Alex’s Tipping Point

Have you ever felt your stomach drop seeing an Amazon order confirmation pop up? Alex did. Last month, after yet another late-night “deal” purchase spree, he faced a $500 credit card bill – and a huge argument with his partner. He felt guilty and trapped, like his hard-earned money was slipping through his fingers. Yet this isn’t a story of moral failure; it’s a system glitch that many of us fall into.

This guide will be your debug tool. We’ll define exactly what bad spending habits are (far beyond skipping your morning latte), show the hidden costs of those habits (the stress, delayed goals, lost compound interest, even relationship strain), and trace how our brains and our smartphones conspire to make us overspend. Most importantly, we’ll give you a battle-tested, no-fluff action plan to break the cycle. You’re not alone in this – and by the end, you’ll have the roadmap to greater financial peace.

What Are Bad Spending Habits? (It’s Not Just Coffee)

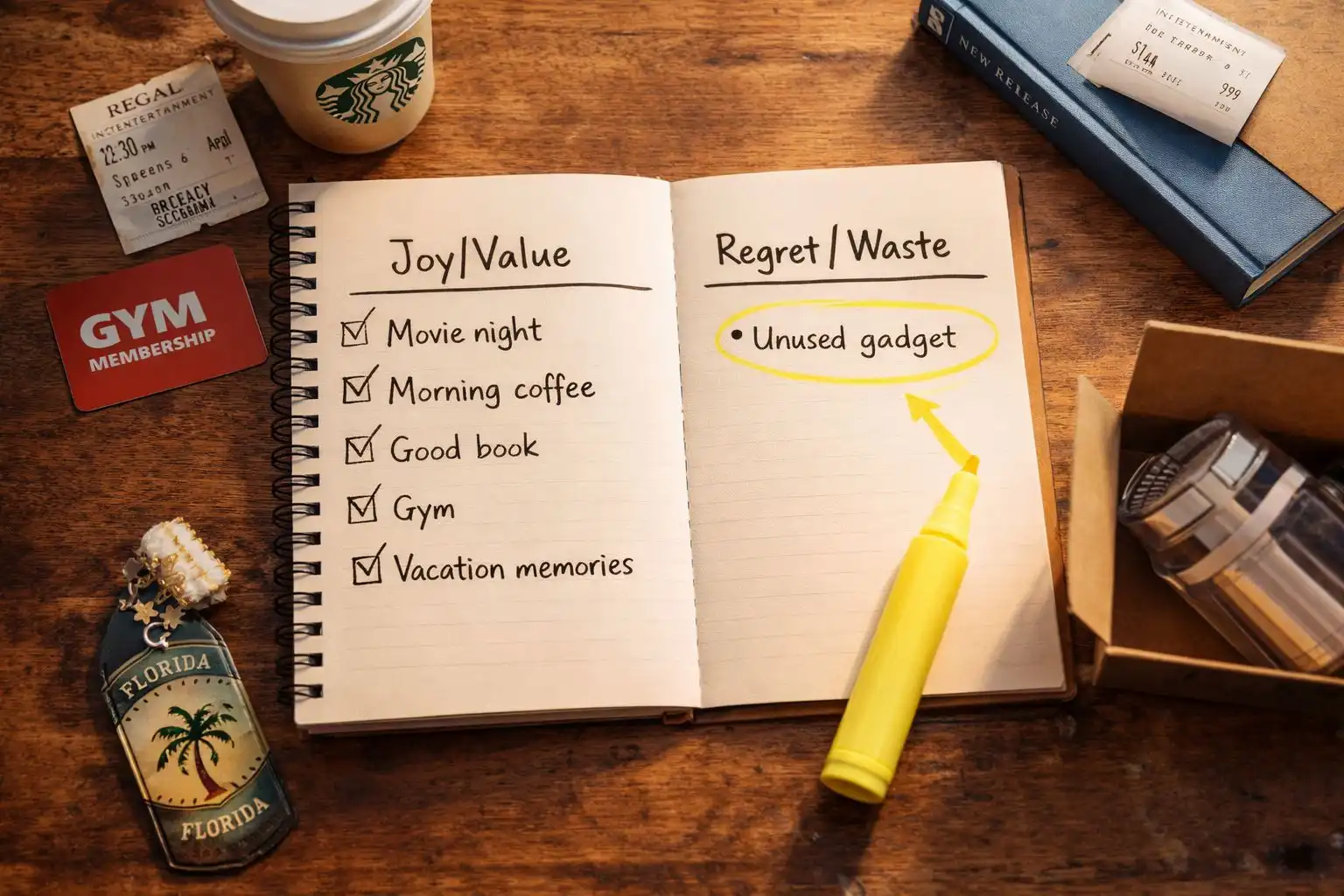

Bad spending habits aren’t about spending money on things you need – they’re about spending in conflict with your own goals and values. In other words, it’s money leaking out to things that don’t actually improve your life or match your priorities. Think beyond the cliché of a daily latte. Today’s common examples include:

Subscription creep: Pay for multiple streaming services, apps, or monthly boxes you barely use (maybe you forgot to cancel that free trial or gym membership).

One-click inflation: Buying things with a few taps on Amazon Prime or through “Buy Now, Pay Later” at checkout – from phone accessories to virtual game tokens – without actually needing them.

Upgrade addiction: Replacing perfectly fine gear or tech gadgets simply because a newer model or “better deal” is out.

Emotional retail therapy: Shopping to cheer up after a bad day or to celebrate, rather than for a planned need.

FOMO spending: Splashing out on concert tickets, dinners, or clothes just because friends post about fancy outings or travel on Instagram.

These patterns silently eat away at your budget. Self-Check: Do you often feel buyer’s remorse right after a purchase? Do you hide shopping bags or lie about how much you spent? Do you have unused app subscriptions sitting on your bank statement? If any of these hit home, keep reading – you’re about to plug those leaks.

