That Sinking Feeling (And Your Life Raft)

You swipe your card, hear the familiar “beep,” and for a moment life feels manageable. Then the statement arrives. The “minimum payment” line mocks you, and the “interest charged” feels like a tax on your past mistakes. It’s not quite drowning – more like treading water in a sea of 24.99% APR. Americans now carry about $1.23 trillion in credit card debt, and average credit card APRs are a record-high _23.4%. No wonder a lot of us end up feeling overwhelmed.

Yet there is a way to stop fighting this current alone. Refinancing your credit card debt isn’t magic, but it can be a powerful life raft. In plain terms, refinance credit card means moving your existing high-interest balances into a new loan or account with a lower interest rate. Think of it like refinancing a mortgage: you’re not erasing the debt, you’re restructuring the war – ideally paying less in interest and attacking the principal faster. By the end of this guide, you’ll have a crystal-clear plan. You’ll know whether refinance credit card is a golden ticket or a trap for you, the exact step-by-step process to do it safely, and roughly how much money you could save (hint: potentially thousands of dollars). Ready to turn panic into power? Let’s dive in.

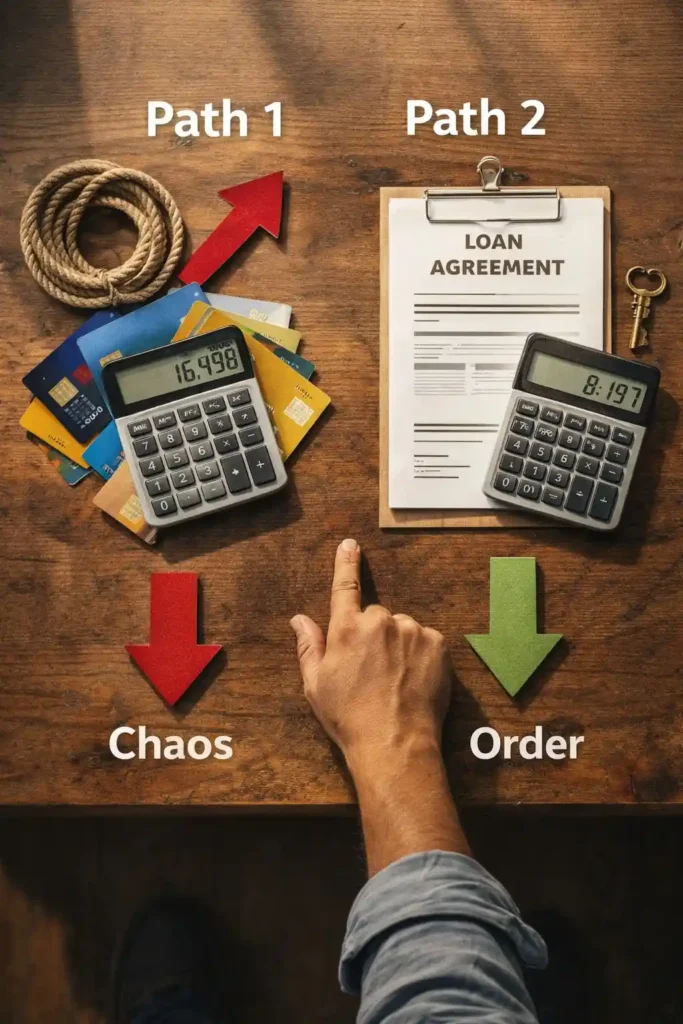

What is Refinance Credit Card? (It’s Not What You Think)

A credit card refinance is simply consolidating your high-interest credit card debt into a new financial product with better terms. You are not waving a magic wand on your balance; you’re calling a cease-fire on sky-high APRs. In essence, it’s like calling in reinforcements for your debt: either a zero-interest balance transfer credit card or a debt consolidation loan (usually a personal loan) that has a lower interest rate than your old credit cards. The goal is that you’ll pay far less interest over time and have a single manageable payment.

