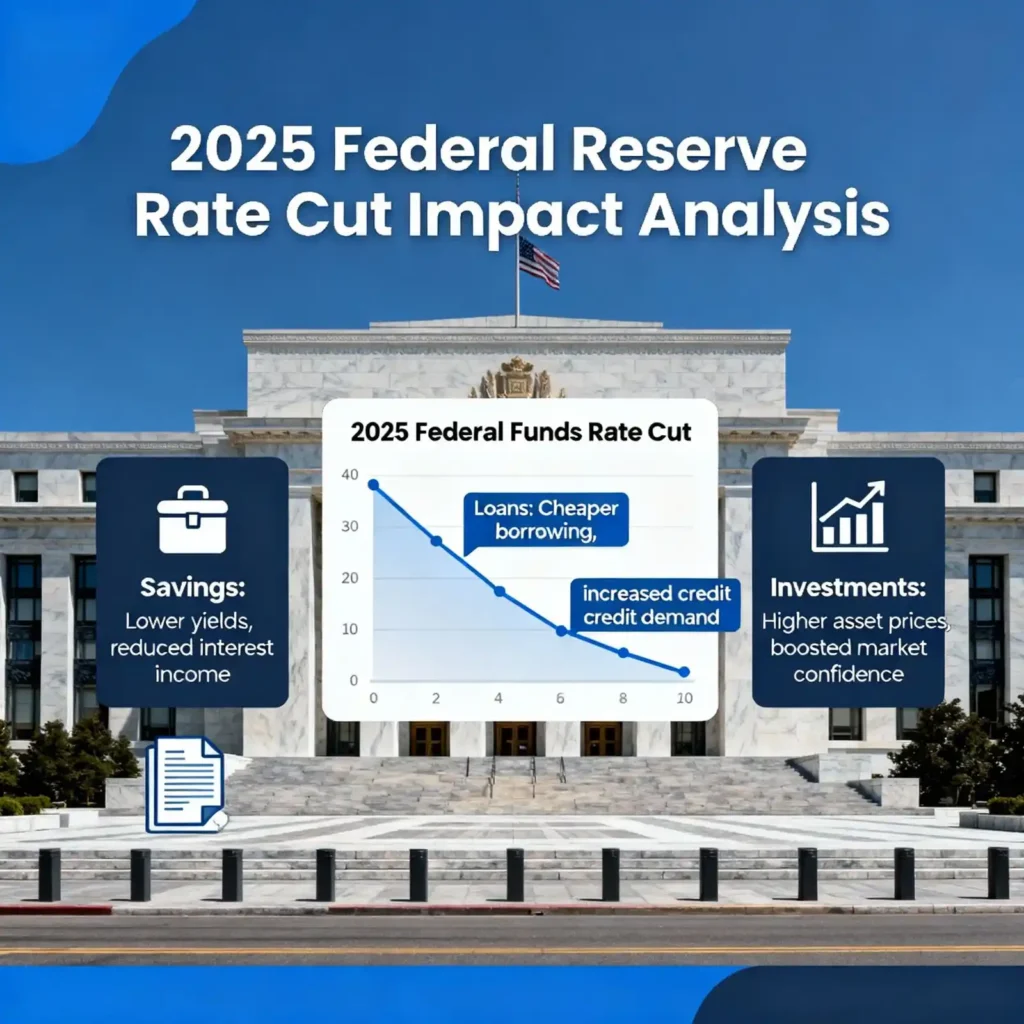

The Federal Reserve’s decision in September 2025 to cut interest rates by 0.25 percentage points has far-reaching implications for households, investors, and borrowers alike. The move, bringing the federal funds rate down to between 4% and 4.25%, was the first in nine months and is expected to be followed by additional cuts before the year’s end. Understanding how this change affects personal finances enables individuals to adapt smartly and optimise their financial strategies in this evolving economic landscape.

Here we understand, How the Fed Rate Cut effects on Savings, Loans and Investment in this 2025 edition.