Key Point: Bad habits are about emotional or mindless spending that contradicts what you really want (a debt-free life, a house, peace of mind).

Why Bad Spending Habits Hurt More Than You Think

It might seem harmless to grab dinner on DoorDash a couple extra nights, or buy that on-sale gadget “just because.” But those dollars add up in ways that go well beyond the immediate purchase. Here’s what’s at stake when we overspend:

The Compound Interest Killer

Every dollar you spend on impulse is a dollar not invested in your future. Compound interest is a powerful force: money you save today grows over time, whereas money you spend disappears forever. For example, imagine putting $150 a month into a retirement or investment account instead of spending it. At a modest 7–8% annual return, that could become tens of thousands of dollars over 20–30 years – easily a down payment on a home or a new car. In concrete terms, one finance writer notes that investing just $5 a day (about $150/month) at 8% could yield nearly $350,000 in 40 years. That’s a life-changing difference. Every impulsive purchase is a tiny ship sailing away on the ocean of compound interest – money you’ll never see again.

The Stress Multiplier

Money worries are a huge source of stress and anxiety. In fact, research shows 42% of Americans say money negatively impacts their mental health. Constant overspending breeds guilt and anxiety (when Alex saw his credit card statement, his heart raced). High financial stress can spiral: you spend to feel better, then stress again about the spending, creating a vicious loop. Over time, chronic financial strain can lead to depression, sleep loss, and even physical health problems. The emotional toll multiplies – it’s not just math, it’s your well-being.

The Goal-Postponer

Every unnecessary dollar in your hand delays achieving big goals: becoming debt-free, buying a house, or retiring. If you funnel cash into video game loot boxes or streaming subscriptions instead of savings, you’re putting your future on hold. For example, skipping $200 monthly of savings could mean years longer till you reach your down payment or retirement goal. In the U.S., 44% of people can’t cover a $1,000 emergency expense from savings. If you can’t even handle a small shock, how will you tackle bigger dreams? Each impulse spend is a step backwards on your savings goal journey.

