Investing regularly is only half the battle – knowing how and when to exit those investments is the other half. Many investors contribute about $500 or $1,000 or any amount a month to stocks or mutual funds through systematic plans, yet few have a clear “SIP exit strategy” in place. A Systematic Investment Plan (SIP) Exit Strategy means proactively planning how to withdraw or reallocate your investments systematically, not just stopping contributions. It’s about maximizing gains toward your goals while minimizing taxes and fees when you pull money out. Why does this matter? Because without a strategy, investors often act on impulse – and it shows: the average equity fund investor earned only 4.9% annually over a decade vs 8.5% for the S&P 500, largely due to poor timing and emotional decisions.

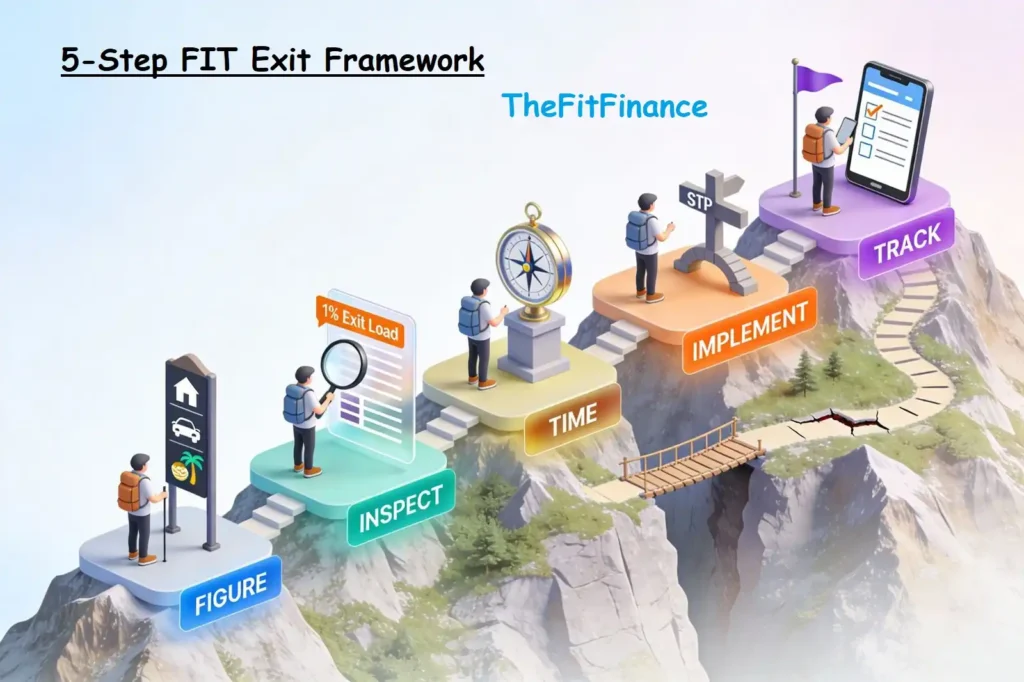

Ready to be smarter than the average investor? In this guide, we’ll introduce a proprietary 5-Step FIT Exit Framework (Figure → Inspect → Time → Implement → Track) to help you systematically exit investments like a pro. We’ll cover different exit methods (partial withdrawals <> fund switching <> SWPs <> “STP” style transfers), demystify U.S. tax implications (short vs long-term capital gains, wash sales, 1099-B forms, and account-specific rules), and address the emotional side of selling (FOMO, regret, panic). Let’s dive in and craft your personalized sip exit strategy for goal-based exits that keep your portfolio fit!

What Is a SIP Exit Strategy?

A SIP Exit Strategy is a plan for systematically withdrawing or reallocating investments that you have been making via a Systematic Investment Plan (SIP). In a traditional SIP (a.k.a. dollar-cost averaging plan), you invest a fixed amount (say $1,000/month) into your brokerage account, IRA, or 401(k) investments. But what happens when you reach a financial goal or decide to reduce your exposure? That’s where a sip exit strategy comes in. It’s not just hitting “sell” on everything in a panic – instead, it means gradually and thoughtfully exiting positions in line with your objectives.