The Context: Why the Fed Cut Rates

The Federal Reserve, through the Federal Open Market Committee (FOMC), influences short-term interest rates primarily to balance economic growth with inflation control. By early 2025, signs of a cooling labor market and moderated inflation prompted policymakers to adopt a “risk management” approach. According to J.P. Morgan Research, this latest rate reduction is viewed not as the start of a deep easing cycle, but rather a precautionary measure designed to sustain employer confidence and household spending without reigniting inflation pressures.

Fed Chair Jerome Powell highlighted during the September meeting that while inflation remains slightly above target, the risks of slower job creation and tighter credit warranted a modest policy adjustment. The central message: stability. The Fed seeks to cushion the economy without fueling speculative growth or asset bubbles.

How the Mechanism Works

When the Fed reduces its benchmark rate—the federal funds rate—it affects the rates at which banks lend to each other overnight. This, in turn, influences the prime rate, the baseline many banks use to set rates on credit cards, auto loans, home equity lines, and some adjustable-rate mortgages. Broadly speaking, a lower funds rate encourages borrowing and investment and discourages excessive savings in cash as yields decline.

The cuts also alter investor psychology. Lower rates typically boost asset values since bonds become less attractive compared to equities, encouraging investment risk-taking. However, as Fidelity’s research points out, the relationship between rate cuts and stock market performance is complex—sometimes supportive, sometimes neutral—depending largely on investor expectations and broader economic signals.

Impact on Borrowing Costs

- Mortgages

The connection between the Fed’s actions and mortgage rates is indirect but meaningful. Although the central bank influences short-term interest rates, long-term mortgage rates depend on broader bond market trends and inflation expectations. In the first weeks following the September cut, most 30-year mortgage rates held steady or even ticked higher, influenced by rising 10-year Treasury yields as investors anticipated future inflationary pressures.

That said, borrowers with adjustable-rate mortgages (ARMs) or those refinancing may soon see slight reductions in monthly payments. ARM holders, whose interest rates reset periodically based on market benchmarks, can expect lower rates in coming months as lenders recalibrate to the Fed’s easing trajectory.

- Credit Cards

Most credit card interest rates are variable, tied directly to the prime rate. The average Annual Percentage Rate (APR) still hovers near 20% despite lower borrowing costs, but consumers may notice modest reductions—potentially by half a percentage point—by early 2026. For those carrying high balances, even these small adjustments can translate into meaningful interest savings over time. - Auto Loans and Personal Loans

Car buyers and personal loan seekers are likely to benefit almost immediately. Lower benchmark rates mean banks can source funds more cheaply and compete to attract borrowers. Expect auto loan interest rates to ease slightly, though not dramatically, particularly for prime borrowers. For personal loans, lower rates will mostly benefit high-credit-score individuals since banks remain cautious about credit risk in a moderating economy.

Impact on Savings and Investments

- Savings Accounts and CDs

Rate cuts often bring disappointment for savers. Returns on cash holdings, particularly in savings accounts and money market funds, tend to drop soon after the Fed’s policy shifts. By late September 2025, average high-yield online savings accounts—which offered between 5% and 5.35% earlier this year—had already begun trending lower. Savers should expect continued declines into 2026 unless inflation unexpectedly re-accelerates.

Certificates of Deposit (CDs) are also likely to offer lower rates going forward. Locking into a long-term CD now could preserve yield in anticipation of further declines later this year.

- Bonds and Fixed Income

Bondholders generally benefit from falling rates because bond prices rise as yields decline. Short-term Treasury yields adjust quickly to Fed policy moves, while longer-term yields depend on inflation and growth expectations. Investors holding longer-duration Treasurys or investment-grade bonds may see capital gains as the rate environment continues to improve.

However, those with floating-rate or variable-income investments—such as certain corporate loans or real estate debt instruments—could experience reduced income streams as coupon payments reset lower.

- Stock Market and Real Estate

Equities often respond positively to lower rates because cheaper borrowing spurs corporate investment and consumer demand. Sectors like real estate, technology, and construction typically see a bump. Smaller homebuilders, for instance, may benefit from renewed buyer interest as mortgage costs moderate, even if only gradually. Meanwhile, real estate investment trusts (REITs) may draw investor appetite as yields on competing fixed-income assets compress.[8]

Yet history cautions us: rate cuts during slowing economies sometimes precede market volatility. Market performance depends on whether investors view the Fed’s decisions as proactive support or a reaction to underlying weakness.