The Relationship Strain

Money is one of the biggest relationship flashpoints. In fact, a Kansas State University study found that “arguments about money is by far the top predictor of divorce”. It doesn’t matter how much you earn – couples fighting about spending can erode trust. Just like Alex’s fight, small money disputes often escalate. And once triggered, financial fights tend to be more intense and longer-lasting than other fights. If uncontrolled spending leads to secret debts or arguments, it eats away at your partnership and family peace.

Key Point: Bad spending habits cost you far more than the purchase price – they steal your future self’s peace of mind, goals, health, and relationships.

How Bad Spending Habits Happen: The Psychology of the Leak

It helps to know why we fall into these traps. The truth is, our brains and the market are wired to make us spend. Here are the main culprits:

- The Trigger–Emotion–Spending Loop: Our moods dictate money moves. Feeling bored, stressed, lonely, or even excited can trigger an “I deserve a treat” response. When we’re down or overwhelmed, retail therapy promises a quick dopamine hit. But like a sugar rush, the happiness fades fast and often leads to regret. Over time, repeated emotional spending reinforces itself: shopping becomes the default coping skill or celebration go-to.

- Retailers and Apps Engineer Impulse: Marketers and platforms train us to spend by design. They use flash sales, scarcity messages (“Only 2 left!”), personalized ads, push notifications, and one-click checkout to make buying automatic and urgent. Free shipping thresholds (“Spend $10 more to save on delivery!”) and endless “confirm” buttons lower our resistance. Some sites even delay showing review pages or hide unsubscribe links, banking on the fact that most people won’t back out at the last minute. In short: they’ve done their homework on our psychology. As one source notes, we’re “tempted by the ‘limited-time offer’ that taps into fear of missing out” and “savvy marketers seduce us… to empty our wallets”.

- Lifestyle Creep – The Silent Salary Eater: Got a raise? Great – but it often brings higher bills. Lifestyle creep is the sneaky habit of ratcheting up spending as income rises. Maybe you move from cooking at home to eating out more, upgrade to a pricier apartment, or sign up for the gym membership you never attended. Each bit of extra comfort feels justified “because I deserve it now,” but cumulatively it can wipe out the extra room you had for saving. As one financial planner puts it, “each time you inflate your spending… you’re chipping away at the surplus that would otherwise go into investments, savings, and emergency funds”. You think you’re better off, but you’re not really getting ahead – you’re just keeping pace with the paycheck, without building real wealth.

- Social Spending – Keeping Up with the Instagrams: Modern spending isn’t done in a vacuum. Watching influencers or friends flaunt new shoes, vacations, or gadgets can trigger envy spending. A recent survey found 51% of Americans admit seeing what others buy on social media motivates them to spend due to FOMO. That means half of us scroll, see a friend’s new travel vlog or a post about a cool watch, and think: “I need that, too.” The line between inspiration and impulse blurs on Instagram, TikTok, and Facebook feeds.

Key Point: Understanding these triggers – emotions, engineered impulse, creeping lifestyle, social pressure – is the first step to breaking free. They’re all outside influences that don’t have to control your wallet.

Financial Peace vs. Temporary Pleasure: Rewiring Your Reward System

Here’s a truth bomb: The dopamine hit from spending fades fast, but the peace you get from financial control lasts. Buying a pair of shoes might make you happy for an afternoon, but paying down debt or seeing your savings grow feels deeper and more sustainable. It’s like choosing between junk food and a nourishing meal: the sugar high wears off, but good food powers your day.

To shift from short-lived pleasure to long-term peace, we have to change how we value things. Enter value-based spending: buying only what truly aligns with your goals and values. Before you hit “pay,” ask yourself: Does this move me closer to financial freedom or farther away? Will this purchase make me happy tomorrow – or just for a moment?

Practice this mindset: every time you’re tempted by instant gratification, pause. Picture your life a year from now if you skip this purchase – maybe you have an extra $500 in emergency savings or you’re $500 closer to that vacation you really want. The serenity of saving is like a deep breath; the thrill of spending is like a quick breath. Train your brain to notice that feeling of calm after saying “no thanks.”

Quick Value Check: Not sure if it’s “value-based”? If the thing you want truly makes your life better (like a needed tool, health investment, or something that sparks genuine joy aligned with your goals), it might be worth it. But if it’s just a fleeting idea of “saving a few bucks” on something you don’t need, that’s a mini leak.

