Warren Buffett famously quips that “success in investing does not correlate with IQ – you need the right temperament”. In fact, research shows today’s richest are not outliers on intelligence tests. A Swedish study found the top 1% of earners had cognitive scores no higher than those just below them. And average IQ Americans make up 80% of the population by definition.

In other words, you don’t need a 160 IQ to join the millionaires’ club – or even think like one. If you have ever worried “do I need to be smart to get rich?”, this guide is for you. We will lay out four non-IQ-dependent pillars that let ordinary people build wealth. By focusing on habits, systems, and emotional intelligence, you can grow money with average IQ just as well as a so-called genius. This guide will show you the 4 non-IQ dependent pillars to build lasting wealth.

Grow Money with Average IQ: The System Over Brilliance Pillar

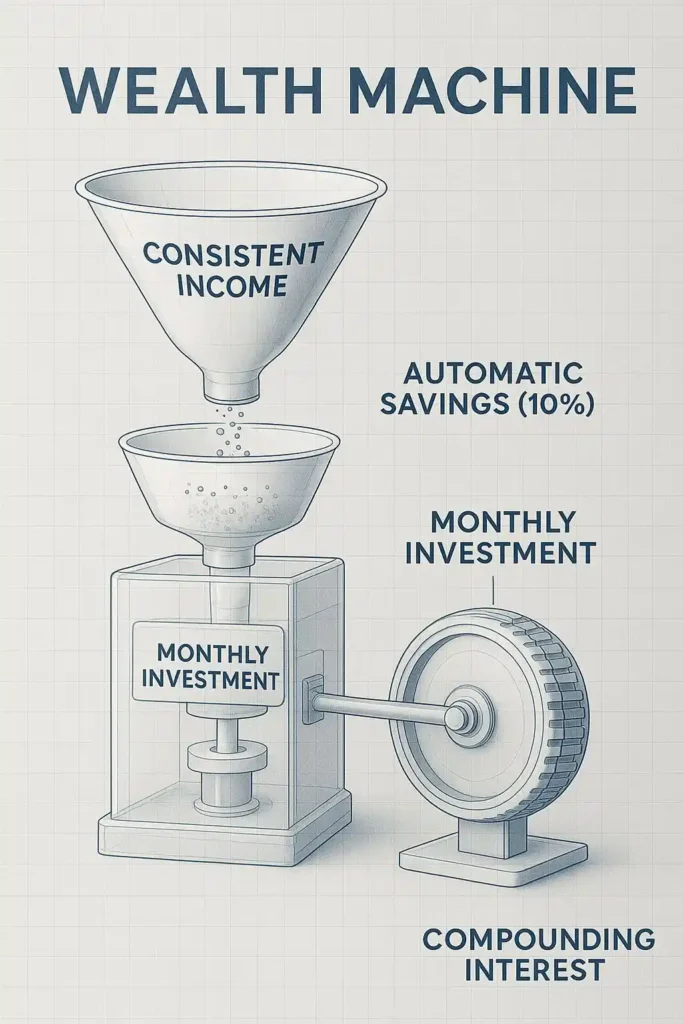

Automate your finances. Like following a simple recipe instead of winging dinner, a system beats raw genius every time. Start by systematizing your money: automate savings and bills so you do not have to think every month. You do not need to be a finance wizard – just a planner. For example, set up your bank or retirement account to automatically transfer a fixed amount to savings or index funds each payday. Automating has big payoffs: it reduces stress (you won’t forget contributions), builds a saving habit, and “ensures you’re prioritizing your financial success”. In practice, follow a simple 3-step “set-and-forget” routine:

• Schedule Savings: Direct-deposit a set portion of each paycheck into a savings or investment account (even $50 or $100 helps).

• Auto-Pay Bills: Use autopay for recurring bills (utilities, loan payments) to avoid late fees and free up mental space.