Strategic Implications for Your Finances

Short Term (6–12 months):

- Refinance high-cost variable debts early, especially before additional cuts thin lender margins.

- Consider consolidating credit card balances with personal loans as rates ease.

- Review adjustable-rate loans to anticipate resets and possibly remortgage to fixed rates.

Medium Term (1–3 years):

- Shift part of your emergency fund into tiered-term CDs before yields decline further.

- For investors, modestly lengthen bond portfolio durations to capture potential price appreciation as yields drop.

- Build exposure to dividend-paying stocks, which may outperform as income alternatives narrow.

Long Term (3+ years):

- Explore asset diversification—mixing equities, bonds, and alternative investments—to hedge against future inflation revival.

- Plan for potential rate hikes around 2027–2028 as the Fed eventually transitions back toward normalization once economic stability is ensured.

The Broader Economic Outlook

Economists forecast two additional rate cuts in 2025, potentially followed by one in early 2026, bringing total reductions near one full percentage point. While this policy easing should stimulate growth, it also raises questions about inflation persistence, currency effects, and income distribution.

For households, the primary net effect of prolonged lower rates is reduced interest income from savings but improved affordability for loans. This dynamic tends to benefit younger homeowners and entrepreneurs more than retirees relying on fixed-income portfolios.

Consumer resilience remains strong—unemployment, though softening, remains under 5%. However, caution persists in sectors exposed to global trade and manufacturing, where investment responses may be muted until credit conditions stabilize.

Managing Finances During a Rate Cut Cycle

- Rebalancing the Portfolio

When the Fed cuts rates, overall portfolio yield expectations shift. Investors might move funds from low-yield savings into growth assets. However, the key lies in balance: maintaining sufficient liquidity for emergencies while deploying surplus funds into diversified markets. - Maximizing Opportunities in Volatility

Volatile rate environments create arbitrage opportunities. For instance, as short-term bond yields fall, locking into intermediate-term securities captures favorable spreads. Similarly, real estate investors can refinance older mortgages into cheaper debt instruments before further policy adjustments take effect. - Caution for Retirees

Those depending on fixed income should consider annuities or laddered bonds to protect against declining yields. Treasury Inflation-Protected Securities (TIPS) also offer a hedge against unexpected inflation resurgence, should monetary easing overshoot its target.

Frequently Asked Questions

- What is the Fed rate cut in 2025, and why does it matter for my personal finances?

The Federal Reserve rate cut 2025 refers to the quarter-point reduction in the federal funds rate decided during the September and expected October FOMC meetings. The Fed lowered its benchmark rate to a 4.0%–4.25% range, aiming to support slowing job growth while keeping inflation near 2%. For consumers, this move directly shapes loan rates, savings accounts, and mortgage interest across the U.S..

A Fed rate cut means borrowing becomes cheaper, loan interest rates fall, and savings yield decline. Understanding these Fed rate cut effects on savings and interest rate drops in 2025 helps you manage personal debt, optimize investments, and plan for inflation more effectively.

- How do the 2025 rate cuts affect credit card interest rates?

Credit card Annual Percentage Rates (APRs) are tied to the prime rate, which moves with Fed actions. When the Federal Reserve cuts rates, credit card APRs usually fall slightly—by 0.25% to 0.5% over time.

However, this relief is modest. If your current APR is around 20%, it might drop to about 19.5% in a few billing cycles. To benefit from the loan rates after the Fed cut, consider transferring high-interest balances to a low-APR card or consolidating them with a personal loan while banks offer cheaper borrowing.

- What are the immediate Fed rate cut effects on savings accounts and fixed deposits?

When the Federal Reserve lowers interest rates, banks reduce their payout on savings accounts, certificates of deposit (CDs), and money market funds. In early October 2025, many high-yield savings accounts already dropped from 5.25% to around 4.75% APY.

This trend highlights the interest rate drop 2025 personal finance experts anticipated. Savers relying on interest income should consider tiered CD strategies or locking in long-term fixed deposits before further rate declines.

