You are cramming for a calculus test at midnight, but a different kind of stress is creeping in: your bank account. (Been there, right?) What if your intelligence in the classroom translated directly to your bank account? Imagine acing both tests and your finances without breaking a sweat. That’s the power of raising your student IQ for money – a skill you can learn, not a gene you’re born with.

By the end of this guide, you will master:

- Budgeting for beginners: How to split every dollar like a boss using the 50/30/20 rule.

- Savvy saving: Creative ways to stash cash (even if all you eat is ramen).

- Investing basics: Growing your money starting with just pocket change.

- Money mindset: Tricks to build long-term wealth, not debt.

Start with a fresh mindset, and transform your financial game one step at a time. Specifically for students, think of a college student IQ for money as the power to budget and invest while you study. You get graded on tests, so why not on your financial health too?

Why “Book Smarts” Are not Enough: The Rise of the Student IQ for Finance

Too often school drills us on algebra and Shakespeare, but never on how to manage a credit card or student loan. Our curriculum feels like a game missing a level: we learn formulas but not how to budget a paycheck. Financial literacy for students is not included in most classes, leaving many college grads with an empty wallet despite a full transcript.

Developing a high student IQ for finance is the true hack to avoiding post-grad debt. Think about it: schools don’t quiz you on interest rates or student loan awareness, yet life certainly does. Tackling money management skills on campus is how you level up your earning potential. It’s not about being born rich or having a high GPA – it takes practice and a financial mindset to grow wealth.

For example, you might debate history or code a video game, but do you know how to negotiate your first salary or build a simple budget? Most degrees don’t include courses on credit, loans, or investing – that’s left as a mysterious side quest after college. Those who skip learning money skills often learn them the painful way with surprise debt. In other words, treat this like a class: if your school didn’t teach it, become your own teacher.

Key takeaway: Book smarts mean great grades, but money smarts mean avoiding debt and building future freedom. Take action today: maybe watch a quick budgeting video or track one expense. Knowledge you build now will save you money later.

The Freshman 15 (Of Debt) vs. The Graduate Gains

College can sneak up on your wallet like that dreaded Freshman 15. While one student happily gains a few pounds in pizza and late-night ramen, another gains financial muscle. Picture two roommates after freshman year:

- Alex: Spends carelessly, swiping cards like unlimited extra lives in a video game. By graduation, Alex has the Freshman 15 of debt – thousands in credit card bills and student loans. Every Netflix plan upgrade or new game purchase felt small, but piled up fast.

- Taylor: Tracks every dollar like it’s XP in a game. She budgets, cooks cheap meals, and even started a side gig tutoring. By graduation, Taylor ends up $10k AHEAD (real-life gains, not just muscle).

Taylor’s secret: she didn’t stop having fun—she found cheaper thrills (free campus concerts, game nights). Alex, however, chased instant gratification (like upgrading to a pricier smartphone model). The difference wasn’t test scores or majors – it was their college student IQ for money. Even one small change (like skipping a $5 coffee once a week -> Small Savings making Big Impact) can save you hundreds by graduation.

Key takeaway: Treat debt like weight gain – nip it early. Ask yourself: are you putting on a financial “Freshman 15”? If yes, practice labeling your last expenses (need, want, or save) and trim one category today.

5 Proven Strategies to Boost Your College Student IQ for Money

Whether you have a part-time job or rely on loans, these steps will boost your college student IQ for money immediately:

1. Master the “Invisible” Budget (The 50/30/20 Hack for Students)

Budgeting for beginners sounds scary, but it’s easier than beating the final boss in your favorite game. Think of your paycheck like coins in a gaming wallet. Divide them into Needs (50%), Wants (30%), and Savings (20%) – that’s the 50/30/20 rule.

- Needs: Essentials like rent, textbooks, groceries, and data plans.

- Wants: Streaming subscriptions, eating out, the latest game DLC or sneakers.

- Savings: Emergency fund, future investments, or extra debt payments.

For example, if you make $600 a month from a part-time job, you’d spend $300 on needs (rent, phone), $180 on wants (dates out, Netflix), and $120 on savings. Use a free app (Mint, EveryDollar, YNAB) or a simple spreadsheet to track this – think of it like managing an RPG inventory, where every item (dollar) has its slot.

- Subscription check: List all your monthly subs (gaming platforms, apps). Cancel any you rarely use. That $15 you save is extra XP for your budget.

- Budget hack: Challenge yourself to a “no-spend” week on wants (no new game skins or takeout). Put that money into savings and feel the progress bar fill.

Key takeaway: Break your paycheck into buckets – it’s like unlocking a cheat code. Track every dollar, and you’ll level up your financial discipline one coin at a time.

