Are You Investing Like a Pro or Just Guessing?

Imagine this: You have been diligently investing for years, watching your portfolio grow. But when it is time to withdraw, you panic. Should you pull out a lump sum? Sell randomly? Or keep investing?

SIP: The Wealth-Building Machine

What is SIP, and Why Should You Care?

A Systematic Investment Plan (SIP) is like setting up an automatic savings plan, but instead of hoarding cash in your bank, you invest it wisely in mutual funds.

Think of SIP like a gym membership for your finances. You do not get six-pack abs in a day, but with consistent effort, results show up!

Here is why SIPs are loved by smart investors:

✅ Start Small, Grow Big: Invest as little as $50/month and let compounding do the magic.

✅ Market Fluctuations? No Problem! Dollar-cost averaging means you buy more units when prices are low and fewer when they are high.

✅ No Emotional Investing: No more panic-selling or impulsive buying—SIPs make you a disciplined investor.

🌍 SIP Wealth Calculator

How to Set Up an SIP Like a Pro

1️⃣ Choose a Fund: Pick a diversified mutual fund based on your goals (growth, stability, or income).

2️⃣ Decide Your Amount: Even $50 a month can lead to significant wealth over time.

3️⃣ Set Auto-Debit: Make it effortless—automate your investments.

4️⃣ Increase Over Time: Got a raise? Boost your SIP amount for even bigger gains.

SWP: Turning Your Wealth into a Stress-Free Income

What is SWP, and How Does It Work?

While SIP helps you grow money, SWP (Systematic Withdrawal Plan) helps you spend it smartly without depleting your savings too quickly.

Why SWP is a Retiree’s Best Friend

✅ Consistent Cash Flow: Get a steady paycheck from your investments, just like a salary.

✅ No Tax Shock: Withdraw only what you need to manage taxes better.

✅ Keeps Money Working for You: Your investments keep growing even as you withdraw.

How to Set Up an SWP That Works for You

1️⃣ Pick Your Fund: Choose a stable, income-generating mutual fund (balanced, hybrid, or debt funds work well).

2️⃣ Decide Withdrawal Amount: Ensure your withdrawals do not exceed your fund’s growth rate.

3️⃣ Schedule Withdrawals: Set up monthly or quarterly payments for predictable income.

4️⃣ Adjust as Needed: Life changes, so review your SWP annually.

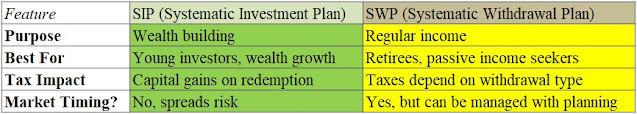

SIP vs SWP: Which One Do You Need?

Are You a SIP or SWP Investor?

Answer these quick questions to find out:

1️⃣ Are you still growing your wealth, or do you need regular withdrawals?

2️⃣ Do you have at least 10 years before retirement? If yes, SIP is your best bet!

3️⃣ Need a steady retirement income? SWP is for you.

Final Thoughts: Take Action Today

📌 If you are in your 20s, 30s, or 40s—start an SIP now and watch your wealth grow.

📌 If you are planning for retirement—set up an SWP to enjoy financial freedom.

📌 Already investing? Review your strategy and optimize for maximum gains!

What’s Next?

If you liked this guide, you will love my breakdown on “Retirement Planning Made Simple <Click here>

🔹 Comment below: Are you using SIP, SWP, or both?

🔹 Share this post with a friend who needs financial clarity.

🔹 Subscribe to TheFitFinance for more no-BS, actionable finance tips!