The two main “weapons” in the refinance arsenal are:

• The Balance Transfer Play

With a balance transfer, you move one or more credit card balances onto a new credit card that offers a low or 0% introductory APR. These cards often give you an interest “vacation” for 12–21 months, but there’s usually a fee (often 3–5% of the amount transferred). Think of that fee like a bouncer at a club: you pay a small percentage up front to get into a more favorable rate club. If you can pay off the balance before the promo period ends, you will have bought yourself significant interest savings. However, be careful: if any balance remains when the 0% period expires, it will typically revert to the card’s high regular APR (often as high as or higher than your original rate). In short, a balance transfer is best for short-term fights – smaller balances you can knock out within the teaser period.

• The Debt Consolidation Loan Tactic

A debt consolidation loan (usually an unsecured personal loan) is another path. Here, you take out a lump-sum loan to pay off all your credit cards at once. You then repay that loan with fixed monthly payments over a set term (often 2–7 years). These loans typically offer a fixed interest rate (so your payment won’t skyrocket) and can sometimes cover multiple debts, not just one card. Because many lenders (especially credit unions and online lenders) advertise rates as low as _6–9% for strong-credit borrowers, this can be much lower than what you’re paying now. It’s best suited for larger debt piles or multiple cards, or when you need more time to pay off a big balance. The trade-off is that personal loans may charge a one-time origination fee (typically 1–10% of the loan) and you must qualify based on your credit/Debt-to-Income (DTI) ratio. Still, with discipline, the fixed rate and single payment can simplify life and cut interest drastically.

Both approaches aim to reduce your APR and give you breathing room. A balance transfer card treats you to a 0% honeymoon (with a fee), while a consolidation loan gives you a fixed-rate marriage. Which is right for you depends on your debt size, credit score, and how long you need to pay things off.

Is Credit Card Refinancing Good or Bad? (Spoiler: It Depends)

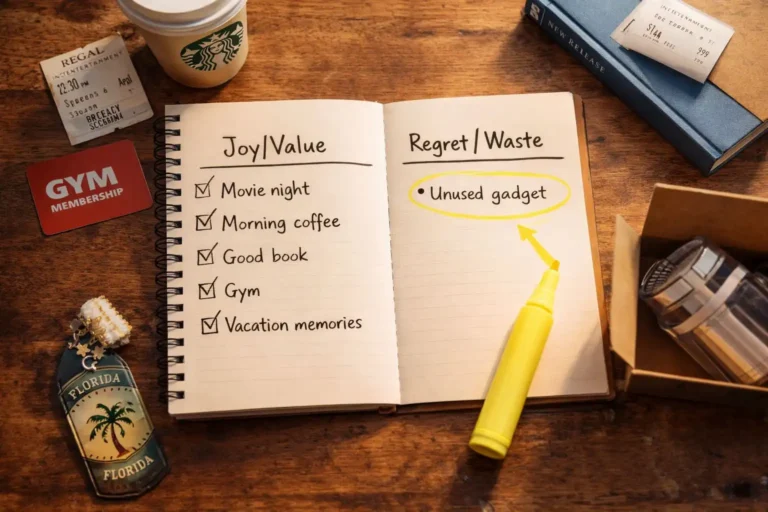

Whether refinancing is a genius move or a potential disaster really depends on your situation and discipline. It’s not inherently “good” or “bad” – it’s a tool. The trick is using it wisely and under the right circumstances. Consider these scenarios:

When Refinancing Your Credit Card is a GENIUS Move

• You have good to excellent credit (690+). With a strong FICO score, you’re more likely to qualify for the lowest rates on personal loans or balance transfer cards. This means you could secure a new APR that’s much lower than your current 20–25%+, immediately slashing interest costs.

• Your math shows clear savings after fees. If a quick run of the numbers indicates that even after any transfer fees or loan origination fee, your total interest will be significantly lower, refinancing makes sense. (By the way, one lender reports borrowers saved about $2,054 on average over 36 months of paying off debt with a consolidation loan.)

