non‑traditional lenders and programs

While major banks dominate advertising, smaller entities often provide competitive terms. Don’t overlook:

• Credit unions and community banks: These institutions frequently offer lower rates and personalized service. Because they are member‑owned, credit unions may prioritize lower fees over profit.

• Mortgage brokers: Brokers work with multiple lenders and may access wholesale rates unavailable directly to consumers. Ask about their compensation structure to ensure your interests align.

• Online lenders and fintech companies: Online‑only lenders have lower overhead and can sometimes pass those savings on to borrowers.

• Government programs: If you’re a first‑time buyer or have a low credit score, explore FHA, VA, and USDA loans. These programs often require smaller down payments and may have more lenient credit requirements, though they carry mortgage insurance or guarantee fees.

Improve your bargaining position

The stronger your financial profile, the more leverage you’ll have during negotiations. Here are ways to boost your position:

• Improve your credit score: Pay down credit cards, keep balances below 30 % of your credit limit, and avoid opening new credit lines during the mortgage process.

• Increase your down payment: Even an extra 5–10 % down can lower your rate and reduce or eliminate PMI.

• Reduce your debt: Paying off car loans or student loans can lower your DTI, helping you qualify for a better rate.

• Build savings for closing costs: Lenders may view you as less risky if you have sufficient cash reserves.

• Stabilize your employment: Lenders prefer borrowers with a stable work history and consistent income over the past two years.

Avoid Common Mortgage Shopping Mistakes

Mistake 1: Not locking your rate

Mortgage rates can change rapidly. If you receive a favorable quote, ask your lender to lock the rate for the anticipated timeline (often 30–60 days). Without a rate lock, your interest rate could increase before closing, wiping out expected savings. Some lenders offer free rate locks, while others charge a fee; make sure to factor this cost into your comparison.

Mistake 2: Focusing solely on the interest rate

While securing a low rate is important, don’t ignore fees, points, and loan terms. A loan with a slightly higher rate but lower closing costs might be cheaper in the short term, especially if you plan to move or refinance within a few years. Evaluate the total cost of borrowing, not just the headline rate.

Mistake 3: Ignoring your credit during the process

After applying for a mortgage, avoid any activity that could harm your credit score. Opening new credit lines, making large purchases on credit cards, or missing payments can lower your score and jeopardize your loan approval. Keep your financial situation stable until closing.

Mistake 4: Taking advice from only one source

Friends, family, and real estate professionals often mean well, but their experiences are limited. Seek information from multiple sources-lenders, mortgage brokers, housing counselors, and trusted financial websites. Verify anecdotal advice with data and credible research. For instance, Investopedia highlights Freddie Mac’s finding that getting at least four quotes can save borrowers $600–$1,200 per year, reinforcing the importance of shopping widely.

Strengthen Your Application: Key Factors Lenders Evaluate

Credit score and history

Your credit score is one of the biggest factors influencing your mortgage rate. Scores above 740 typically qualify for the best rates, while scores below 620 may require government‑backed loans. Review your credit report and fix errors. Pay down balances, avoid late payments, and keep older accounts open to maintain a longer credit history.

Debt‑to‑income ratio (DTI)

Lenders prefer DTIs below 43 %, though some programs allow higher ratios. To lower your DTI, consider paying off smaller debts or postponing large purchases. If your income is variable, average your earnings over the past two years to present a stable picture.

Employment and income stability

Steady employment shows lenders you can repay the loan. A history of changing jobs isn’t necessarily disqualifying, but frequent industry switches or long gaps may raise questions. Self‑employed borrowers often need to provide additional documentation, such as profit‑and‑loss statements or business tax returns.

Down payment and savings

A larger down payment reduces the loan‑to‑value ratio and can lower your interest rate and monthly payment. Savings reserves reassure lenders that you can cover unexpected expenses. If you’re receiving a gift for your down payment, provide a gift letter and verify that funds are seasoned (i.e., in your account for at least two months).

Property type and occupancy

The type of property and how you plan to use it influence your rate. Primary residences typically qualify for lower rates than second homes or investment properties. Similarly, single‑family homes are often cheaper to finance than multi‑unit properties or condominiums, which may have additional risk factors for lenders.

Interactive Element: Assess Your Mortgage Shopping Readiness

Self‑Assessment Quiz

Answer these questions honestly to gauge how prepared you are to shop for a mortgage:

1. How many lenders have you contacted for quotes?

• A) None yet – I plan to start with my bank

• B) One – I received a pre‑approval already

• C) Two or three – I’m comparing quotes actively

• D) Four or more – I’m casting a wide net

2. Do you understand the difference between interest rate and APR?

• A) Not really – they seem the same

• B) Somewhat – I know APR includes some fees

• C) Yes – I evaluate offers based on APR and total costs

3. Have you reviewed your credit report and addressed any issues?

• A) No – I’m not sure how

• B) Partially – I looked once but didn’t follow up

• C) Yes – I checked reports from all three bureaus and disputed errors

4. Do you know how much you can afford monthly?

• A) No – I’ll figure it out as I go

• B) I have a rough number based on rent

• C) Yes – I calculated my budget, including taxes and insurance

5. Are you prepared to negotiate with lenders?

• A) No – negotiating feels uncomfortable

• B) Maybe – I’d like guidance

• C) Yes – I have specific questions and know my leverage

If you answered mostly A’s, you have some homework to do before shopping. Review the sections above, download the checklist provided, and empower yourself with knowledge. Mostly B’s indicate you’re on the right track, but more preparation could lead to better deals. Mostly C’s and D’s? You’re well on your way-just remember to always shop your mortgage quote and remain diligent through closing.

Downloadable checklist

To help you stay organized, we created a Mortgage Shopping Checklist. This downloadable document outlines the steps you should take before and during the mortgage shopping process. From checking your credit score to gathering financial documents and comparing lender fees, the checklist keeps you on track. Click the link below to download it.

Conclusion

Shopping for a mortgage may feel daunting, but the potential rewards are worth the effort. Research by LendingTree shows that borrowers who take the time to compare offers can save tens of thousands of dollars over the life of their loan. Freddie Mac’s simulation illustrates that even obtaining two quotes can shave $600 off annual payments, while four quotes can save $1,200 or more per year. The Federal Reserve study further underscores that low‑income borrowers have the most to gain, with potential rate reductions averaging 28 basis points.

In an environment where rates can vary by a full percentage point, it’s critical to adopt a proactive, informed approach. Strengthen your financial profile, understand the components of a mortgage quote, and leverage the power of negotiation. Remember, you deserve the best terms available. So, next time you’re in the market for a home loan, repeat this mantra: always shop your mortgage quote. The savings could be the key to unlocking financial freedom.

Call to Action

Have you recently shopped for a mortgage? Share your experiences and questions in the comments below-we’d love to hear your story. If this guide helped you or taught you something new, pass it along to friends or family. For more in‑depth personal finance and investing insights, subscribe to the TheFitFinance newsletter. Finally, don’t forget to download your Mortgage Shopping Checklist and start your journey toward a smarter home loan today.

If you enjoyed this article, check out our previous post on Low Risk Saving for a down payment and How a smart SIP exit strategy can multiply your long-term financial freedom. It pairs perfectly with the savings you will unlock when you always shop your mortgage quote.