• Annual Review: Once a year, log in and bump up the transfer amount or re-balance your budget – but the system does the heavy lifting for you.

Key Takeaway: Using your intelligence to make money means working smarter, not harder. Even how to use your intelligence to make money can be automated – let tech and simple rules do the math, not your ego. By following this systemized approach, you can reliably grow money with average IQ.

Grow Money with Average IQ: The Compounding Consistency Pillar

Time and consistency are your secret weapons – not brainpower. Think of two investors: one buys an index fund and lets it grow for decades, another frantically picks stocks every week. Over time, the disciplined index-funder wins, no genius required. The lesson? Time in the market beats timing the market. As one Buffett-esque insight goes, “Successful investing takes time, discipline, and patience…You can’t produce a baby in one month by getting nine women pregnant”.

Compound interest is your friend. Even tiny, regular deposits snowball into serious sums. For example, saving $100 a month at ~4% annual growth from age 25 to 65 yields over $150,000 – your principal was just $54,100. That’s the power of compounding showing through.

• Start Small, Stay Steady: Open a low-cost S&P 500 or total market ETF (or automated investment app). Commit to a small monthly buy (even $50–$100).

• Reinvest Returns: Opt for dividend reinvestment plans so every $ from profits buys more shares.

• Increase Over Time: Each year, raise your monthly amount by a little (e.g. when you get a raise). Small habits over decades beat one-time windfalls.

Mythbusting: Can a person with average IQ become a millionaire? Absolutely. The math of compounding does not care about IQ scores. Consistent savers even with modest contributions often outgrow “brainiacs” who try to time the market. You can match millionaires simply by sticking to the plan.

Bold Takeaway: Learn how to use your intelligence to make money by being patient, not by racing the clock. Consistency and compounding multiply your efforts – even someone of average smarts can become wealthy by investing steadily.

Grow Money with Average IQ: The Emotional IQ Dividend Pillar

Your attitude is an asset. In market booms and busts, average IQ investors who master their emotions outperform hotshots who panic. Picture two friends during a crash: Ted freaks out and sells his stocks at the bottom; Pat stays calm and buys more. Guess who’s up thousands when the market rebounds? Being cool-headed is a sign of real financial intelligence.

Behavioral finance tells us that emotions drive financial decisions. Vanguard research notes that when markets plunge, feelings of anxiety and fear often lead investors to act irrationally – even when opportunity knocks. The same studies show the market’s lowest points hold the most opportunity. In practice:

• Plan for Downturns: Before a crash, set rules (like “I will hold or buy more, never sell out of fear”). This way your future self follows logic, not panic.

• Stay Goal-Focused: Keep a long-term plan. Write down your goals (e.g. “retire at 45”) and revisit them when markets wobble. It’s hard to stay emotional when you are visioning your future goals.

• Mind Over Market: Educate yourself slightly. Learn basic financial concepts so you know recessions are normal. When news feeds try to scare you, remind yourself that history rewards patient investors. As one expert notes, purely logical decisions without emotion can also be bad – emotions actually help motivate good habits like saving.

Key Insight: In this pillar we again ask how to use your intelligence to make money. Here “intelligence” means emotional intelligence. Using it means resisting fear, sticking to your plan, and even enjoying the discipline of saving. Not only is this easier than frantic stock picking, it’s proven. As Vanguard sums up, emotions often push us to save (love for family, security, hope are powerful drivers). Harness those feelings!

Grow Money with Average IQ: The Leverage & Outsourcing Pillar

You do not have to solve every problem yourself. Think of a plumbing emergency: average homeowners wouldn’t re-engineer the pipes – they call a plumber. Likewise, you can leverage tools and expert help in finance. No genius required – just smart delegation.

• Use Low-Cost Index Funds: Instead of hand-picking stocks, invest in broad ETFs or mutual funds with tiny fees. For example, a fund charging 0.20% still yields far more over decades than a 1.00% fund (one Vanguard analysis shows $100K grows to ~$372,756 at 0.2% vs $320,714 at 1% in 20 years). Save your brainpower for life, not calculations.

