The $1 Lesson That Could Make Your Kid a Millionaire

( Planting the Seeds of Financial Wisdom )

Imagine if your child could grow up without the stress of debt, confidently making smart financial decisions, and even investing wisely before they hit adulthood. Sounds like a dream? It’s entirely possible—and it starts with you.

1. Building a Strong Financial Foundation

The Early Bird Gets the Worm

Just as learning a new language is easier for young minds, grasping financial concepts early can set the stage for lifelong fiscal responsibility. Children who understand the value of money tend to make wiser spending choices and are better prepared for financial challenges.

Real-Life Example:

Actionable Steps:

• Introduce Allowances: Provide a weekly allowance tied to chores to teach the connection between work and earnings. Also let them feel the sting of bad choices (RIP, candy budget)

• Set Savings Goals: Encourage your child to save for a desired toy or game, teaching delayed gratification. Also you can offer to “double” what they save for big goals (miniature 401(k), anyone?).

• Use Clear Jars: Visual aids like transparent jars can help children see their savings grow, reinforcing positive behavior. Use clear jars labeled Save, Spend, and Share (for charity).

2. Navigating the Cashless Society

Digital Dollars and Sense

With the rise of digital transactions, children are less likely to handle physical money, making it harder to grasp its value. Teaching them about digital finances is crucial in today’s economy.

A parent noticed their child frequently purchasing in-game items without understanding the real-world cost. By reviewing the monthly statement together, the child became more mindful of their spending habits.

Actionable Steps:

• Use Prepaid Cards: Introduce prepaid debit cards with set limits to teach budgeting in a controlled environment.

• Discuss Online Purchases: Review digital transactions together, explaining the impact on the family budget.

• Set Digital Allowances: Allocate a portion of their allowance for online spending, teaching them to manage digital funds responsibly.

3. Encouraging Entrepreneurial Spirit: Teach Budgeting Like a CEO (But With Fewer Spreadsheets)

From Lemonade Stands to Startups

Fostering an entrepreneurial mindset can empower children to think creatively about earning and managing money.

A young girl started selling handmade bracelets at school. With guidance, she learned to price her products, manage profits, and reinvest in materials, laying the groundwork for future business ventures.

Actionable Steps:

• Support Small Ventures: Encourage your child to start a simple business, like a lemonade stand or dog-walking service.

• Teach Cost Analysis: Help them understand expenses versus profits, emphasizing the importance of budgeting. Also teach “Income – Costs = Profit” using their hobbies.

• Celebrate Successes: Recognize their efforts and achievements to build confidence and motivation. Also help them use profits to upgrade their “business”.

4. Making Financial Education a Family Affair

Learning Together

Integrating financial discussions into family life normalizes the topic and reinforces its importance.

A family held monthly budget meetings, involving children in planning for vacations and big purchases. This transparency fostered trust and taught practical skills.

Actionable Steps:

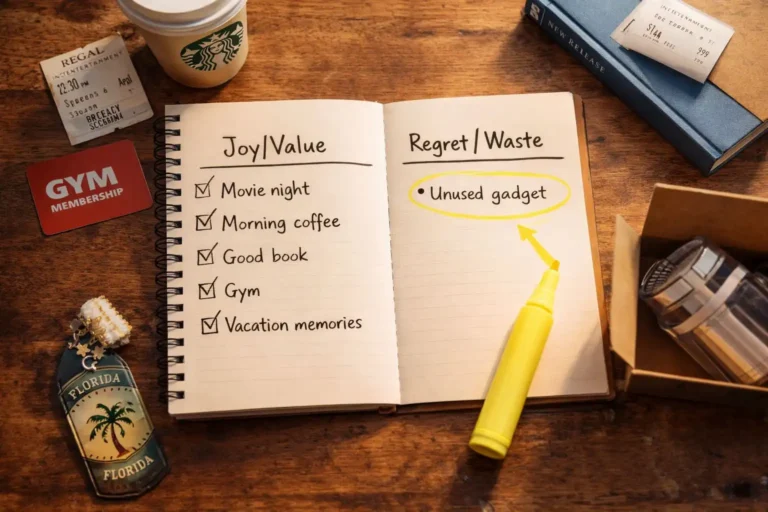

• Involve Kids in Budgeting: Let them help plan grocery lists or vacation budgets, providing real-world experience.

• Discuss Financial Goals: Share your savings goals and progress, demonstrating the value of planning.

• Play Educational Games: Use board games or apps designed to teach financial concepts in a fun, engaging way.

5. “Why Cannot We Buy a Jet?”: Normalize Money Talks Without the Eye-Rolls

Actionable Steps:

• Demystify spending: Use grocery trips to compare prices (“This cereal costs 3 hours of your chores!”).

Financial Literacy Self-Assessment for Parents

Reflect on your current practices with this quick quiz:

1. Do you discuss financial topics with your child regularly?

• Yes / No

2. Have you provided opportunities for your child to earn money?

• Yes / No

3. Does your child have a savings goal they’re working toward?

• Yes / No

4. Have you involved your child in any budgeting decisions?

• Yes / No

Conclusion: Empowering the Next Generation

Teaching your child about money is not just about dollars and cents; it is about instilling confidence, responsibility, and independence. By introducing financial concepts early, you are providing them with a toolkit for success in an increasingly complex economic landscape.

Call to Action:

We would love to hear your thoughts! Share your experiences or questions in the comments below. Do not forget to share this post with fellow parents and subscribe to TheFitFinance newsletter for more insights.