Think of it as the reverse of systematic investing: you might redeem a portion of your fund units regularly or shift money to safer assets over time, rather than all at once. This approach helps lock in profits, minimize taxes, and avoid exit penalties (the so-called exit load or redemption fees) while keeping your long-term strategy intact. A good SIP exit plan answers questions like: “How much should I sell and when?”, “Which account or fund should I withdraw from first?”, and “How do I minimize capital gains tax on my way out?” By the end of this guide, you’ll be able to craft a clear exit game plan that aligns with your financial goals and peace of mind.

Introducing the 5-Step FIT Exit Framework

To bring structure to your sip exit strategy, we’ve created the 5-Step FIT Exit Framework – a simple roadmap to plan and execute exits systematically. FIT stands for Figure, Inspect, Time, Implement, Track. Here’s a quick overview of each step before we unpack them in detail:

Step 1: Figure– Clarify Your Goals and Exit Needs

Figure out why and how much you need to exit. Are you cashing out for a specific financial goal achievement (e.g. a home down payment or college fund), or reallocating due to a strategy change? Pin down the purpose and scope of your exit.

Once the goal is clear, figure out how much money needs to come out of your investments and by when. This gives you a target for your exit strategy (e.g. redeem $20K over the next year). It could be a partial exit or a full exit from a particular investment. Also decide if the exit will come from one specific fund or stock, or across multiple holdings.

Tip: Write down your exit objective and amount in plain terms. This will serve as your North Star as you proceed through the next steps of the framework.

Step 2: Inspect– Assess Your Investments and Tax Picture

Inspect your portfolio’s health and details. Which holdings might you sell (any underperformers, or funds with a manager change)? What are the tax implications (cost basis, short vs long-term gains)? Check for any exit load or fees. Review each account type – taxable, IRA, 401(k) – to strategize where to draw from first.

Do not forget to inspect account-specific factors:

• Taxable brokerage accounts: Sales here will trigger capital gains/losses reporting. Also, prepare for paperwork (for tax filing): your broker will issue a Form 1099-B after year-end detailing the proceeds, cost basis, and whether each sale was short or long-term.

• Traditional IRA or 401(k): Selling investments inside these tax-advantaged accounts does not itself create a taxable event – there’s no capital gains tax to worry about inside the account.

• Roth IRA: With a Roth, qualified withdrawals are tax-free, which is beautiful – but qualifications matter. However, you might consider fund switching within the Roth for e.g., moving to more conservative funds, as part of your exit strategy if you’re nearing a goal or concerned about market volatility, since that internal shift won’t trigger taxes.

Step 3: Time– Plan Your Exit Timing Strategically

When and how fast should you exit? Timing is a critical piece of the puzzle – but it’s about strategic planning, not clairvoyance. Here’s how to approach the timing element of your sip exit strategy:

- Align with your timeline and goals

- Consider market conditions (but don’t try to time perfectly)

- Mind your holding periods and tax calendar

- Avoid rushed exits due to short-term noise

- Plan around fees and loads

Step 4: Implement: Execute Your Exit Plan with the Right Method

Now choose how to exit. Options include partial redemption (sell only part of your holdings), full redemption (sell all units of an investment), fund switching (move from one fund to another), setting up a Systematic Withdrawal Plan (SWP) for gradual cash-outs, or an STP-style transfer (systematically shifting assets to a different fund or account).

Implement with confidence: Whichever method(s) you choose, the key is to execute your plan consistently. Make use of any automation your platform offers (automatic investments aren’t just for investing – many have automatic withdrawal features too). If you’re nervous about pulling the trigger on a large sale, consider breaking it into smaller orders

Step 5: Track– Monitor Your Plan and Stay On Course

Congrats – you have started executing your exit strategy! But exiting is not a one-and-done; you need to track your plan’s progress. A plan on paper can only take you so far; real life will throw curveballs, and you need to keep an eye on things to ensure you’re still headed in the right direction.

Here’s how to stay on top of your SIP exit strategy:

- Track your withdrawals/transfers

- Review the outcomes

- Stay vigilant on taxes and paperwork

- Watch out for emotional drift

- Adjust if life or goals change

- Celebrate and redeploy when fully exited

U.S. Tax Implications & Account Strategies: Minimize Tax and Exit Load

One of the biggest advantages of having a SIP exit strategy is optimizing it for tax efficiency and low costs. In this section, we’ll dive deeper into how different accounts and tax rules affect your exits – and how you can minimize taxes and any “exit load” fees that eat into your returns.