2. Turn Your Side Hustle Into an Investment Engine

Got a side hustle? Awesome. But don’t let that cash just sit in checking like unused energy points. First, earn extra with gigs: think tutoring online, selling art on Etsy, freelancing coding, or delivering for a rideshare app (if you have a license). Next, invest a chunk of those earnings.

Use micro-investing apps like Acorns or Stash to turn spare change into stocks or ETFs. For example, if you make $20 from an online gig, automatically invest $5. Over time, those small deposits can snowball. It’s like plugging your bonus coins into an idle game – watch them grow without extra effort. This is where your student IQ for finance (and money) turns small dollars into long-term wealth.

- Start small: Automate $5-$10 per week into an index fund or a Robo-advisor. These apps make it easy to begin.

- Learn the basics: Read blogs or watch videos on stocks vs bonds. Consider low-cost index funds to spread risk.

- Boost earning potential: If you game on console, turn it into income – stream or coach beginners. Into crafts? Design and sell on Redbubble or Etsy. Even hobbies can be side hustles.

Key takeaway: A side hustle not invested is like a car in neutral. Engage the gears: invest part of your extra cash and let compound interest accelerate your earnings into future wealth.

3. Credit Scores: The Game You Can’t Afford to Lose

Your credit score is a gamer rank for money. Lenders and landlords check it like a leaderboard: the higher your score, the more options (and cheaper loans) you unlock. Every on-time payment is XP, every late payment is a setback.

If you are new to credit, start safe: get a student credit card or secured card. Pay it in full each month, treat it like a practice round. Don’t max it out; try to use under 30% of your limit.

- Credit score for students: Some campus banks offer beginner credit cards with no annual fee. Or a credit-builder loan (small loan where you pay monthly).

- Borrowing power: A better score can save you thousands – think lower interest on a car loan or your first apartment lease.

- Quick hack: Ask a parent to add you as an authorized user on their credit card (with their permission). It’s a shortcut to start your history if you use it responsibly.

Actionable: Check your credit score for free (many banks or Credit Karma). Set a calendar reminder to pay each bill a day early. Mark payment due dates like event reminders.

Key takeaway: Build credit now by treating one small bill like a top priority — each timely payment is valuable XP in your money game. Missing a due date is like losing health in a boss fight; avoid it at all costs.

4. Understanding Compound Interest (The Snowball Effect)

Compound interest is your friend if you start early—like rolling a snowball downhill instead of pushing it uphill. Time makes your savings grow exponentially.

Example: If you invest $50 a month from age 20 at an average 7% return, by retirement (age 65) you’d have around $180,000. Wait until 30 and invest $100 a month, and you end up with only about $60,000 (despite contributing twice as much). Starting early beats throwing more money at a late start.

- Time advantage: Every year you delay is money left on the table. The early bird doesn’t just get the worm – it gets your worm’s worth of profits.

- Practical move: Automate small transfers to savings/investments (even $5 a day). That’s $150 a month; at 7% for 30 years, it could turn into ~$180k.

- Example: $5/day (skip a latte!) from 20 to 65 at 7% grows to ~$180k. Start at 30, and it’s only ~~$60k.

- Tools: Use an online compound interest calculator or app to visualize your “money snowball” as it grows. Set goals (car, retirement) and see the future totals.

Key takeaway: Compound interest turns time into your money-powerup. Start now, even with pocket change, and let your savings roll into a financial avalanche.

Calculate your compound interest with SIP Calculator

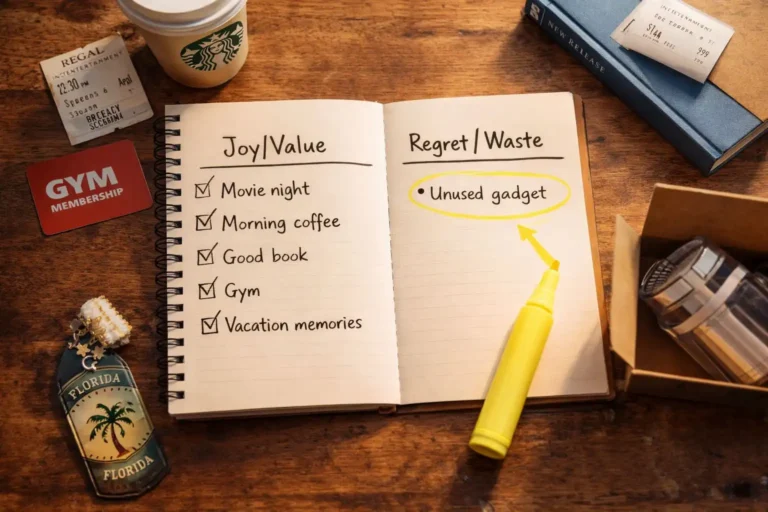

5. The “Invisible Costs” of Lifestyle Inflation

Lifestyle inflation is when expenses grow so slowly you hardly notice, like a subscription here or upgrade there. Those invisible costs leak wealth. In college, it’s upgrading from homemade ramen to Uber Eats daily, or buying every new gadget.