• You are disciplined and committed to change. You have a solid budget and really won’t run those paid-off cards up again. In fact, you may have even canceled some old cards to remove temptation. You’ll stick to the new payment schedule, aiming to pay extra when you can.

• You want a predictable payoff schedule. Instead of chipping away at revolving credit, you’d like a fixed plan. A personal loan sets a payoff date (e.g. 3 years) and a fixed monthly payment, which can be highly motivating. After all, “no longer minimum paying” can feel like reclaiming control.

• High APR + Options for low rates. Perhaps your current cards charge 20–25%, but you can find a consolidation loan in the 7–10% range, or a balance transfer card at 0% for 18 months. When the delta between old and new APR is large, the interest savings can be substantial.

In short, refinancing is a genius move if the numbers work, your credit qualifies you for a much lower rate, and you’re in a strong place mentally to follow through. A common example: “With a 720+ credit score and $15K in card debt at 22%, I was able to get a 3-year consolidation loan at 9%. Over those three years I’ll save thousands in interest!”

When Refinancing is a Recipe for Disaster

• You’re using it to dodge bad habits. If the real problem is overspending or living beyond your means, a new loan won’t fix that. In fact, experts warn that consolidation won’t address core spending habits. If you earn little to spend and still keep charging on the same cards (or new ones), you’ll just dig yourself deeper.

• Fees wipe out the savings. Let’s say you have $10,000 at 22% and a balance transfer card charges a 5% fee. If you can’t pay it off in the promo window, the math might not save you money overall. Always calculate: if a 3–5% fee costs you more than interest savings, skip it.

• You don’t qualify for a low enough rate. If your credit is fair (<650) and you only qualify for another 20%+ card or a poor-rate loan, you might be trading one pain for another – plus added fees.

• It becomes a crutch for avoidance. Are you pushing this off so you don’t have to face tough spending choices? Refinancing can feel like progress while you continue reckless spending, but that’s a quick path to worse debt. As Discover notes, a transfer only helps if you use it responsibly otherwise you may end up increasing your debt load.

• You add complexity without simplicity. For some, opening a new loan while juggling old cards (maybe forgetting to close or pause them) can actually complicate finances. If you end up with multiple payments or fees, or if your debt grows behind the scenes, you might trade one headache for another.

In the “bad” column, behavioral risks loom large. Renewed access to credit, ignoring a budget, or falling for the illusion that “interest can’t hurt me anymore” are classic traps. Remember: refinancing is a tool, not a cure-all. If you’re not ready to change behaviors, it might only buy time, not freedom.

The Nuts, Bolts, and Numbers: How to Refinance Credit Card, Step-by-Step

Let’s roll up our sleeves and get practical. We’ll use The REFI Method here – Rate, Evaluate, Figure, Implement – to turn your refinance plan into reality.

Step 1: The Financial MRI – Know Your Numbers

Rate: First, do a full inventory of your debts. List every credit card (balance, APR, minimum payment), plus any other high-interest debt you’re considering paying off (like personal loans). Your “financial MRI” checklist:

- Current credit card balances and APRs (e.g. $6,000 @ 24.9%, $3,500 @ 19.9%, etc.)

- Your credit score (order a free FICO or Vantage score; even a soft check on LendingClub or Credit Karma will do). Scores in the mid-600s+ unlock the best rates.

- Debt-to-Income (DTI) ratio: Calculate your monthly debts (including rent/mortgage, car payments, minimum credit card payments) divided by gross income. A high DTI (especially over _40-43%) makes qualifying for low rates harder.

- Monthly budget: Know exactly how much extra you can pay per month. This tells you the realistic payoff timeline.

Why this matters: You can’t build a repair plan without knowing the damage. By quantifying your balances and rates, you’ll know how much interest you’re truly paying now.

Step 2: Shop Like a Pro – Where to Find the Best Rates

Evaluate: Now that you have your numbers, hunt for the best refinance offers. Don’t just check one source; compare:

- Credit Unions: Often have the lowest personal loan rates for qualifying members. For example, Navy Federal, PenFed, or your local union might advertise consolidation loans starting in the low single digits for excellent credit. (Membership requirements vary, but many allow joining with a small deposit.)