- How will the 2025 Fed rate cuts affect mortgage and home loan rates?

The Fed does not directly control mortgage rates, but it heavily influences them. Mortgage rates often track long-term bond yields, which react to Fed policy expectations. After the September 2025 rate cut, 30-year fixed mortgage rates stayed near 6.5%–6.7%, while adjustable-rate mortgages (ARMs) fell faster.

Homebuyers and homeowners with variable-rate loans will gradually feel relief. For those looking to refinance, this could be an ideal time to lock in slightly lower rates before potential further interest rate cuts in December 2025.

- Why does the Fed cut interest rates?

The Federal Reserve cuts rates to stimulate spending, lending, and investment when economic momentum weakens. With 2025 showing slower job growth and modest inflation, policymakers opted to make credit cheaper. This policy supports the Fed’s dual mandate of full employment and price stability.

Lowering interest rates helps consumers access cheaper home loans, personal loans, and car loans, which can boost demand in key sectors. However, prolonged low rates can also reduce savings returns*” and encourage excessive borrowing if not managed responsibly.

- What are the benefits of lower loan rates after the Fed rate cut?

Lower borrowing costs directly help anyone with adjustable-rate or new loans. The loan rates after the Fed cut are expected to ease across personal loans, small business loans, and lines of credit by around 25–75 basis points by early 2026.

This makes it easier to refinance debt at reduced rates, start new ventures, or upgrade assets. The main advantages include:

- Reduced EMIs on floating-rate loans

- Improved cash flow due to lower monthly payments

- Easier credit availability for qualified borrowers.

For personal finance planning, leverage these opportunities before interest rates drop too far, limiting bank margins and credit offers.

- How do interest rate drops in 2025 influence inflation and prices?

Every interest rate drop puts more money into circulation, boosting spending and investment. However, excessive rate cuts can risk higher inflation over time. The 2025 Fed cuts are considered “insurance cuts” designed to prevent recession rather than ignite inflation.

So far, inflation forecasts remain near 2.6%, suggesting manageable price control. Consumers won’t likely face dramatic price hikes unless future cuts spark renewed consumer demand beyond production capacity.

- Are bond investors and retirees affected by the 2025 Fed cuts?

Yes — bond prices rise when the Fed cuts rates, making older, higher-yield bonds more valuable. For retirees dependent on fixed income, this initially seems positive. However, reinvestment risk increases: when older bonds mature, new ones yield less.

To counteract declining fixed-income yields, retirees may invest in bond ladders, municipal bonds, or Treasury Inflation-Protected Securities (TIPS). Diversifying with dividend-paying equities can help offset shrinking returns from safe savings instruments amid the interest rate drop 2025 personal finance environment.

- How can I optimize my portfolio after the Fed’s 2025 rate cuts?

This is the time to rebalance your portfolio based on risk appetite and market direction. Consider these Fed-rate-cut strategies:

- Shift part of your savings into equities, real estate, or REITs that grow in low-interest climates.

- Extend bond durations gradually to capture rising prices as yields fall.

- Hold cash equivalents. for flexibility if additional cuts occur.

- Diversify globally to guard against U.S. currency volatility linked to Fed rate cycles.

Optimizing asset allocation ensures that both conservative and growth components benefit even as interest rates decline further into 2026.

- What does the Fed’s dual mandate mean, and how does it guide rate cuts?

The Federal Reserve’s dual mandate means it must promote maximum employment and stable prices. In 2025, uncertainty around inflation and job data (partially due to a temporary government data halt) forced the Fed to act cautiously. Rate cuts serve as a preventive mechanism against unemployment spikes while keeping inflation manageable.

For personal financial planning, the Fed rate cut effects reinforce why having both emergency savings and flexible debt strategies is key. When borrowing costs fluctuate, preparedness ensures you adjust efficiently.

- How do investors react to repeated rate cuts?

Market sentiment often turns optimistic after rate cuts—stocks and property prices tend to rise. Yet expert consensus suggests that perception matters more than action. If investors think rate cuts signal economic trouble, optimism might fade.