Your Action Plan: How to Stop Bad Spending Habits for Good

Alright – time to put knowledge into practice. Here’s the step-by-step toolkit to break the cycle:

- Step 1: The No-Judge Spending Audit Track every dollar you spend for 7 days – no shame allowed. Use a notebook, an app, or even voice memos. Don’t edit yourself; just jot down every coffee, app subscription, takeout meal, impulsive click. After a week, review it with zero judgment. Categorize your spending (Essentials vs. Wants vs. Waste). This lets you see patterns. Often, you’ll spot surprises: maybe you’re spending $50/month on unused subscriptions, or $200 on junk food orders. Seeing the hard numbers is empowering and eye-opening.

- Step 2: Identify Your Personal Triggers Look at your audit and reflect: when and why did you spend unnecessarily? Is it boredom, stress at work, scroll-induced envy? Do you splurge on weekends out with friends, or late-night Amazon binges? Make a list of your top triggers. For example: “Bored on Friday nights”, “Stressed after arguments”, or “Feeling left out of social events”. Knowing your triggers means you can plan alternatives (see Step 7).

- Step 3: The 48-Hour Rule & The Wishlist Next time you want to buy something non-essential, sleep on it. Write the item down in a “wishlist” note (phone or paper). Commit to waiting 48 hours before deciding. Many impulse purchases lose their appeal once you’ve had time to think. When 2 days pass, revisit the list: you may find half of it looks silly or unnecessary. If you still truly want something after 48 hours, then it’s more likely a deliberate decision, not a knee-jerk reaction.

- Step 4: Unsubscribe & Unfollow (Digital Hygiene) Are your inbox and Instagram filled with spending temptations? Time to declutter. Unsubscribe from marketing emails (“Get 50% off today!”) and discount newsletters you never use. Unfollow brands or influencers that make you feel “I need that.” If shopping apps or sites are too tempting, remove them from your home screen or delete accounts. You might consider a separate email for subscriptions so your main inbox isn’t constantly buzzing with deals. Out of sight, out of mind helps break the impulse.

- Step 5: Go Cash-Only for Problem Categories (Envelope System) For spending categories where you overspend (like dining out, entertainment, or clothes), switch to cash envelopes. For example, decide you’ll spend no more than $100/week on “eating out.” Withdraw $100 in cash and put it in an envelope. When the cash’s gone, that’s it until next week. This tactile approach makes spending real – you literally see money walking away – and automatically limits your outflow. No one can swipe more cash you don’t have. Alternatively, use a debit card with a tight limit on those categories. The idea is to feel the “pain of paying” again, which cards often mask.

- Step 6: Automate the Good Stuff (Pay Yourself First) It’s often said, “If you don’t see it, you won’t spend it.” Schedule automatic transfers the day you get paid: e.g., $100 goes straight from checking to savings or debt payment the moment your paycheck arrives. Treat savings and debt repayment as non-negotiable bills (like rent or utilities). You’ll feel like you never had that money to begin with. Over time, these small automated steps build financial discipline and keep you on the path to your goals with minimal effort.

- Step 7: Find Your “Why” and Visualize It This is your fuel. Why do you want to break these habits? Maybe it’s to eliminate stress, buy a home, pay off student loans, or have a cozy retirement. Write down your top 2–3 reasons in vivid detail. Then visualize them: imagine opening the door to your new home, hitting $0 on your debt, or finally taking that dream trip. Keep a photo or sketch of that goal where you’ll see it daily (fridge, wallet, or phone wallpaper). When temptation strikes, revisit that vision. It’s much stronger motivation than any fleeting sale or impulse thrill.

Quick Tips: Keep reminders of your goals handy, use budgeting apps to stay organized, and reward yourself for milestones (within reason – a free activity or small treat after 30 days of sticking to the plan can keep you motivated).

Interactive Quiz: What’s Your Spending Habit Archetype?