- Online Lenders: Sites like LendingClub, Upgrade, or SoFi specialize in debt consolidation. They can sometimes approve borrowers with fair credit as well, though rates climb with risk.

- Banks: If you have a healthy relationship with your bank, see if they offer a debt consolidation loan (sometimes called a personal loan or signature loan). These rates might be higher than a CU, but if you’re a loyal customer, you might negotiate a bit.

- Balance Transfer Cards: Check card comparison sites (Bankrate, NerdWallet, credit card issuers) for 0% APR balance transfer offers. Watch out for the fine print: typical balance transfer fees are 3%–5% of the amount transferred. If you plan a balance transfer, make sure the fee (and any annual fee) doesn’t erase your savings.

- Pre-Qualification: Use soft-credit tools that let you see potential loan or card offers without a hard pull. This can give you an idea of your rate range and whether refinancing is feasible.

When shopping, use rate tables like credit karma’s or bankrate’s tools. For a ballpark: as of recent data, personal loan APRs roughly range from _7% (best credit) up to 36% (poor credit). You want the lowest APR you can get.

Also consider loan term (the “T” in term). Shorter loans have lower APRs but higher payments; longer loans reduce monthly cost but increase total interest. A 2–5 year term is common for consolidation.

Step 3: Run the Real Math – The Hidden Calculator

Figure: Now do the calculations that most people skip. We want to be absolutely sure you save money (or time) by refinancing. Compare total cost of your current debt vs the new plan:

- Old debt cost: Calculate how much interest you’d pay if you continue your current payments. You can use an online amortization calculator: plug in each credit card’s balance, APR, and your monthly payment to see total interest and payoff date. Or approximate: $X balance at Y% APR for Z years yields _$XYZ/100 in simple interest (rough guide).

- New loan cost: For a consolidation loan, use a loan calculator with the new principal (sum of balances), interest rate, and term to see total interest. Don’t forget fees: if there’s a 3% origination fee on a $10,000 loan, that adds $300 to your cost. For a balance transfer, include the 3–5% fee in your calculation.

- Savings (or cost): Subtract the new plan’s total interest+fees from the old interest. If you refinance properly, you should see a positive savings number.

For example, suppose you owe $6,000 at 24% APR and pay $200/month. Over 4 years, you’ll pay roughly $8,800 total, about $2,800 in interest (this is a rough estimate). If instead you refinance that $6,000 with a 24-month personal loan at 10% APR, your monthly payment would be about $276 and total cost about $6,650 (≈$650 interest). Even with a $180 (3%) origination fee, your total outlay ($6,830) is still much less than $8,800 – a net savings of nearly $2,000 in this simple case.

Real-life data backs this up. A lending platform found average borrowers saved about $2,054 over 36 months by moving credit card debt into a personal loan. Your situation may differ, but that’s the ballpark of possibility. By doing the math upfront, you avoid unpleasant surprises. (If your numbers show zero or negative savings, refinance might not make sense unless behavior or terms change drastically.)

Step 4: Execute & Escalate – The Final Moves

Implement: You’ve done the prep work. Now it’s action time:

- Apply for your chosen option. If it’s a loan, get pre-approved and then finalize the application. If it’s a balance transfer card, fill out the transfer request (you’ll need balances and account numbers). Don’t forget to confirm the new rates in writing.

- Pay off the old cards immediately. Once the funds hit your accounts (or the balance transfer posts), call each card issuer to ensure it’s paid off. Often you can do this online too. The moment they’re cleared, your old cards should have $0 balances.

- Secure the old accounts (or close them). The old debts are gone, but the temptation can remain. Common advice: cancel the card accounts to remove temptation. However, be careful: closing a card can lower the average age of your accounts and reduce your total credit limit, which can ding your credit score. If the card has no annual fee, a smarter move might be to keep the account open but cut up the card, freezing it in a drawer. That way you preserve the credit history and available limit (keeping utilization low) while removing instant access. Decide based on the card – e.g., if it’s a store card with a huge rewards program you don’t care about, closing it might not matter.