Still, sectors like real estate, banking, construction, and technology see consistent inflows after easing cycles. The 2025 Fed rate cut trend is expected to sustain moderate asset appreciation until mid-2026, provided inflation stays under control.

- Should I refinance my home loan or car loan now?

Absolutely—refinancing during a rate cut cycle helps lock in lower costs before lenders tighten margins. Borrowers with adjustable-rate mortgages (ARMs) can especially benefit from re-negotiating terms. Even a 0.25% drop can save thousands over long-term loan repayment.

For auto loans, lenders may introduce competitive refinancing offers through early 2026. Comparing rates across credit unions and online marketplaces can maximize the impact of declining loan rates after the Fed cut.

- How are small business owners affected by the rate cuts?

Lower Fed rates mean cheaper access to capital for small and medium enterprises (SMEs). Banks often lower their prime lending rates, reducing costs for equipment loans, credit lines, and commercial property purchases. As of October 2025, SBA loan rates have dipped nearly 0.4%, improving business liquidity and hiring capacity.

However, entrepreneurs should remain cautious—if the rate-cut cycle continues too long, inflation pressure could raise future input costs.

- When is the next Fed meeting, and what are experts predicting?

According to the Federal Reserve’s official FOMC calendar, the next meeting is scheduled for October 28–29, 2025, where another 0.25% rate cut is likely. Economists at Barron’s and J.P. Morgan forecast two additional cuts by early 2026, pushing rates closer to 3.75%.

The Fed remains committed to data-driven policy, meaning every cut will depend on labor market reports and inflation prints.

- What should I do right now to protect my personal finances?

The simplest Fed-era personal finance checklist includes:

- Pay off variable-rate debts early before your lender resets rates.

- Shift emergency funds into locked CDs to protect yields.

- Refinance high-interest loans.

- Reinvest in inflation-protected or dividend-yield assets.

This proactive approach ensures your money continues to grow smartly during the interest rate drop 2025 period while retaining liquidity for new opportunities.

Conclusion

The Fed’s 2025 rate cuts mark a pivotal moment in the post-pandemic financial normalization era. For consumers, this cycle offers both relief and challenge—cheaper borrowing but lower savings returns. The best approach is active financial management: refinancing debt, reallocating investments, and staying alert to shifts in both inflation and employment data.