• Automated Advice: Try a robo-advisor or simple automated portfolio. Many platforms rebalance and reinvest dividends for you. (Think of it as setting an autopilot for your nest egg.)

• Professional Helpers: If you are overwhelmed, use a financial advisor or trusted mentor – even budgeting apps count. Focus on decisions you enjoy and outsource the rest. Even the brightest people don’t hoard all tasks.

A clever design reminds us: simply having a big brain doesn’t print money. The best use of intelligence (IQ 130-160 or not) is in using the right tools and habits.

Bonus tip: “Best way to monetize IQ 130-160”? Often it is not brute smarts, but common sense. As Buffett notes, a 160-IQ investor doesn’t automatically beat one with 130. The smartest move for high-IQ folks can be surprisingly simple. They do best by the same basics: diversify, hold for the long run, and avoid high fees.

Finally, make the system work for you. Max out free money (e.g. a 401(k) match), use high-yield savings for emergency cash, or take advantage of credit card rewards and tax credits. Every lever you pull multiplies your effort. In fact, many billionaires rely on scalable ideas and networks more than raw IQ, proving that with the right leverage, ordinary people can achieve extraordinary wealth.

Bonus Pro-Tips: The Uncommon Leverage

These are not “more of the same.” These are counter-intuitive, high-leverage moves that let an ordinary person punch far above their IQ on the road to wealth. Think of them as the secret menu: simple to implement, hard to forget.

Bonus Tip 1: Exploit Your “Average” Advantage in Behavioral Economics

Thesis: Being average can be your competitive edge. Less overconfidence and less analysis-paralysis often equals fewer mistakes.

Why it works (short): People with very high intellectual curiosity can over-trade ideas — chasing the newest strategy, the latest edge, the flashiest trade. The average person who follows a simple system (automate, diversify, stick) avoids those behavior-driven losses. This is the investing version of the tortoise vs. the hare — the tortoise keeps buying and compounding while the hare reinvents the wheel.

Story / Analogy: Imagine two gardeners. The first reads everything about exotic fertilizers and keeps switching methods. The second waters on schedule, rotates crops, and harvests reliably every season. The latter accumulates more produce — not because they’re smarter, but because they stick to actions that compound.

Actionable Framework — The Cognitive Bias Audit (3 questions)

Before you make any financial move, run this three-question audit. If you answer yes to any, pause for 48 hours.

1. Am I chasing novelty? (Is this new/flashy or just fancy packaging of a known risk?)

2. Am I trying to prove how smart I am? (Does the move make me feel clever more than it makes me more secure?)

3. Does this feel complex and exciting? (Excitement = emotion. Emotion + money = mistakes.)

How to use your intelligence to make money — here’s the reframe: Use intellectual capacity to design rules that protect you from your own impulses. That is how to use your intelligence to make money: create constraints, not just clever strategies.

Bonus Tip 2: The “Inversion” Principle for Financial Security

Thesis: Fight poverty by asking the opposite question: “What would guarantee I remain broke?” Inversion (Charlie Munger’s favorite mental model) exposes the easy, high-impact things to avoid.

Simple mental model: Instead of “How do I get rich?” ask “What behaviors would ensure I never get rich?” The answers are usually boring but fixable.

The 5 Guaranteed Paths to Financial Ruin — and How to Invert Them

1. Guarantee #1: Have no emergency fund.

Inversion: Automate a $500 starter buffer. Next target: a 3-month living expense reserve. Keep it liquid.

2. Guarantee #2: Spend every new dollar.

Inversion: Use the “first-dollar” rule — direct 10% of each paycheck to investments before you plan spending.

3. Guarantee #3: Rent the best credit; ignore interest.

Inversion: Audit all debt annually. Refinance or consolidate if you can cut interest by 2%+.