- Set up autopay and a budget. Ensure your new loan or card payment is set to auto-pay to avoid late fees. Then, redouble your commitment: don’t charge new purchases to the paid-off cards (or use cash/debit for new expenses). Focus on attacking the new balance with your budget. If you used a consolidation loan, consider applying the extra snowball/avalanche strategies described below to pay it off even faster.

With these steps, you’ve effectively swapped a high-cost problem for a manageable one. The hard part is over – now you just stick to the plan.

Refinance vs. Payoff: The Strategic Smackdown (differences)

Here’s the big showdown: pay off your debt aggressively (no refinance) vs. refinance then pay off. Both get you to the finish line – debt freedom – but they differ in approach.

| Strategy | Key Approach | Pros (Strengths) | Cons (Drawbacks) |

|---|---|---|---|

| Debt Snowball | Pay smallest debt first, then roll to next | Quick wins keep you motivated; simple to track. | May cost more in interest; not mathematically optimal on total cost. |

| Debt Avalanche | Pay highest-interest debt first | Minimizes total interest paid; generally fastest payoff overall. | Slow initial progress if big balance; can feel discouraging without quick wins. |

| Refinance Path | Consolidate all debts to lower-rate loan/card | Lower APR and monthly payment; one fixed schedule; simplifies payments. | Fees for transfer/loan; risk overspending; requires good qualification. |

| Hybrid Champion | Refinance into low-rate loan and then use avalanche | Best of both worlds: lower interest plus structured payoff. | Must qualify for low rate; still requires discipline; a bit more complex setup. |

In the Snowball/Avalanche camp, the payoff is internal: you chip away at debts with your existing funds. Avalanche (highest-APR first) is mathematically best – you pay the least interest overall – but it can feel glacial. “You may save some money with avalanche, but if the principal is large, the time it takes can be discouraging,” warns Wells Fargo. Snowball (smallest-balance first) gives faster emotional wins but sacrifices some savings. Use whichever will keep you working at it (both are valid).

In the Refinance camp, you’re effectively lengthening the fuse by grabbing a new loan. You immediately reduce your interest rate and merge payments. The risk? If you then treat it like a free pass to spend, you could end up further in debt (since, as Discover notes, you might actually increase your credit card balances if you overspend after a transfer). But if you’re disciplined, you could wipe out debt much faster.

The Hybrid Champion strategy is exactly that: refinance at a low rate, then tackle the loan with avalanche (or snowball) zeal. In practice, this might look like getting a consolidation loan at, say, 8% fixed, then directing any extra money to payoff (which is cheaper debt, since 8% is typically lower than most credit card rates). This combo often wins for both speed and savings, so we call it the champion strategy

No matter the path, the finish line is debt freedom. Pick the one that fits your financial personality. Use the chart above to compare which strengths and weaknesses align with your situation.

The Unvarnished Truth: Pros and Cons of Refinancing Credit Card Debt

Let’s lay it out straight – the light and shadows of refinancing. On one hand, it can feel like a new dawn; on the other hand, it can come with hidden clouds.

The Sunshine (The Pros)

- Big interest savings. This is the headline. By cutting your APR from 25% down to, say, 8–12%, you literally save money every month. Those saved interest dollars can shave months or years off your payoff timeline. (Even after paying a one-time fee, many find the math still ends in a win.)

- Fewer payments to track. Instead of juggling 3–4 due dates and statements, you get a single loan or card statement each month. This simplicity often means fewer late payments and fees.

- Fixed payment schedule (with a loan). A personal loan gives you a set payoff date. Psychologically, knowing you’ll be debt-free by a certain month is motivating. It’s a clear finish line to race toward.

- Lower credit utilization (potentially helping your score). By paying off the old cards, your credit utilization can drop dramatically. If you keep those lines open, your overall used credit % plummets, which may boost your score over time. (Just keep those old cards closed in practice!)