Short-Term vs Long-Term Capital Gains:

We have emphasized it before because it is crucial: the length of time you hold an investment before selling can dramatically change your tax outcome.

Short-term gains (held ≤1 year) are taxed at ordinary income rates – which, for high earners, can be much higher than long-term rates.

Long-term gains (held >1 year) enjoy special lower rates (0%, 15%, 20%). For example, if you are a married couple with $100k taxable income, a short-term $10k gain might be taxed at 22% (your income bracket), whereas a long-term $10k gain would likely be 15%. The difference on $10k is $700 – not chump change! High-income investors might dodge an even bigger hit (37% short-term vs 20% long-term).

The lesson: whenever feasible, hold that investment a bit longer to cross the 1-year mark. Also consider the sequence of selling: if you have multiple lots, you could sell the ones that qualify as long-term first, and delay selling any short-term lots until they age into long-term. This way, you maximize after-tax gains.

Capital Losses and Offsets:

If some of your investments are down, an exit strategy can actually turn lemons into lemonade through tax-loss harvesting. By selling losers, you realize capital losses, which can offset your gains (and up to $3,000 of ordinary income per year).

For instance, suppose you need to sell some winners for your goal – you expect $5,000 in capital gains. If you also have an underperforming fund with a $2,000 loss, selling it in the same tax year could offset part of those gains, so you’re only taxed on $3,000 of net gain.

Net Investment Income Tax (NIIT):

For very high earners (above $250k for married or $200k single), remember there’s an extra 3.8% tax on investment income (including capital gains) called NIIT. If you are in this bracket, factor that in – your effective long-term capital gains rate could be 18.8% or 23.8%. This might not change your strategy, but it’s good to be aware so you are not surprised by a slightly higher tax bill.

Form 1099-B and Record-Keeping:

Every taxable sale will be reported on Form 1099-B by your broker. These forms list each trade’s date, proceeds, cost basis, and whether it’s short or long-term. While brokers typically send these in January/February, don’t wait until then to know what you owe. As you execute your SIP exit, keep an informal tally of realized gains and losses.

If you are withdrawing over multiple years, you might try to spread gains across years to keep income in lower brackets (for example, selling some in December and some in January of the next year). Use tax software or a CPA to run projections if it’s a large sum. Also double-check your 1099-B against your expectations – mistakes can happen, and it’s easier to address them if you have your own records.

Understanding “Exit Load” (Redemption Fees):

In the U.S., we do not commonly use the term “exit load” like in some other countries, but the concept exists as redemption fees or back-end loads. These are fees charged by some mutual funds when you sell. As mentioned, short-term redemption fees (to discourage quick trading) might be up to 1-2% if you sell too soon. Back-end loads (deferred sales charges on certain fund share classes) can be 5%+ if you sell within the first year or two, often decreasing to 0% after 5-7 years.

Taxable vs Tax-Advantaged Accounts- Which to Tap First?

Choosing which account to withdraw from is a strategic decision:

• General rule: Use taxable account funds for short-term goals, and leave retirement accounts untouched for retirement needs. This avoids penalties and keeps tax-deferred growth intact.

• However, there are nuances. For instance, if you’re in a low-income year, a partial IRA withdrawal might not hurt much tax-wise (though penalties still apply if under age). Or if you’re above 59½, you might consider using a Roth IRA withdrawal (tax-free) for something, but that forgoes future tax-free compounding, so it’s a trade-off.

• If your goal is retirement itself, then of course you will be withdrawing from those accounts eventually. In that case, plan which account to use when: e.g., maybe tap taxable funds early in retirement to let the IRA grow until RMDs (Required Minimum Distributions) kick in at age 73, or do Roth conversions strategically.

• For investors still accumulating, the takeaway is: prefer withdrawals from taxable accounts for flexibility. If you must touch an IRA/401k for a non-retirement goal, understand the tax hit and penalty exceptions (certain situations like first-time homebuyer for IRA up to $10k, or hardship withdrawals, etc., can lessen penalties).