4. Guarantee #4: Constantly chase “hot” investments.

Inversion: Adopt a simple allocation (e.g., 60/40, or 80/20 stocks/ bonds for long horizon) and automated monthly buys.

5. Guarantee #5: Never learn one basic financial skill.

Inversion: Master one compensating skill: taxes, budgeting, or basic investing—and apply it relentlessly.

Concrete takeaway: The inversion approach reduces the domain of catastrophic error. It’s not glamorous, but it’s how ordinary people lock in financial survival — the bedrock from which wealth grows.

How to use your intelligence to make money — inversion edition: Use brainpower to spot and remove systemic holes in your financial life. That is smarter than trying to invent ten new ways to “beat the market.”

Bonus Tip 3: Build a “Money Council,” Not Just a Budget

Thesis: High IQ is useful — but only when channeled. Build a tiny, permanent advisory ecosystem: curated books, a few podcasts, and one vetted flat-fee planner. The goal: multiply your judgment, not replace it.

Why it beats solo brilliance: You don’t need every answer. You need curated, trustworthy answers that keep you moving. Imagine a personal board of directors you can consult that keeps your decisions simple and sane.

Your First 3 Council Members (practical, non-obvious picks)

1. Book: The Psychology of Money — mental models you’ll return to yearly (mental anchor).

2. Podcast/Feed: ChooseFI or a practical, slow-money show that emphasizes systems over speculation (habits > hacks).

3. Advisor: One flat-fee, fiduciary planner for a one-time “system check” (asset allocation, tax strategy, estate basics). Pay once, fix structural leaks.

Monthly Council Routine (15 minutes / month)

• Check automatic transfers (2 min)

• Rebalance or confirm auto-invest settings (5 min)

• One micro-learning (podcast chapter or 10 pages) (8 min)

How to use your intelligence to make money — curatorial form: Your job is to choose whose intelligence to borrow. Curating quality inputs is one of the highest-ROI ways to use your brain: it prevents analysis paralysis and filters noise.

Bonus Tip 4: Tactical Levers (A short toolkit)

• Tax arbitrage: Use a Roth vs. Traditional map — funnel raises into tax-advantaged buckets first.

• Leverage low-cost platforms: Use brokerage fractional shares, dollar-cost averaging tools, and auto-rebalancing.

• Move fast on “free money”: Employer 401(k) match is a guaranteed return — capture it ruthlessly.

FAQs & Costly Myths Debunked — Clarity Over Cleverness

Myth (The Lie) → Reality (The Truth)

Q: Can a person with average IQ become a millionaire?

Myth: “Millionaires are all geniuses who saw opportunities no one else could.”

Reality: The path to a million for most people is arithmetic and habit, not genius.

Show the math (simple, exact): If you save $500 per month and earn an average return of 7% annually, after 40 years you’ll have approximately $1,312,407. That’s the compounding of steady contributions — not a single spectacular hit.

So, can a person with average IQ become a millionaire? The numbers scream YES. Discipline + time = wealth more reliably than cleverness does.

Q: Is it possible to become a self-made millionaire but have a below average IQ?

Myth: “Below average IQ is a life sentence to financial struggle.”

Reality: IQ tests measure certain problem-solving and pattern-recognition skills. Wealth accrues mostly from discipline, systems, and opportunity — things that don’t require a perfect IQ score.

Case profile — “Joe the Plumber” (fictional, but realistic):

Joe ran a trade business. He: charged fair prices, saved a portion of each job, bought a rental property when the numbers made sense, and reinvested cash flow. Over 20 years, Joe had multiple income streams and zero financial drama. No PhD. No trading. Just a system.

Conclusion: Yes — it’s possible. The decisive variables are time, saving rate, leverage (e.g., property or business), and luck. IQ is not a gating factor.

Q: What’s the best way to monetize an IQ of 130–160?

Myth: “If you’re very smart, there’s a direct deposit slip waiting for you.”