- Financial breathing room. Lower payments mean more free cash. You could use the extra to build an emergency fund (avoid next debt spiral) or to pay off the loan faster. This new flexibility can feel liberating.

The Storm Clouds (The Cons & Pitfalls)

- Fees and costs. Balance transfers charge 3–5%; personal loans may charge 1–10% origination fees. In some deals, that one-time fee can erase much of the interest savings if you’re not careful. Always double-check “after-fee savings” before committing.

- Temptation to overspend. Perhaps the biggest risk: if you don’t close old cards (or at least lock them up), you may rack up new debt. Refinancing is useless if you just replace old debt with new. As Discover warns, a transfer or loan only helps if you use it to pay down balances. If you fall back into charging habits, you’ll likely be in a worse hole (with extra fees to boot).

- Credit score hiccup. Applying for new credit triggers a hard inquiry, which can ding your score a few points in the short term. Opening a new loan or card can also temporarily lower your average account age. If you then close old accounts, Discover notes this can further hurt your credit history age. Usually these effects are minor and temporary, but they are worth noting if you’re planning something like a mortgage soon.

- You still have debt. Refinancing doesn’t eliminate debt – it rearranges it. You must pay it off. If you ever miss a payment on the new loan/card, that’s another hit (and possibly at a different rate). Keep the commitment.

- No safety net for overspending. If you’re using credit to make ends meet or escape emergencies, refinancing might defer the reckoning. In extreme “financial hardship” cases, a Debt Management Plan (via a nonprofit credit counselor) might actually be safer and cheaper. These DMPs negotiate lower rates with your existing creditors, without taking a new loan. It’s not flashy, but for some very tight budgets, it’s a healthier path than adding a new payment. (If that sounds like you, reach out to a certified counselor – they often have free consultations.)

Bold Key Takeaway: Refinancing can be a powerful weapon against debt if you respect it. It won’t fix spending problems, but it can give your payoff plan a major boost if used responsibly.

Your Secret Weapon: Using a Personal Loan to Refinance Credit Card

While balance transfers are great, let’s spotlight personal loans specifically, since they’re a top choice for refinancing credit card debt.

Personal loans for debt consolidation are unsecured installment loans with fixed APRs and terms (no collateral required). That means your credit card debt (which is unsecured anyway) is replaced by another unsecured loan. Typical terms: 2 to 5 years (some lenders go up to 7), with interest rates depending on credit and profile. Current reality check: as noted, personal loan APRs range roughly from the mid-single digits (for stellar credit) up to the mid-30s for poor credit. Recently, many lenders advertise rates around 7–15% for borrowers with good scores.

• Fixed vs. Variable: One big plus is stability. Your new loan’s APR is fixed, meaning the rate you start with stays the same (barring delinquency). Contrast that with credit cards, which usually have variable APRs that go up as the Fed rate climbs. A fixed rate loan protects you from future rate hikes. (Of course, if market rates drop, you don’t benefit from cuts either – but right now credit card rates are at record highs.)

• Unsecured Loan: Because these loans are typically unsecured, you don’t need to put up your home or car. This makes them riskier for the lender, but still widely available. Some lenders do offer secured debt consolidation (like a HELOC or title loan) at lower rates, but these carry the risk of losing your asset if you default. We’ll stick to unsecured personal loans here.

• Credit Union Perks: Don’t forget credit unions! Many CU loans start in the single digits for qualified borrowers. One credit union’s consolidation loan runs “as low as 4.99% APR,” for example (though you do need membership). Generally, credit unions consistently offer lower APRs than big banks.

• Origination Fees: Factor in origination fees. These cover the loan’s admin and range from 1–10% of the loan amount (commonly _3–5%). The lender may either take this from your disbursed funds or add it to your loan balance. For instance, a 3% fee on a $10,000 loan is $300. Include this in your calculations to ensure the refinancing still saves money.