In short, rate cuts are neither purely good nor bad—they are transitional signals. How you respond determines whether they enhance or erode your long-term financial stability. With thoughtful planning, diversification, and proactive adjustments, households can transform this macroeconomic episode into a personal opportunity for growth.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What is the Fed rate cut in 2025, and why does it matter for my personal finances?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “The Fed rate cut in 2025 refers to the quarter-point reduction in the federal funds rate to the 4.0%–4.25% range during the September and expected October FOMC meetings. This move aims to support slowing job growth and keep inflation near 2%. The rate cut affects personal finances by lowering borrowing costs, reducing savings yields, and influencing mortgage and loan interest rates.” } }, { “@type”: “Question”, “name”: “How do the 2025 rate cuts affect credit card interest rates?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Credit card APRs are linked to the prime rate, which moves with Fed actions. After a rate cut, credit card APRs typically drop slightly—around 0.25% to 0.5%. For example, a 20% APR might decrease to about 19.5% over a few billing cycles. Consumers can benefit by transferring high-interest balances or consolidating debt into lower-rate options.” } }, { “@type”: “Question”, “name”: “What are the immediate Fed rate cut effects on savings accounts and fixed deposits?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Following the 2025 Fed rate cuts, banks have reduced payouts on savings accounts, CDs, and money market funds. High-yield savings accounts fell from 5.25% to around 4.75% APY in early October 2025. Savers should consider tiered CD strategies or locking in long-term deposits before further rate declines.” } }, { “@type”: “Question”, “name”: “How will the 2025 Fed rate cuts affect mortgage and home loan rates?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “The Fed does not directly set mortgage rates, but it influences them through long-term bond yields. After the September 2025 rate cut, 30-year fixed mortgage rates remained around 6.5%–6.7%, while ARMs fell more quickly. Homebuyers and homeowners with variable-rate loans may benefit from gradually lower rates, and refinancing could become more favorable.” } }, { “@type”: “Question”, “name”: “Why does the Fed cut interest rates?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “The Federal Reserve cuts interest rates to stimulate lending, spending, and investment during periods of slower economic growth. With 2025 showing weaker job growth and modest inflation, the Fed lowered rates to support its dual mandate of full employment and price stability. While lower rates make borrowing cheaper, they also reduce returns on savings.” } }, { “@type”: “Question”, “name”: “What are the benefits of lower loan rates after the Fed rate cut?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Lower loan rates help borrowers with adjustable-rate or new loans. Personal loans, small business loans, and credit lines may see a 25–75 basis point reduction by early 2026. Benefits include reduced EMIs, improved cash flow, and easier credit availability. Refinancing before further rate drops can maximize savings.” } }, { “@type”: “Question”, “name”: “How do interest rate drops in 2025 influence inflation and prices?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Interest rate drops increase money circulation, boosting spending and investment. However, excessive cuts can raise inflation risks. The 2025 rate cuts are considered ‘insurance cuts’ to prevent a recession, with inflation forecasts near 2.6%. Moderate price stability is expected unless further cuts create high consumer demand.” } }, { “@type”: “Question”, “name”: “Are bond investors and retirees affected by the 2025 Fed cuts?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Yes. Bond prices typically rise after rate cuts, increasing the value of older high-yield bonds. However, retirees face reinvestment risk as new bonds offer lower yields. Strategies like bond ladders, municipal bonds, TIPS, and dividend-paying stocks can help maintain stable income amid falling interest rates.” } }, { “@type”: “Question”, “name”: “How can I optimize my portfolio after the Fed’s 2025 rate cuts?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Investors can optimize portfolios by reallocating toward equities, real estate, and REITs that perform well in low-rate environments. Extending bond durations helps capture rising bond prices, while holding cash equivalents provides flexibility. Global diversification also protects against currency volatility tied to Fed policy changes.” } }, { “@type”: “Question”, “name”: “What does the Fed’s dual mandate mean, and how does it guide rate cuts?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “The Federal Reserve’s dual mandate requires promoting maximum employment and stable prices. In 2025, uncertain inflation and job data pushed the Fed to cut rates cautiously. These rate adjustments help stabilize borrowing costs and ensure consumers and businesses can manage debt effectively during economic fluctuations.” } }, { “@type”: “Question”, “name”: “How do investors react to repeated rate cuts?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Investors often become optimistic after rate cuts, leading to rising stock and real estate markets. However, sentiment depends on whether cuts are seen as economic support or a response to weakness. Sectors such as banking, construction, and technology typically attract investment during easing cycles.” } }, { “@type”: “Question”, “name”: “Should I refinance my home loan or car loan now?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Refinancing during a rate-cut cycle is beneficial, especially for borrowers with adjustable-rate mortgages (ARMs). Even a 0.25% drop can result in significant long-term savings. Auto loan refinancing may also become more competitive through early 2026, offering additional opportunities to reduce costs.” } }, { “@type”: “Question”, “name”: “How are small business owners affected by the rate cuts?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Small and medium businesses benefit from cheaper borrowing as banks lower prime lending rates. SBA loan rates dropped by about 0.4% in October 2025, improving business liquidity and hiring potential. However, prolonged rate cuts could raise future costs if inflation accelerates.” } }, { “@type”: “Question”, “name”: “When is the next Fed meeting, and what are experts predicting?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “The next Federal Reserve FOMC meeting is scheduled for October 28–29, 2025. Analysts expect another 0.25% rate cut, with two additional cuts possible by early 2026, potentially bringing rates near 3.75%. Future decisions will depend on incoming labor and inflation data.” } }, { “@type”: “Question”, “name”: “What should I do right now to protect my personal finances?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “To protect your finances during the 2025 rate cuts, focus on paying off variable-rate debts, locking emergency savings into CDs, refinancing high-interest loans, and investing in dividend stocks or inflation-protected assets. These steps ensure consistent growth and stability amid falling interest rates.” } } ] }