- Track the small stuff: List all subscriptions (streaming, music, apps). Cancel what you don’t use. Each $5-$10 saved is extra XP for savings.

- Impulse upgrades: Ask “Will this improve my life or just show off?” For instance, one designer hoodie could be worth a month of rent someday.

- Frugal living: Cook more at home or grab campus freebies for fun. Use student discounts everywhere. Every $10 saved is muscle for your budget.

Key takeaway: Lifestyle creep is sneaky — stop it by questioning every new splurge. Treat every saved dollar as extra strength for your financial independence.

Real Talk: What High Student IQ for Money Looks Like in Action

Meet two soon-to-be grads and understand their student IQ for money:

- Jordan (High IQ for Money): Jordan worked weekends delivering groceries and used cash-back apps. She cooks at home and tracks expenses in a notes app. By senior year, Jordan has $10k saved and zero credit card debt. She rented a modest apartment (even though she could afford more) because she’s thinking long-term. In her free time, she reads finance blogs and dreams of early retirement.

- Casey (Low IQ for Money): Casey went out nearly every night, paying with credit cards. Without budgeting, Casey racked up $10k in debt. Every paycheck vanishes on streaming services, dining out, and a new smartphone on finance. Casey never thought twice about a $5 snack. The difference was not their major or job – it was their college student IQ for money.

Analyze their moves: Jordan meal-prepped instead of UberEats, skipped expensive gadgets, and built credit by paying bills. Casey kept up appearances, living beyond her means, and ignored money-saving opportunities.

You can do it in a different way too, for example Turning a First Job Into a Wealth-Building System: A graduate with high student IQ for money sets up automatic transfers into savings and investment accounts.

- Contribute to their 401(k) early or Roth IRA and invest consistently

- Build a 6-month emergency fund or Invest in skill development or certifications

- Instead of upgrading lifestyle keep living expenses close to student budget

- Avoid high-interest debt or pay down student loans faster

Key takeaway: You do not need a finance degree to win. Mirror one good habit from Jordan (like reviewing your spending each Sunday) and understanding that consistency beats income level, you will already be ahead of Casey.

Interactive Element: The 5-Minute Money Mindset Audit

Take 5 minutes to quiz yourself with these questions:

- Do you know your checking account balance right now (within $50)?

- Can you name your three biggest monthly expenses without looking?

- Have you set a savings goal (emergency fund, trip, etc.) and a timeline?

- Do you have at least one retirement or investment account started (even a free ETF or index fund)?

- Do you spend more to impress others or because you genuinely enjoy it?

- When you have extra cash (gift or gig pay), is it mostly spent or saved?

- Are there subscriptions you forgot you were paying for?

Write down your answers. If any question makes you hesitate, pick one and take action today. Maybe set up a $5 weekly transfer to savings, or cancel an unused sub. Knowing the answers is the first step toward improvement.

Key takeaway: Awareness is step one. Turn these answers into goals: fix one weak spot (like tracking spending) and make this week the start of smarter habits.

Conclusion: Your Financial Future Starts With One Decision

You have got the blueprint: set a budget, start saving, invest early, build credit, and outsmart lifestyle creep. This is not a mystery test—it is life. Every strategy here is a power-up. Every time you check your budget or invest $10, you level up your financial status.

Remember: even Olympic athletes started with small reps. Every budgeting act, every dollar saved, is a rep for your future wealth. Small steps lead to big outcomes – you’ve got this. In a few years, you might even be the one giving money advice to others. How cool is that? Each smart move now bumps up your student IQ for money.

Your degree may get you a job, but your student IQ for money is what builds wealth. So hit “apply” to these tips like you do on an exam. Just like you wouldn’t cram the night before finals, don’t let your finances drag. Invest in both mind and money, because real gains come from balancing health, knowledge, and wealth.

Key takeaway: Your financial future is earned one smart decision at a time. Start now, and watch your life change.

Call to Action

- Drop a comment below: What’s the biggest money mystery you want solved next?

- Share this guide: Tag a friend who needs this financial wake-up call.

- Subscribe to TheFitFinance: Get weekly tips that make money moves as easy as your workout routine.

Just like we make kids to understand about what wealth really buys in the last post, today we optimized your wallet to build financial muscle. Don’t let your gains fade – invest in both mind and money.