Let’s summarize the differences in a quick reference table:

| Account Type | Tax on Investment Sales | Withdrawal Taxes/Penalties | Ideal Use for SIP Exits |

|---|---|---|---|

| Taxable Brokerage | Yes – realized gains taxable (short-term @ ordinary rates; long-term @ 0/15/20%). Losses deductible/offsettable. | No extra penalties. 1099-B issued for all sales. You control timing across tax years. | First choice for non-retirement goals (no age restrictions). Plan sales to use long-term rates and harvest losses. |

| Traditional 401(k) / IRA | No tax on internal sales/trades (tax-deferred). (Can rebalance freely inside account.) | Withdrawals taxed as ordinary income. 10% penalty if under 59½ (exceptions apply). RMDs start at age 73. | Avoid withdrawing before retirement if possible (due to tax & penalty). Use for reallocation (switching funds) inside account since it’s tax-free to do so internally. |

| Roth IRA | No tax on internal sales (tax-free growth). | Withdrawals: Contributions can be taken out tax & penalty free anytime; Earnings are tax-free only if account ≥5 years and age ≥59½ (otherwise tax+10% on earnings). | Use only if absolutely needed (contributions only, ideally). Better to let it grow tax-free for retirement. If used for an exit, try to limit to what you contributed. Good for last resort goal funding. |

Table: Tax and withdrawal differences across account types for your exit strategy. As shown, taxable accounts give the most flexibility for goal-based exits (just manage the capital gains tax), whereas retirement accounts have strings attached. When planning your strategy, it often makes sense to use taxable funds for early goals and reserve IRAs/401(k)s for retirement – unless you have a specific plan to replace those funds or have hit qualifying conditions.

State Taxes: Do not forget, if you live in a state with income tax, capital gains usually count there too. A long-term gain might not get any special rate at the state level (some states tax all income the same). This could add, say, 5-10% tax depending on your state. While you can’t change state tax except by moving or using tax-exempt state-specific bonds (beyond our scope), just factor it in so you’re not surprised. If you realized a large gain, maybe set aside a bit for the state tax man as well.

By being savvy about tax implications and fees, your SIP exit strategy will truly “maximize gains, minimize tax & exit load.” A smart investor doesn’t just focus on investment returns – they focus on net returns after tax and costs. This section armed you with the knowledge to do exactly that. Keep it in your toolkit whenever you plan an exit.

Navigating Emotional Pitfalls: FOMO, Regret, and Staying Disciplined

Even the most well-crafted exit strategy can be sabotaged if our emotions run wild. Selling investments often triggers more emotional reactions than buying does. After all, when you sell, you’re cutting ties with an asset – maybe one that treated you well (fear of missing out on further gains), or one that treated you poorly (regret for not selling sooner). Let’s address some common emotional hurdles and how to handle them like a fit investor:

- Fear of Missing Out (FOMO): This is that little voice that whispers “What if it keeps going up after I sell?” Suppose you set a plan to systematically exit a stock fund that has doubled in value. You sell the first 20% chunk and – boom – the fund’s price jumps 5% the next week. It’s hard not to second-guess yourself. But remember, you set this plan for a reason – likely to secure your goal or reduce risk. No one ever catches the absolute top consistently.

One trick: if FOMO is strong, you can leave a small celebratory position in as “fun money” – say you planned to sell all, but you keep 5% just in case of further upside. That sometimes appeases the psyche, while 95% of your money still follows the plan. - Regret and Self-Blame: On the flip side of FOMO is regret – especially common if an investment plunges and you think “I should have sold earlier” or you sell and it soars (the classic “seller’s remorse”). Regret is natural, but don’t let it paralyze you. Every investor will have moments of hindsight bias. The key is to learn without overreacting. and remind yourself that you made the best decision you could with the info at hand and that no one sells at the peak each time.

- Overreacting to News and Noise: News headlines can be the enemy of a systematic strategy. In a 24/7 news cycle, you are bound to see scary stories – market crashes, recessions looming, political turmoil – or euphoric ones – record highs, miracle stocks, etc. Overreacting means deviating from your plan based on short-term noise. Emotional discipline is like a muscle – flex it regularly by not giving in to every market shout, and it will strengthen.

- The “Investor’s Cycle of Emotions”: It’s worth noting that investor psychology tends to follow a cycle during market moves – from optimism to euphoria (at the top), then anxiety, fear, and panic (near bottoms), and back to optimism. Where you are in this cycle can heavily influence your exit feelings. In fact, legendary advice is to be fearful when others are greedy and greedy when others are fearful – but for our purposes, it means use the mood as a contrarian indicator for your strategy adjustments, not as a direct trigger.