Reality: High IQ often tempts people into overcomplication — trading proven methods for intellectually stimulating but low-probability experiments. The best way to monetize IQ 130-160 is strategic focus.

Practical routes that scale high IQ well:

• Master one deep domain (e.g., software engineering, machine learning, biotech) and productize that skill.

• Build systems or teams — high-IQ people make excellent architects of businesses and processes. Your brain is best used to design repeatable, automated value — not to day trade.

Warning: The “high-IQ trap” is boredom with simple compounding. Use intelligence to build leverage (teams, IP, scalable products) rather than to chase edge cases.

Q: Can a person with average IQ become a billionaire?

Myth: “Billionaires are super-geniuses by definition.”

Reality: Becoming a billionaire usually requires extraordinary scale, network effects, and often luck. The foundational playbook — scale a valuable idea, retain equity, and reinvest — is the same whether you’re aiming for millions or billions.

A practical perspective: Focus on mastering the millionaire playbook first. Think of extreme wealth like an Olympic marathon: before you attempt a marathon, you train a decade of consistent 5Ks. A person with average IQ can become a billionaire, but the odds are low and the path demands exceptional scale, timing, and often the right ecosystem.

The question, “person with average IQ can become a billionaire?” is tricky — possible but uncommon. Focus on repeatable, compounding wins first.

Q: How do the ways for smart people to make money differ from this path?

Myth: “Smarter people have access to secret, better strategies.”

Reality: Ways for smart people to make money often involve high-skill, high-concentration paths: quant trading, venture-backed startups, complex arbitrage. Those can produce massive returns, but they’re riskier and require continuous cognitive bandwidth.

Contrast: The average-IQ path is low-friction and scalable: automation, index investing, income growth, and steady reinvestment. One path is a job of the brain; the other is automated machinery you build once and maintain.

Q: You keep saying “use your intelligence.” What does that actually mean?

Myth: “Intelligence = complex calculations and prediction.”

Reality: Using your intelligence to make money is simpler and more practical: it is about designing systems so you do not need to be brilliant every day.

Short, bold distillation: Use your intelligence to design a life where smart decisions become the default, not the emergency play.

Concrete checklist — how to use your intelligence to make money (3 ways):

1. Automate the routine: set up transfers, autopilot investing, and bill pay.

2. Recognize emotional triggers: know what makes you sell low or buy high and build rules to prevent it.

3. Pick a simple allocation and stick to it: rebalance annually, not hourly.

Your Average IQ Wealth Audit: 5 Questions to Ask Yourself Today

• Do I automate my finances? (Set up recurring savings/investments and autopay bills.)

• Am I consistently investing? (Do I contribute something every month, even when markets wobble?)

• Do I have a clear budget and emergency fund? (Can I handle surprise expenses without panic?)

• Can I stay calm when markets fall? (Have I decided in advance to hold or buy more in downturns?)

• Am I using tools/advisors wisely? (Do I invest in low-cost funds and ask for help instead of going it alone?)

Use this mini-checklist often. The goal is to build habits, not test your IQ. Pick a question and improve one thing at a time.

Conclusion & Next Steps

You’ve now seen that grow money with average IQ isn’t just a slogan – it’s a strategy. By following these pillars (system, compounding, emotional control, and leverage), you can create an actionable roadmap to wealth. Start small, stay consistent, and be patient. Remember: building wealth is a marathon, not a sprint. Just like we discussed mastering your monthly cash flow in our guide to cash flow management, the key here is consistent application and a steady pace.

Believe it: average folks do become millionaires. Even people with below-average IQ have amassed seven-figure fortunes through grit and timing. If they can do it, an average IQ person like you definitely can. So… which pillar will you start with? Share this post with a friend who thinks you need to be a genius to get rich. Drop a comment below on your first step, and subscribe to TheFitFinance for more non-genius, step-by-step wealth advice.