• Loan Term: As mentioned, shorter terms mean lower rates but higher payments. For example, a 36-month loan might have a 1–2 point lower APR than a 60-month loan. Decide if you can afford the higher payment for a big rate cut. A longer term lowers your monthly burden but costs more interest overall.

• Pre-Qualification: Many lenders let you do a soft pull pre-qualification to get rate estimates without hurting your score. Always pre-qualify wherever possible to compare offers side-by-side.

In practice, a personal loan for credit card refinancing might look like this: You borrow $20,000 to clear five credit cards. You end up with one $20K loan at, say, 10% APR for 4 years. You now pay one $512 monthly payment instead of juggling 5 separate ones (some much higher due to min payments). The trade is you pay roughly $4,742 in total interest (plus fees) instead of perhaps $10–15K you would have over many years on credit cards. Those numbers vary, but the key is the fixed interest rate and set payoff date give you clarity and peace of mind.

Interactive Element: The “Should You Refinance?” Decision Dashboard

Let’s make this concrete. Take this quick self-check:

1. What is your FICO credit score?

• A: Below 580 (Poor)

• B: 580–689 (Fair/Good)

• C: 690–719 (Good/Very Good)

• D: 720+ (Excellent)

2. Are you committed to not using your old credit cards again?

• A: Not really – I might swipe again

• B: Absolutely – I’ve already cut them up

3. Does the math (after fees) show savings on your debt?

• A: No – the fees wipe out the benefit

• B: Yes – I’m saving $X or more

Tally it up: If you mostly answered A’s, refinancing may not be right for you right now. For example, if you have a low score, are tempted to overspend, or the fees negate savings, you could end up worse off. Instead, focus on budgeting and paying down debt (avalanche or snowball) until you improve your situation. If you mostly answered B’s (C’s and D’s), you have many of the winning ingredients: decent/excellent credit, discipline, and a positive savings scenario. In that case, refinancing likely can help you save a significant amount of interest and simplify your payoff. (If you’re in the middle – say a mix of As and Bs – maybe try a hybrid approach: refinance part of the debt or take one loan and use one payoff strategy on the rest.)

Conclusion: Your Path to Lighter Days

Refinancing is a powerful tactic, but debt freedom is the strategy. We’ve armed you with the map: you know the terminology, the calculations, the pros/cons, and the next steps. Whether you choose to refinance your debt or simply double down on paying it off the traditional way, the most important thing now is action.

Do not let decision paralysis keep you stuck. Choose one small step from this guide and do it today. Maybe check your credit score or look up one refinance loan offer or even just write down all your debts on paper. Each bit of momentum propels you forward. Remember, even a single extra payment or a small interest reduction adds up over time.

Call to Action (CTA):

• Stuck on a number or scenario? Drop a comment below describing your situation, and our community can help brainstorm ideas tailored to you.

• Save a friend from financial fog. If you found this guide useful, share it with one person who’s juggling card debt. They’ll thank you later.

• Get the “Refinance Readiness Checklist.” Want a step-by-step PDF to ensure you don’t miss anything? Just comment below for our free guide to walk through each refinance action with confidence.

• Stay on track. Consistency beats intensity. Sign up for TheFitFinance Newsletter to get weekly, bite-sized money tips that build habits without overwhelm.

Punchy Correlating Line: Mastered your debt game? Now it’s time to make your money work for you. Learn 12 Powerful Ways to Make Your Card Work for You

Refinancing isn’t a silver bullet, but it can be your springboard to lighter days. You now have the knowledge to decide wisely. Choose one action – even a small one – and take it. The journey to financial freedom begins the moment you move off the shore. Good luck!

Sources: All data and quotes above are drawn from reputable financial sources and research reports Experian: Manage Your Credit and Save on Loans, Credit Cards, Car Insurance, NerdWallet: Finance smarter, Investor Relations | LendingClub Corporation, Discover - Personal Banking, Credit Cards & Loans, Credit scores and much more - Intuit Credit Karma, ensuring this guide gives you up-to-date facts and real-world examples.