- Sticking to the Plan (Accountability): One way to combat emotions is to add accountability. If you have a trusted friend, family member, or financial mentor, tell them about your exit plan. Having someone check in (“Did you follow through with selling this month?”) can keep you honest and less likely to procrastinate or chicken out. Alternatively, automate as much as you can (as discussed with SWPs).

- Focus on Your Why: Lastly, the best antidote to emotional swaying is to focus on why you are executing this strategy. Is it to achieve financial independence? To pay for your kid’s college without debt? To secure a down payment? These goals have emotional weight of their own – positive emotion. Every time you feel regret or FOMO creeping in, picture the goal that motivated you. This shifts your mindset from “I’m losing my investment” to “I’m gaining my dream/goal.”

In a nutshell: Emotions are inevitable – we’re human, not robots. The objective isn’t to eliminate feelings but to manage them so they don’t derail your strategy. Use techniques like setting rules, automating, seeking support, and reminding yourself of the bigger picture.

SIP Exit Strategy Health Check Quiz 🤔

Wondering if you’re truly prepared to execute your SIP exit strategy? Take this quick 5-question quiz to gauge the health of your plan and mindset. Answer honestly with “Yes” or “No”:

1. Goal Clarity: Do you have a specific financial goal, amount, and timeline for which you’re planning to exit your investments? (e.g. “$50,000 for house down payment in 2 years”)

2. Tax & Account Planning: Have you analyzed the tax implications of selling – including knowing which holdings are short vs long-term, and which account (taxable, IRA, etc.) is best to withdraw from first – to minimize taxes and penalties?

3. Structured Game Plan: Do you have a clear plan on how much you will sell or withdraw and when (frequency or schedule), rather than making ad-hoc sell decisions on the fly?

4. Emotional Readiness: Can you confidently say that you won’t let fear or greed divert you from this plan – for example, you won’t dump everything in a panic or hold off on selling due to market hype, barring truly major changes?

5. Monitoring & Flexibility: Do you have a system to track your progress (like a checklist or reminders) and a willingness to adjust the plan only if your goals or life situation change (not just because the market had a bad day)?

Quiz Analysis: Give yourself 1 point for each “Yes”. How did you score?

• 4–5 Points: SIP Exit Strategist – Your exit plan is in great shape! ✅

• 2–3 Points: Work-in-Progress – You’re on the right track but a bit more refinement is needed. 😉

• 0–1 Points: Needs Attention – Your exit strategy (or mindset) might not be ready for prime time yet. ⚠️

This “health check” isn’t about passing or failing – it’s about identifying areas to strengthen. The more “Yes” answers, the more confidence you can have moving forward. If you found a few “No”s, you now know what to work on. Ultimately, being self-aware and prepared is what separates smart investors from the rest.

Conclusion & Next Steps

Crafting a SIP exit strategy might not be as thrilling as hunting for the next hot stock, but it’s arguably more important for long-term success. By following the 5-Step FIT Exit Framework – Figure, Inspect, Time, Implement, Track – you’ve learned how to systematically and smartly wind down investments to meet your goals while maximizing gains and minimizing taxes or exit fees. Instead of reacting to the market’s every twitch, you now have a plan that keeps you in control of your financial journey. Every dollar you wisely exit and put toward your life goals is a win for The Fit Finance mindset!

We hope this guide has empowered you to become a more proactive and disciplined investor. Now, we would love to hear from you: What are your experiences or tips with planning exits? Do you have questions or scenarios you are unsure about? Join the conversation by leaving a comment below! Your insights and questions may help other readers, and we’re here to help each other grow.

If you found value in this guide, please share it with your fellow investors and friends. Spreading financial fitness is what TheFitFinance community is all about. And don’t forget to subscribe to our blog/newsletter for more in-depth guides and smart investing tips – we’re constantly cooking up content to help you invest better and live richer.

Curious about starting a SIP from scratch? Be sure to check out our companion guide on How to Start a Systematic Investment Plan the Right Way, also calculate your future SIP value with SIP Calculator – it’s the perfect primer to complement this exit strategy playbook. After all, every great journey has a beginning and an end. Master both, and you’ll be far ahead of the pack in the pursuit of financial freedom.

Here’s to maximizing your wealth, minimizing your worries, and knowing when to say goodbye to an investment – on your terms. Happy investing (and exiting)!