Find out what kind of spender you tend to be and get tips to fix it. For each scenario below, pick the answer that best matches what you would do. Then tally up your letters.

- You just got a $500 bonus at work. You immediately feel like:

- A: “Time to celebrate! Let me get something special.”

- B: “Maybe I should shop for something cool that everyone’s talking about.”

- C: “Better stash it in my savings or pay extra on a bill.”

- A friend invites you to an expensive concert next month, but funds are tight. You think:

- A: “We deserve a fun night out no matter what!”

- B: “If I don’t go, I’ll feel left out of all the pictures on social media.”

- C: “I’ll politely decline – my budget can’t stretch right now.”

- It’s a rough day at work and you’re stressed. Your coping mechanism is to:

- A: Scroll shopping apps to feel better, maybe place an order for something “nice.”

- B: See what friends bought or did on Insta to cheer yourself up.

- C: Take a walk, talk to someone, or do something relaxing that isn’t shopping.

- You see a “Buy 2, Get 1 Free” sale at a store. You react by:

- A: “Sweet deal, I need one shirt anyway, so might as well.”

- B: Thinking everyone else is grabbing these deals, so you should too before they’re gone.

- C: Realizing you don’t need that many – maybe buy just one or nothing.

- You forgot to cancel an app subscription and just got billed. You:

- A: Ignore it and let it keep renewing because it’s easier.

- B: Feel annoyed and a little silly, then cancel but forget to check others.

- C: Immediately cancel and check your other subscriptions for leaks.

Mostly A’s – You’re the Emotional Spender. You shop in response to feelings – stress, happiness, or boredom. Tip: Next time you’re triggered, try a non-shopping ritual (call a friend, take a walk, journal) to soothe that feeling. Delay purchases with the 48-hour rule (Step 3). Remember, shopping only temporarily masks emotions.

Mostly B’s – You’re the FOMO/Influencer Spender. You’re driven by what you see others doing. Social posts and trends pull you toward spending. Tip: Curate your feed – unfollow accounts that make you feel “I need that.” Practice gratitude for what you already have and remind yourself of your own goals (Step 7). When tempted, ask: “Do I really want this, or do I just want what it symbolizes?”

Mostly C’s – You’re the Budgeter/Conscious Spender. You tend to think twice about purchases and prioritize savings/goals. You might even have friends who say you’re too frugal! Tip: Keep it up. Use your conscientious habits to help friends. You can gently guide an Emotional or FOMO friend toward smarter spending with your example. And if you ever slip, remember that self-awareness is your greatest asset.

Mixed Results: You might have a blend of styles. That’s okay! Identify which “letter” you lean on more often and focus on those tips. The goal is awareness: now that you know your pattern, you can start tweaking it.

Conclusion: Progress, Not Perfection

We’ve gone from awareness (identifying bad spending habits), to understanding why they hurt so much, to grasping how they sneak into our lives. Now you have the transformation plan. Remember: breaking these habits is a practice, not an instant fix. Some days you’ll nail your budget, other days you’ll make a mistake. That’s normal – it’s about progress over perfection. Each mindful choice you make is a victory. Over time, you’ll build more moments of financial peace – a calm knowing you’re in control – than moments of “spend-then-regret.”

Think of it like fitness: you’re retraining your brain’s muscle. The more you choose long-term serenity over short-term thrills, the easier it becomes. Soon, the relief of saving and growing your security will feel even better than any purchase high.

You have got this. Every dollar you save is a vote for the life you truly want.

Comments: What’s your biggest spending leak? An impulsive Amazon click? Late-night delivery orders? Share below – we’re in this together.

Share the Knowledge: Know someone who could use this no-judgment guide? Pass it along and help them plug their money leaks.

References;

Lifestyle Creep: The Sneaky Phenomenon Eating Your Savings / The Top 7 Psychological Reasons Why People Overspend / Financial FOMO | Empower / TIAA Institute report finds ties between financial stress and mental health | Institute / Researcher finds correlation between financial arguments, decreased relationship satisfaction / The Power Of Compound Growth: How Small Investments Lead To Big Returns – Nate Panza | Finance